June 2015

2

T

ECH

K

NOW

ECH NOW

Our past editions

XaaS— Xplaining As-a-Service

Services in the digital world

The 2nd issue of Techknow explored the area of cloud computing and the huge

opportunity it provides to transform businesses digitally in the near future. We

discussed the factors that favor large-scale adoption of cloud computing among

enterprises, which will be in the form of “Everything as a Service (XaaS)” business model

where everything from technology services to key business processes can be delivered

as a service utility. We shed some more light on the same in our latest issue, which will

cover:

1. What is XaaS and role of players in the ecosystem?

2. How big is SaaS? Is it a threat to Indian IT services sector?

3. Expert Speak: Prasenjit Saha, CEO – IMS and Security business, Happiest Minds

4. What are the imperatives to flourish and not perish in the new wave of technology

services?

T

ECH

K

NOW:

CLOUD

T

ECH

K

NOW:

DIGITAL

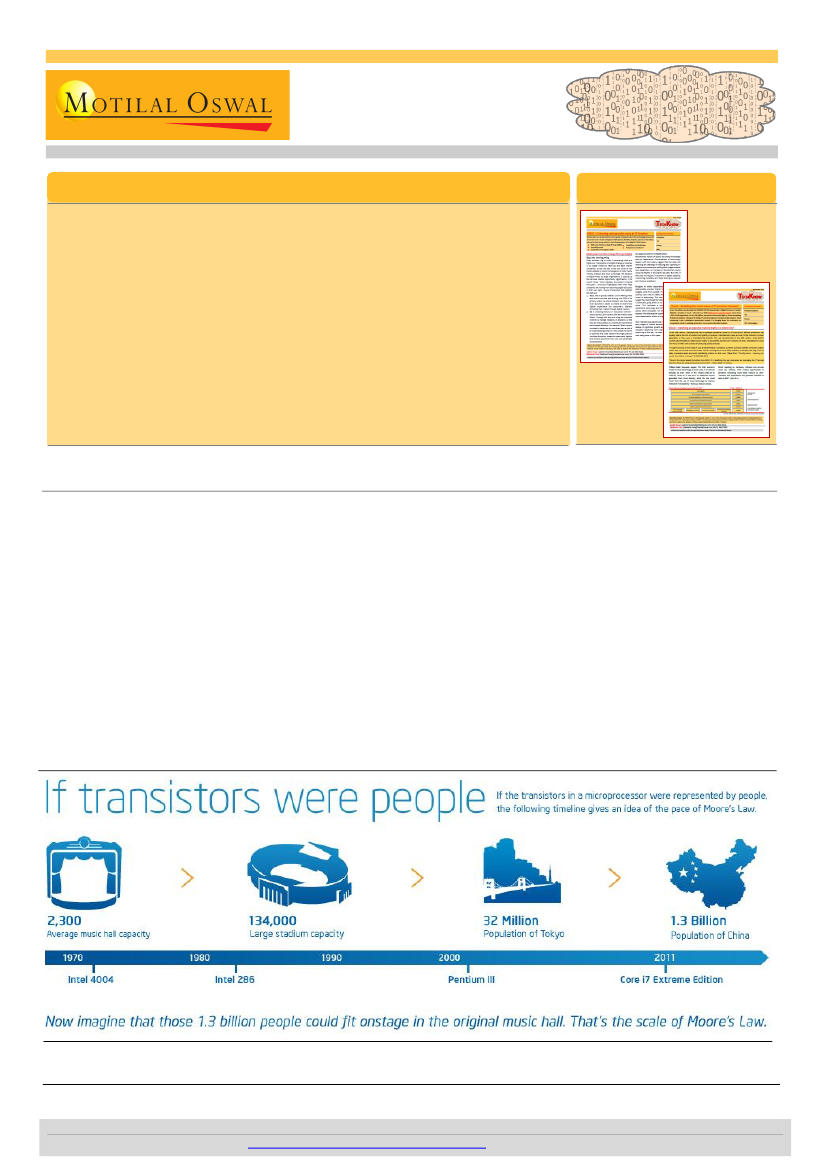

Is it time for Moore’s law in services?

Cloud to act as the services multiplier

Gordon Moore, the co-founder of Intel, made an

observation in his 1965 paper that the number of

components in an integrated circuit will double every

year. The famous law has lasted for 50 years in

computing power and has seen various offshoots in

other segments.

With the advent of cloud, the same is not unimaginable

in services market - for the same cost, the quantum of

Moore’s law simplified!

services delivered could double every 2-4 years. Fueling

this belief is the savings obtained from moving

infrastructure to cloud, along with ever-reducing prices

charged for per unit of services. This gets compounded

by the increasing acceptability of Robotic Process

Automation. All this feeds into the flexibility in the way

customers chose to consume storage and computing

capabilities.

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com) +91 22 3982 5424

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.