13 January 2015

Results Update | Sector:

Textiles

Kitex Garments

BSE SENSEX

27,426

Bloomberg

Equity Shares (m)

S&P CNX

8,299

KTG IN

47.5

CMP: INR558

TP: INR720 (+29%)

Buy

Strong margin expansion drives profitability

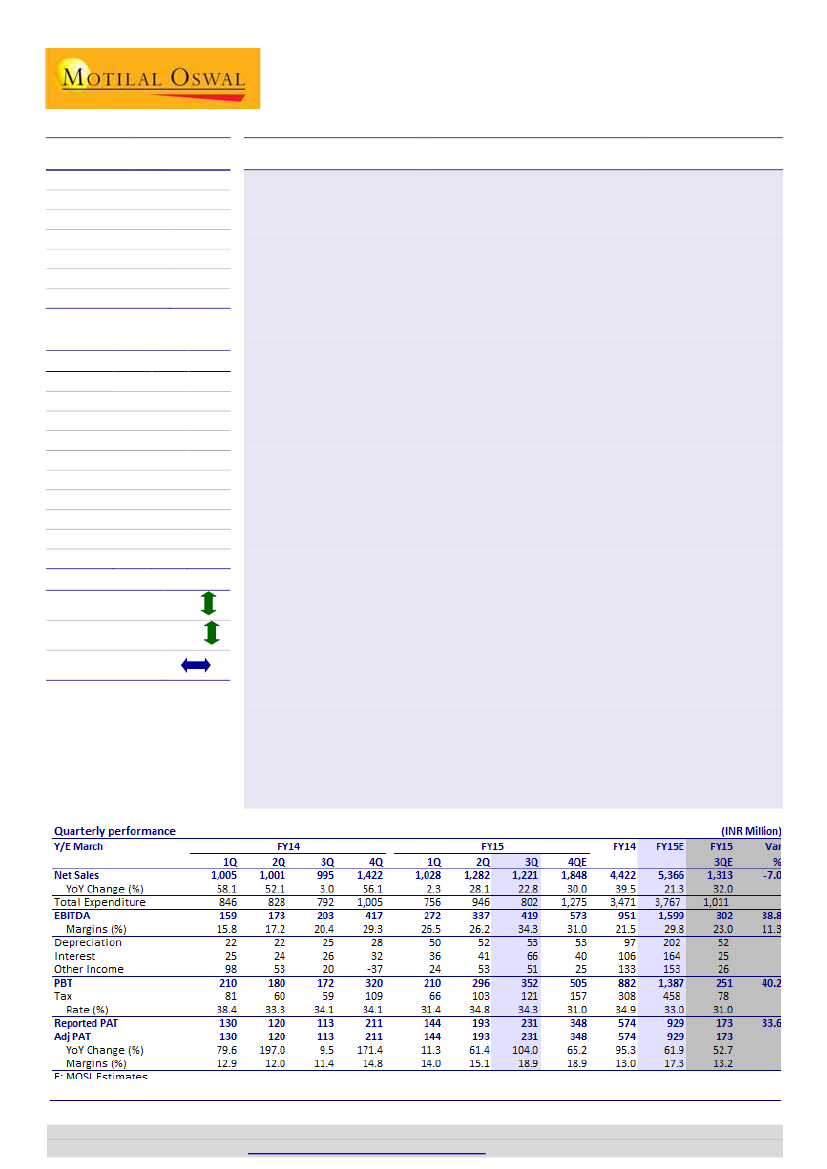

Kitex Garments Ltd (KTG) reported 3QFY15 numbers with a revenue of INR1.22b (est.

M.Cap. (INR b)/(USD b)

26.5/0.4

INR1.31b), compared to INR995m in 3QFY14, marking a YoY growth of 22.8%. Growth

52-Week Range (INR)

602/81

was lower than our estimates due to higher-than-normal yearend spill-over of sales by

1, 6, 12 Rel. Per (%)

3/132/516

US clients from 3QFY15 to 4QFY15. EBITDA grew by 106% this quarter to INR419m

Avg Val/Vol ‘000

54/152

(est. INR302m), EBITDA margin stood at 34.3% (est. 23%) in 3QFY15, compared to

Free float (%)

45.8

20.4% in 3QFY14, an expansion of 13% YoY driven by lower cotton prices, higher

pricing and lower wastages due to technology upgradation. Hence, PAT for 3QFY15

Financials & Valuation (INR Billion)

stood at INR231m (est. INR173m), compared to INR113m in 3QFY14, marking a YoY

Y/E MAR

2015E 2016E 2017E

growth of 104%. Capacity utilization in the processing unit is ~50-55%, while in the

Sales

5.4

6.6

8.1

sewing unit it is ~100%. KTG is planning to double the sewing capacity in the next

EBITDA

1.6

2.0

2.6

three years and further upgrade technology, thus driving further efficiencies.

NP

0.9

1.3

1.7

EPS (INR)

EPS Gr. (%)

BV/Sh. (INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

19.6

61.9

54.0

43.1

47.8

28.5

10.3

27.5

40.4

77.9

41.6

56.2

20.3

7.2

36.0

31.2

107.0

39.0

58.2

15.5

5.2

Brand launch on the right path

We expect KTG to capture a larger pie of the value chain through its forward

integration with the launch of its own brand in the US market and licensing of private

labels in the US market. During the quarter, company already made significant in-

roads in both these endeavors and expects revenue from brands and private labels to

generate in 1HFY16. Forward integration holds high significance for the company as

margins in its own brand will be double of the current business (~60% v/s ~30%

currently), along with higher realization. We have not factored additional growth from

brands business, which provides further upside to our estimates.

Valuation and view

Management has guided for doubling of current turnover to INR10b over the next

three years, along with margin expansion led by foray into brands business. Further,

capital expenditure over the next three years will be limited to INR0.4-0.5b, thus

resulting in significant free cash generation. We upgrade FY15/16/17 earnings by 6%

each to factor in stronger margins and expect 23% revenue CAGR and 36% PAT CAGR

over FY15-17E. With huge scalability, strong return ratios and free cash generation, we

believe KTG deserves a multiple of 20x one-year forward. We maintain

Buy

with a

target price of INR720, valuing the stock at 20x FY17E earnings.

Estimate change

TP change

Rating change

5.6%

10.8%

Niket Shah

(Niket.Shah@MotilalOswal.com); +91 22 3982 5426

Atul Mehra

(Atul.Mehra@MotilalOswal.com); +91 22 3982 5417

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.