27 April 2016

4QFY16 Results Update | Sector: Healthcare

Biocon

Sell

BSE SENSEX

26,064

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, (INR m)

Free float (%)

S&P CNX

7,980

BIOS IN

200.0

114.2/ 1.7

581/397

20/29/35

313

39.3

CMP: INR571

TP:INR490 (-14%)

Mixed results; Development on Biosimilars portfolio is key

Financials & Valuation (INR b)

Y/E Mar

2016 2017E 2018E

Sales

34.5

39.4

46.5

EBITDA

7.9

9.4

11.4

Net Profit

4.6

5.2

6.1

Adj. EPS (INR)

23.2

26.2

30.6

EPS Gr. (%)

15.5

13.0

16.5

BV/Sh. (INR)

195.2 213.8 235.4

RoE (%)

11.9

12.3

13.0

RoCE (%)

21.1

12.6

14.0

P/E (x)

24.6

21.8

18.7

P/BV (x)

2.9

2.7

2.4

Estimate change

TP change

Rating change

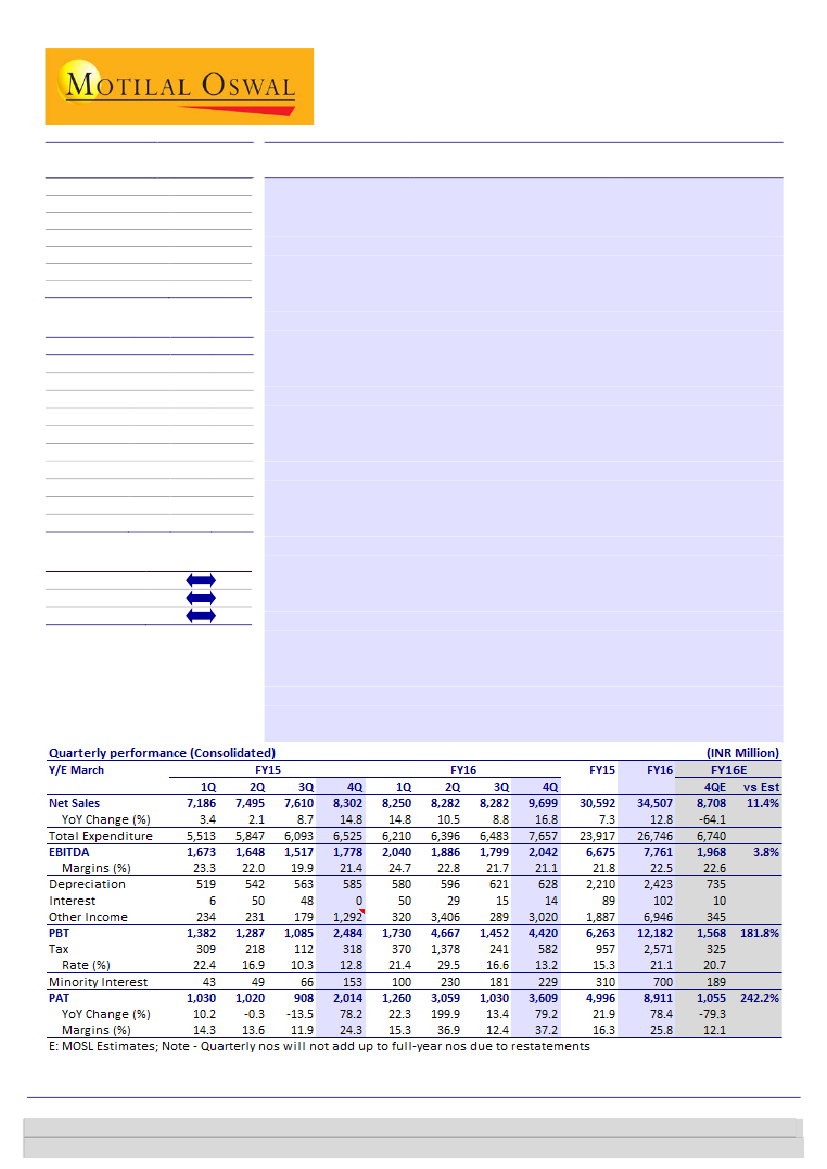

Biocon’s 4QFY16 PAT at INR3.6b was boosted by a one-time deferred income of

INR2.6b, excluding which the PAT came in line with our estimate. Topline grew 17%

YoY (11% beat) to INR9.7b, aided by a strong growth in Syngene. EBITDA stood at

INR2b, while EBITDA margin was lower at 21.1% due to higher R&D expenses.

CRO leads in terms of Revenue:

The CRO/Syngene business continued to

witness strong momentum with a 32% YoY revenue growth, while the

Biopharma business (excluding India) also reported a higher than expected

growth (up 8% YoY) due to growing sales of biosimilars in emerging markets.

The India branded business remained sluggish with a growth of 3.4% YoY,

affected by portfolio rationalization and weak sales of in-licensed products.

Overall, we project a 15% YoY revenue growth over FY15-18E, supported by a

20% YoY growth in the Syngene business.

R&D investment at record high:

The EBITDA margin at 21.1% was down 36bp

YoY, owing to a spike in R&D expenses (10.3% of sales as against 6.7% in

4QFY15). We expect further margin improvement to be restricted by increased

R&D activities on account of higher number of ANDA filings and progression of

biosimilar projects in clinical trials (five molecules in Phase 3 clinical trial). We

project an EBITDA CAGR of 20% on the back of a slightly improved EBIDTA

margin at 24-25% by FY18E.

Biosimilars sales in regulated markets to kick off only post FY19:

Though Glargine

approval for Japan market is encouraging, approvals for US and EU region would be

key growth driver for the company and launches in these regulated market is only

possible post FY19. Until then, the company’s profitability is likely to remain under

pressure due to high R&D expenses, increasing capex and lower utilization levels of

new capacities. We maintain our SELL rating on the stock with a target price of

INR490 as the earnings outlook for Biocon remain modest over FY17/18E (15% EPS

CAGR as against ~20% for its peers), and big investment projects like the

biosimilars/Malaysia insulin plant are unlikely to generate significant revenue

before FY18.

Kumar Saurabh

(Kumar.Saurabh@MotilalOswal.com); +91 22 3982 5584

Amey Chalke

(amey.chalke@motilaloswal.com); +91 22 39825423

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.