1 August 2014

1QFY15 Results Update | Sector: Real Estate

DLF

BSE SENSEX

25,895

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

7,721

DLFU IN

1,781.6

353.5/5.8

243/120

-10/18/-1

CMP: INR198

TP: INR252

Buy

Financials & Valuation (INR m)

Y/E March 2015E

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr (%)

RoE (%)

RoCE (%)

P/E (x)

P/BV (X)

2016E

2017E

87,309 92,027 107,645

29,445 71,922 87,137

7,241

4.1

12.1

2.0

4.5

48.8

1.2

10,471 18,222

5.9

44.6

169.3

16.2

12.7

33.7

1.2

10.2

74.0

177.3

19.6

15.3

19.4

1.1

BV/Sh (INR) 165.8

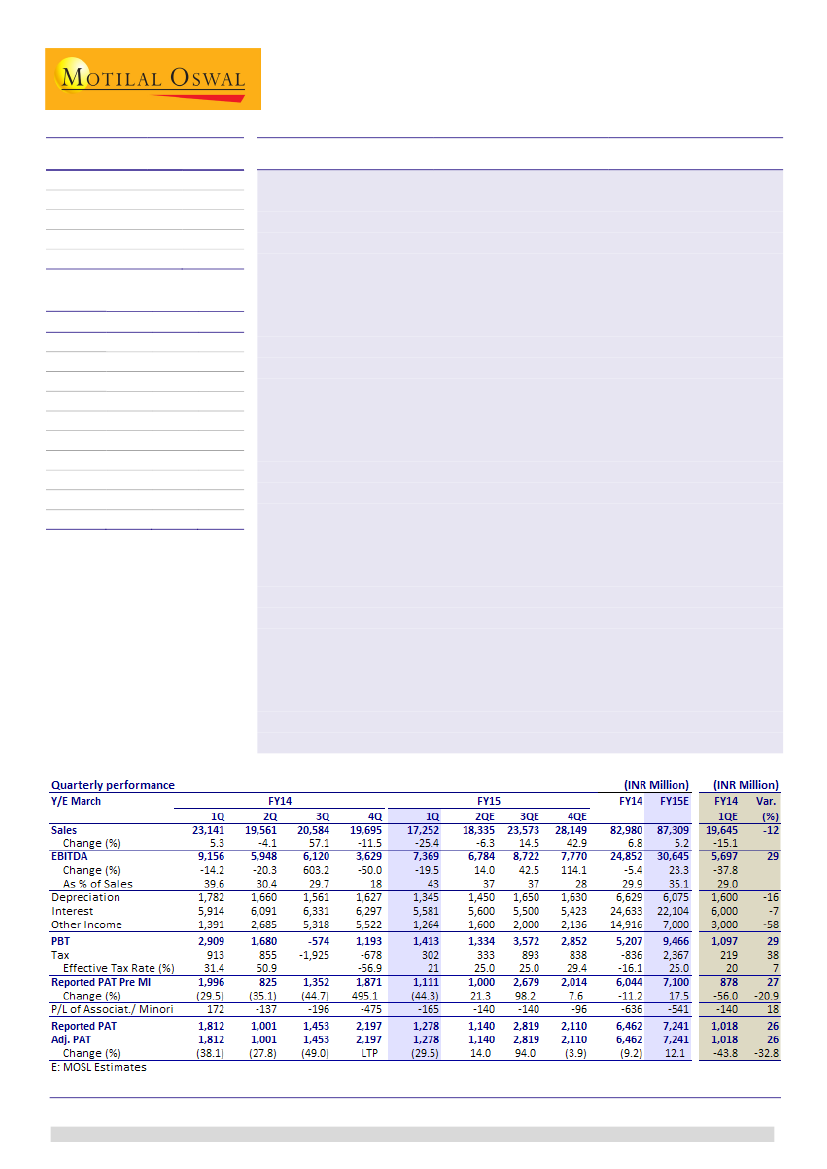

P&L beat, margin bounce back; lower interest, tax boosts PAT:

DLF has

reported 1QFY15 EBITDA at INR7.4b (v/s est of INR5.7b) on the back of sharp

uptick in margin to 43% (v/s 35% in FY14). Revenue stood at INR17.3b (-25%

YoY) v/s est of INR19.6b, while PAT stood at INR1.28b (ahead of estimate of

INR1.02b) on the back of lower interest cost (-11% QoQ) and lower tax (21%).

We believe CMBS of ~INR9b with average cost of debt of 10.9% to have partially

benefitted lower interest expense.

Lowest presales continue, leasing momentum positive:

1QFY15 presales

remains lowest ever level of 0.38msf (INR3.1b) v/s 0.44msf (INR3.1b) in 4QFY14.

Luxury projects viz. Kings Court and Camellias contributed ~45% of presales,

while Hyderabad, Indore and Bhubaneswar were other key contributors.

Annuity vertical performed better with 0.71msf of leasing (v/s 0.6msf in 4Q,

1.7msf in FY14). Major leasing happened in Gurgaon, Chennai and Delhi malls.

Annuity income stood at INR5.25b (v/s INR4.95b in 3Q)

Core FCFE negative INR7.7b; net debt up INR5.3b QoQ

:

Sustained weakness in

presales and lack of fresh launch has resulted in deterioration in core operating

cash flow. We calculate core FCFE negative at INR7.7b (post-dividend) v/s

negative INR13.1b in 4Q (-INR25b in FY14). DLF received ~INR2.4b of divestment

proceeds in 1QFY15, resulting into net increase in net debt by INR5.3b to

INR200b (0.7x), unadjusted for JV partners’ stakes.

Guiding deferred recovery cycle:

While concerns over gearing have moderated,

weakness in operations remains overhang. Management has been portraying a

cautious outlook for near-term with restrained strategy and likely torpidity in

cash flows in FY15. However, improving

macro outlook and various positive

developments in policy front should offer big benefits to the stock on leverage

play. The stock trades at 1.2x FY16 BV and 33.7x FY16 EPS. Asset based

valuation keeps us Buy.

We will revisit our estimates post further clarity in

Concall at 4pm on 1

st

August 2014 dial in +91 22 3960 0641 .

Sandipan Pal

(Sandipan.Pal@MotilalOswal.com); +91 22 3982 5436

Investors are advised to refer through disclosures made at the end of the Research Report.