Dashboard

The Monthly Auto Update

December 2015

Data Track:

Nov 2015 volume update of auto majors

Sector overview and outlook ........................................................ 2

Hero MotoCorp ............................................................................. 3

Bajaj Auto ......................................................................................4

HMSI ............................................................................................. 6

TVS Motor ..................................................................................... 7

Maruti Suzuki .................................................................................9

Mahindra & Mahindra ................................................................. 11

Tata Motors ................................................................................. 13

Ashok Leyland .............................................................................. 15

Eicher Motors .............................................................................. 16

Two-wheelers .............................................................................. 18

Three-wheelers ........................................................................... 20

Cars and UVs ................................................................................ 22

Commercial vehicles..................................................................... 24

Maruti launches Swift, Dzire with added safety features……………26

Tata Kite compact sedan to launch soon; may be priced at

INR4 lakh ....................................................................................... 26

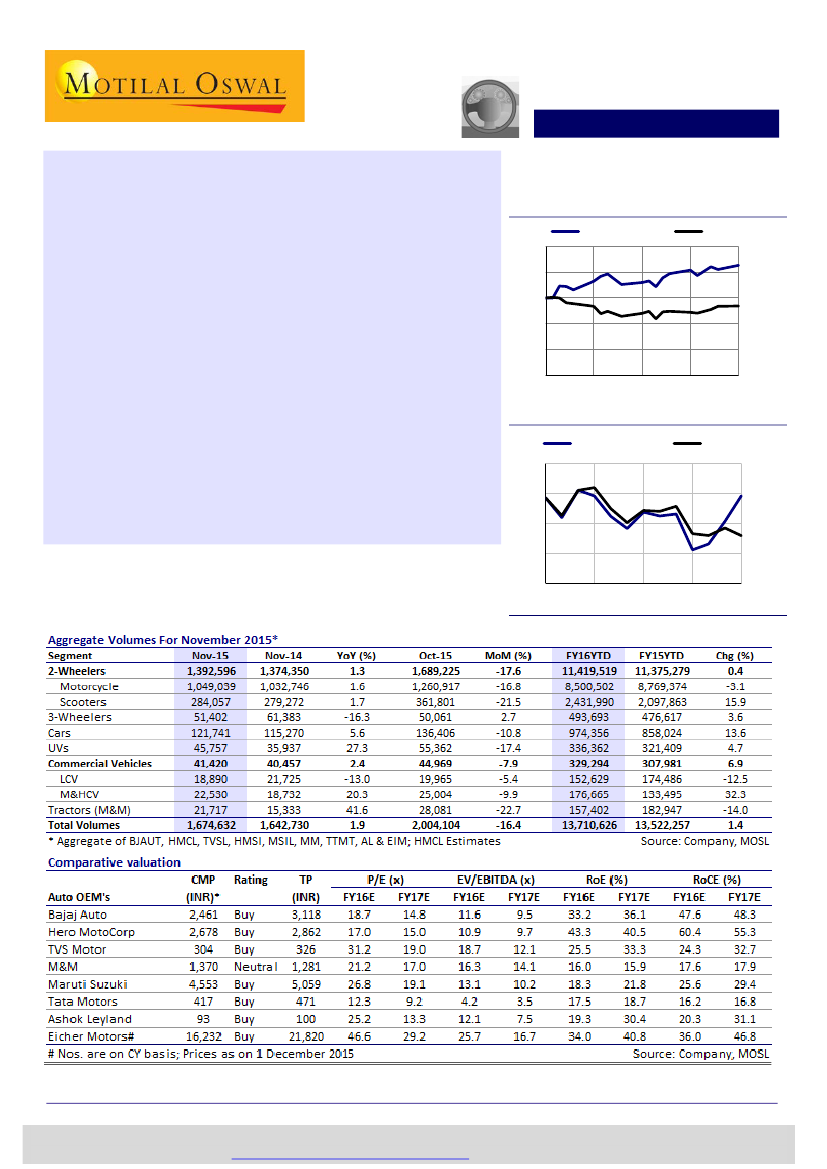

Speedometer

November 2015 relative performance

MOSL Auto Index

Sensex

110

105

100

95

90

85

2-Nov

9-Nov

16-Nov 23-Nov 30-Nov

Sector Gauge:

Oct 2015 update

12-month relative performance

MOSL Auto Index

108

101

94

87

80

Nov-14

Feb-15 May-15 Aug-15 Nov-15

Sensex

News and developments

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Jay Shah

(Jay.Shah@MotilalOswal.com); +91 22 3078 4701

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.