Thematic | April 2016

Capital Goods

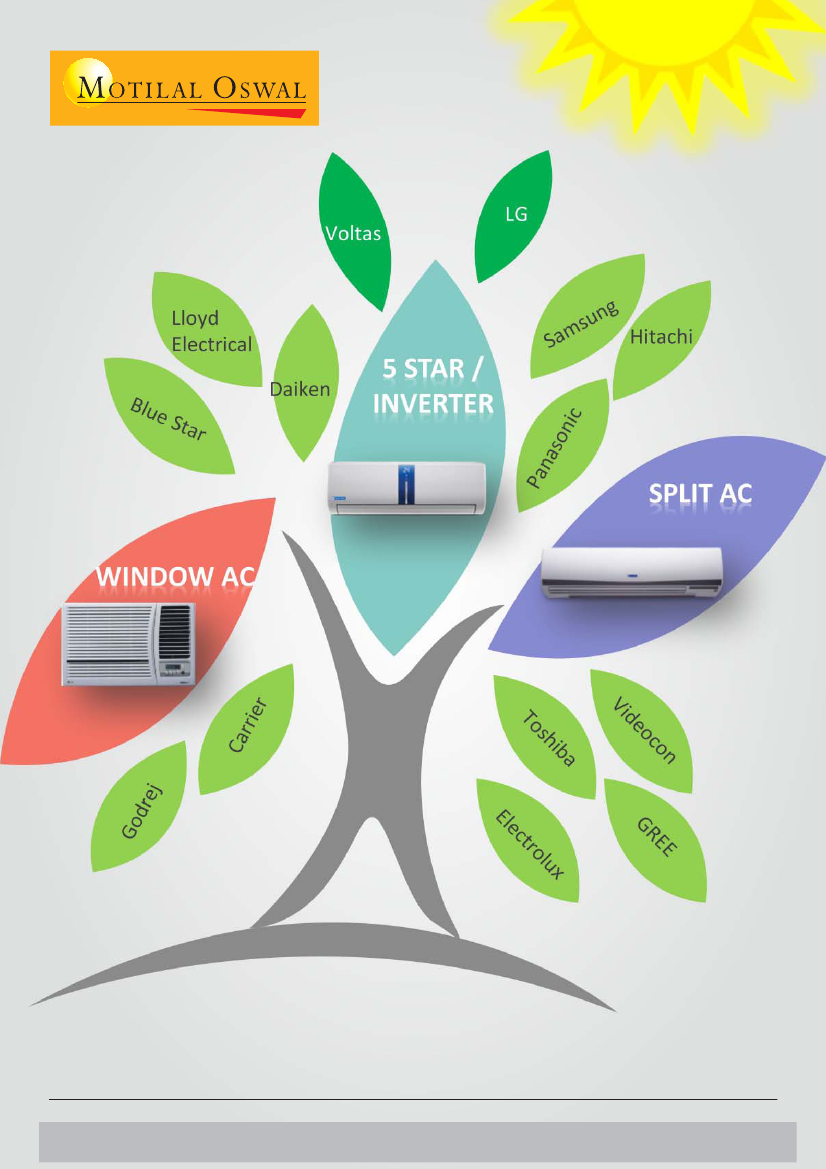

Room air conditioners | At an inflection point

Ankur Sharma

(Ankur.VSharma@MotilalOswal.com); +91 22 3982 5449

Amit Shah

(Amit.Shah@MotilalOswal.com); +91 22 3029 5126

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.