Wonderla Holidays

BSE SENSEX

22,952

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, (INR m)

Free float (%)

S&P CNX

6,976

WONH IN

56.5

20.7 / 0.3

430/242

-6/41/36

40

29.0

11 February 2016

Q3FY16 Results Update | Sector: Others

CMP: INR337

TP: INR400 (+19%)

Buy

Results below expectations; Hyderabad Park on track for 1QFY17

Financials & Valuations (INR b)

Y/E Mar

2016E 2017E 2018E

Sales

2.0

3.1

3.9

EBITDA

0.8

1.2

1.6

NP

0.6

0.7

0.9

EPS (INR)

9.9

13.0

16.5

Gr. (%)

10.1

31.9

27.2

BV/Sh. (INR)

70.6

80.7

94.3

RoE (%)

14.7

17.2

18.9

RoCE (%)

21.0

24.4

26.9

P/E (x)

34.2

25.9

20.4

P/BV (x)

4.8

4.2

3.6

Estimate change

TP change

Rating change

5%

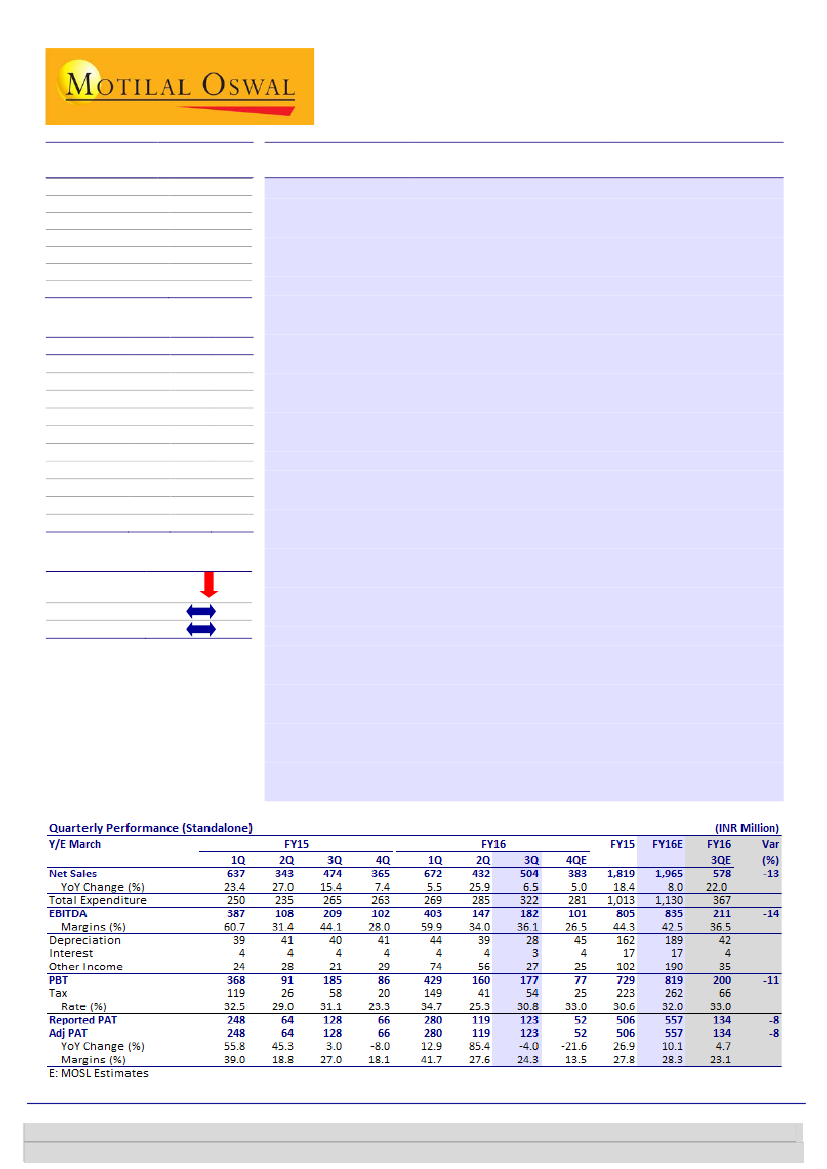

Price hikes and adverse weather in south impacts performance:

Wonderla

Holidays saw 3QFY16 revenue grow 6.5% YoY to INR504m (est. of INR578m)

impacted by lower footfalls on account of the unfavorable weather conditions

(rains and colder weather) in November. Footfalls de-grew 12% YoY. Footfalls

in Kochi Park declined 9% while Bangalore Park declined 15% impacted also

due to lesser participation from school and college groups on account price

hikes (20-22% during 1HFY16). Impact of footfalls de-growth on revenues was

offset by higher average revenue per visitor (ARPU) which grew 22% YoY to

INR866. Bangalore ticket ARPU grew 24% while non-ticket ARPU grew 31%,

Kochi saw 13% growth in ticket ARPU and 47% increase in non-ticket ARPU.

Margins miss by higher employee costs and provision for disputed service

tax:

EBITDA de-grew 13% YoY in 3QFY16 to INR182m (est. of INR211m); EBITDA

margins stood at 36.1% (est. of 36.5%) v/s 44.1% YoY. Margins impacted by

250bp increase in employee costs and 890bp increase in other expenses.

Employee costs grew 26% YoY due to top-level hires, employees for Hyderabad

Park (INR10m) and retrospective bonus provision (INR2.5m). Other expenses

increased due to provisions on account of disputed service tax of INR48.5m.

Consequently, PAT de-grew 4% to INR123m.

Hyderabad Park to keep growth momentum intact:

Hyderabad Park is on

track for a launch in March-April 2016. It shall have 43 rides and capacity of 9-

10k people in a day. Recruitment for the park has already begun and people

are undergoing training. Management highlighted that footfalls have seen

rebound beginning January 2016 for Bangalore and Kochi Parks so they expect

growth momentum to continue.

Valuation and view:

We expect WONH’s revenue to clock 29% CAGR and 23%

PAT CAGR over FY15-18. We cut our FY16E/FY17E/FY18E EPS by 8%/6%/5% to

factor in the subdued growth of 3QFY16 given that 3Q is expected to be

strongest quarter. We believe WONH is on track to be a major beneficiary of

the amusement park industry’s development. The stock trades at 34.2x FY16E,

25.9x FY17E and 20.4x FY18E earnings; we value WONH at 24x FY18E EPS, with

a target price of INR400 (rolled over to FY18). Maintain

Buy.

Niket Shah

(Niket.Shah@MotilalOswal.com); +91 22 3982 5426

Chintan Modi

(Chintan.Modi@MotilalOswal.com); +912239825422/Kaustubh

Kale

(Kaustubh.Kale@MotilalOswal.com); +912230102498

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.