Thematic | July 2016

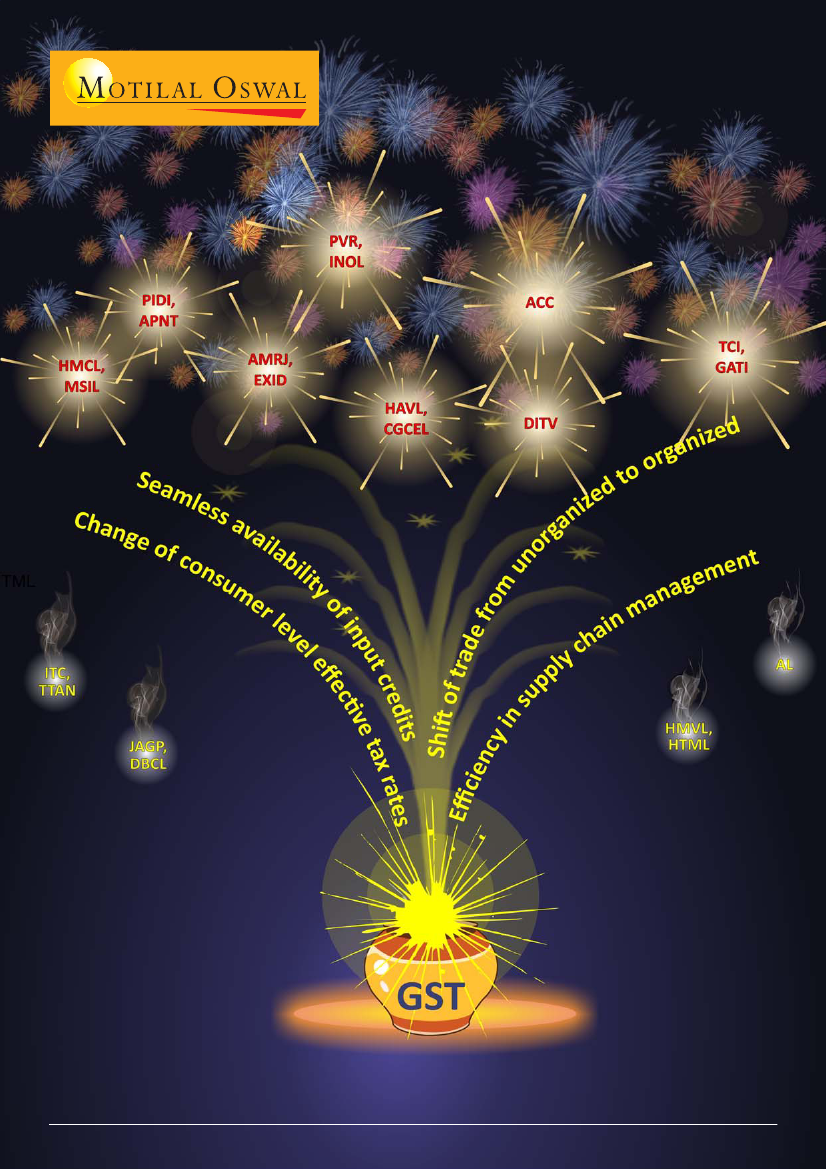

GST

Ushering in a new era

Sandeep Gupta

(S.Gupta@MotilalOswal.com); +91 22 39825544 /

Nikhil Gupta

(Nikhil.Gupta@MotilalOswal.com); +91 22 3982 5405

Somil Shah

(Somil.Shah@MotilalOswal.com); +91 22 3312 4975 /

Mehul Parikh

(Mehul.Parikh@MotilalOswal.com); +9122 3010 2492