22 July 2015

1QFY16 Results Update | Sector:

Textiles

Kitex Garments

BSE SENSEX

28,505

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

S&P CNX

8,634

KTG IN

47.5

31.1/0.5

1070 / 244

-21/52/200

130/206

45.8

CMP: INR839

TP: INR970 (+15%)

Buy

Results below estimates; FY16 growth outlook remains intact

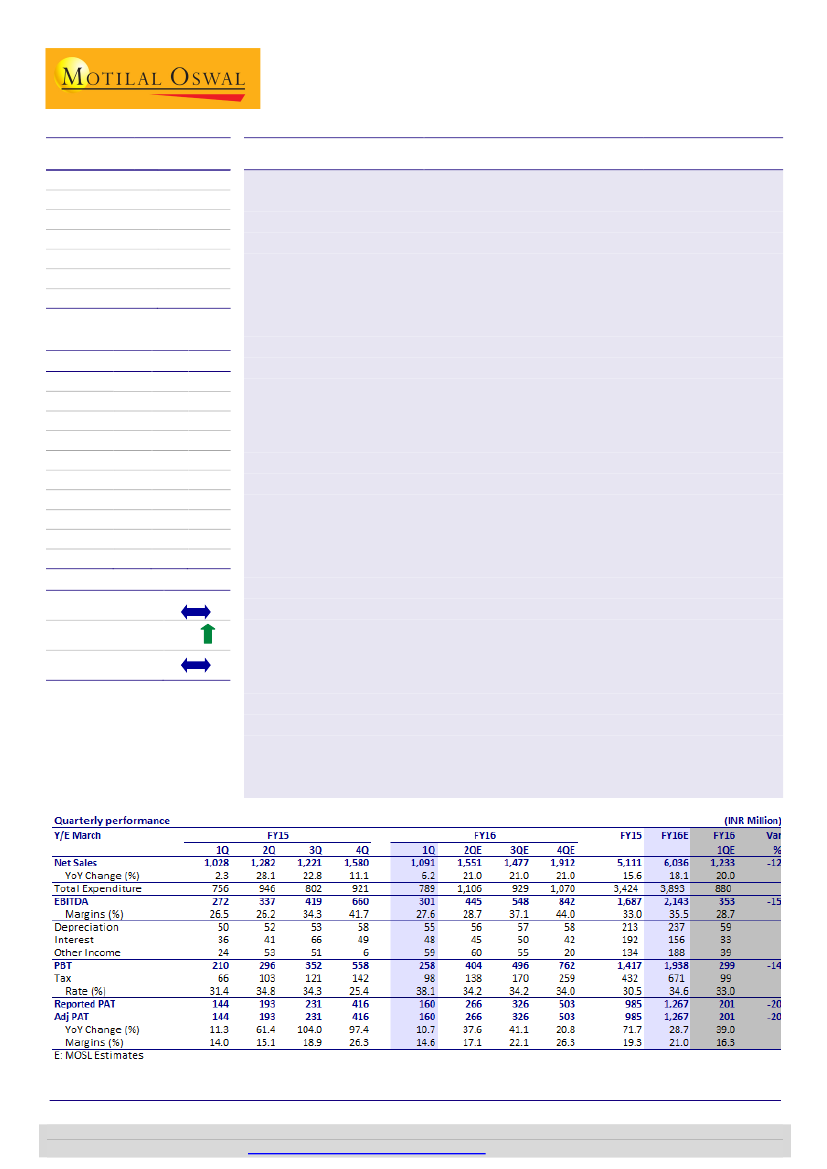

Kitex Garments Ltd’s (KTG) 1QFY16 revenue was up 6.2% YoY to INR1.09b (est.

INR1.23b) compared with INR1.03b in 1QFY15. Garments segment reported 11% YoY

growth; however, a 13% decline in fabric revenue negatively impacted revenue

growth. EBITDA grew 11% to INR301m (est. INR353m), while EBITDA margin stood at

27.6% (est. 28.7%) in 1QFY16 compared with 26.5% in 1QFY15—a 120bp YoY

expansion. PAT stood at INR160m (est. INR201m) compared with INR144m in 1QFY15

(10.7% YoY growth). The management highlighted that 1Q is seasonally the smallest

quarter (20% of annual revenues) as all shipments for ‘Spring’ are largely concluded by

March while shipments for ‘Fall’ commence by August first week. Even in FY15, 1Q

saw 2% growth while the balance three quarters saw 21% average growth. Given this

background, the management is confident of posting 15-20% growth in FY16.

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val/Vol ‘000

Free float (%)

Financials & Valuation (INR Billion)

Y/E MAR

Sales

EBITDA

NP

EPS (INR)

EPS Gr. (%)

BV/Sh. (INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

2015 2016E 2017E

5.1

1.7

1.0

20.7

71.7

55.6

45.0

43.9

40.5

15.1

6.0

2.1

1.3

26.7

28.7

78.7

39.7

48.7

31.5

10.7

7.3

2.8

1.8

37.1

39.2

108.9

39.6

56.7

22.6

7.7

Brand launch delayed due to legal hiccups; to finalize over the next quarter

The management highlighted legal hiccups have delayed brand tie-up with US brand.

However, the company expects to conclude the agreement over the next quarter. The

brand will be owned by Kitex LLC (KTG will own 50% stake and Kitex Children’s wear

will own the remaining 50%). The management outlined that the JV structure will de-

risk issues around capacity constraints and both companies will invest equally in

building the licensed brand. On KTG/KCL merger, the company highlighted that E&Y

has given three distinct options for the merger and the management will evaluate and

take a call by the next quarter. The merger, once approved, would take approximately

a year’s time to fructify.

Estimate change

TP change

Rating change

15%

Valuation and view

With foray into the brands business, we expect strong 20% revenue CAGR along with

400bp margin expansion, driving 34% PAT CAGR over FY15-17. Capital expenditure

over the next three years will be limited to INR0.4b-0.5b, thus resulting in significant

free cash generation. With huge scalability, strong return ratios and free cash

generation, we believe KTG deserves a multiple of 26x one-year forward. We maintain

Buy

with a target price of INR970, valuing the stock at 26x FY17E earnings.

Niket Shah

(Niket.Shah@MotilalOswal.com); +91 22 3982 5426

Atul Mehra

(Atul.Mehra@MotilalOswal.com); +91 22 3982 5417

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.