Eveready Industries

BSE SENSEX

27,882

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

29 January 2017

Q3FY17 Results Update | Sector: Others

S&P CNX

8,641

EVRIN IN

Growth continues to be subdued; New categories to drive growth

73

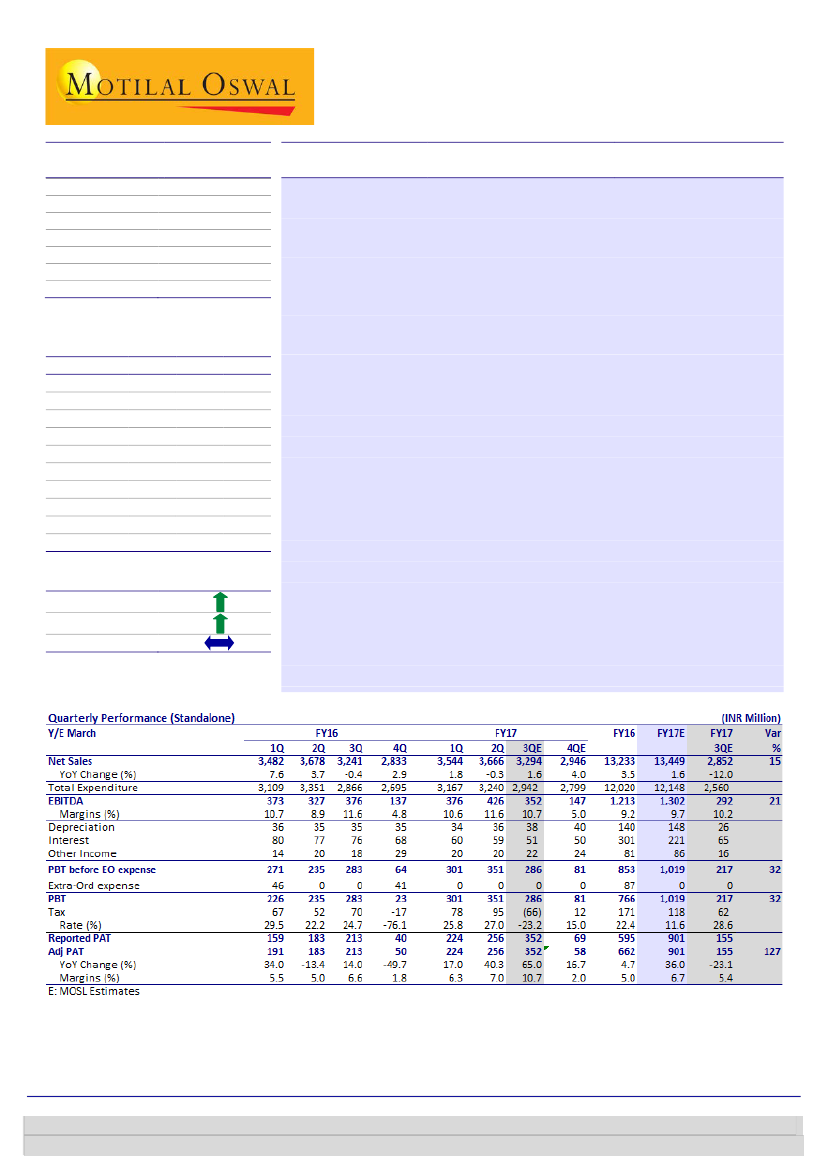

Revenue and EBITDA beat estimates:

EVRIN’s 3QFY17 revenue grew 2% YoY

17.5 / 0.3

to INR3,294m (est. of INR2,852m). Growth, however, was impacted by lower

291 / 190

demand due to demonetization, flattish growth in battery and a decline in

12/-2/-17

flashlights. LED business grew 73% YoY. This, however, was offset by a 56%

45.8

decline in CFL business, leading to small blended growth in the lighting

56.0

CMP: INR242

TP: INR287 (+19%)

Buy

Financials & Valuations (INR b)

2016 2017E

Y/E Mar

Sales

13.2

13.5

EBITDA

1.2

1.3

NP

0.7

0.9

EPS (INR)

9.2

12.4

EPS Gr. (%)

8.3

34.3

BV/Sh. (INR)

28.4

37.3

RoE (%)

16.2

37.8

RoCE (%)

15.2

26.8

P/E (x)

26.2

19.5

P/BV (x)

8.5

6.5

2018E

15.0

1.5

1.0

13.9

11.9

46.5

33.1

25.1

17.4

5.2

Estimate change

TP change

Rating change

segment. EBITDA declined 6% YoY to INR352m (est. of INR292m) due to

incremental cost in appliances business, with EBITDA margin contracting

90bp to 10.7% (est. of 10.2%). Adjusted PAT grew 65% YoY to INR352m (est.

of INR155m) due to reversal of tax relating to the previous year.

Healthy growth in LED sales:

Total sales of LED increased 73% to INR467m

from INR269m in 3QFY16. This included revenue from government orders to

the tune of INR50m. Volume-wise, growth was 168% YoY. Management

highlighted that average selling prices have almost halved from last year and

that de-growth in CFL business has impacted lighting segment growth.

New product categories to drive growth:

EVRIN’s range of products in small

appliances segment (value for money positioning) clocked revenue of

INR120m in 3QFY17. The response for kitchen and heating appliances was

good; EVRIN plans to launch air purifier in 4QFY17. It also plans to expand in

west and south India, and invest ~5% of revenue in brand building in FY18.

Valuation and view:

We believe that new categories and LED business will

drive growth for EVRIN, leveraging upon its strong brand. Considering the

impact of tax reversal, we increase earnings for FY17E/FY18E by 34%/8%.

We expect revenue CAGR of 8% and PAT CAGR of 22% over FY16-19E. We

value the stock at 17x FY19E; maintain

Buy

with a target price of INR287.

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Niket Shah

(Niket.Shah@MotilalOswal.com); +91 22 6129 1535

Chintan Modi

(Chintan.Modi@MotilalOswal.com); +91 22 6129 1554