Sector Update| 01 February 2017

rrrrrrr

CMP: INR6,173

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

MSIL IN

302.1

1,865/27.4

6195 / 3202

10/25/43

Automobiles

TP: INR6,808 (Upside 10%)

Buy

Automobiles | Update

Sales up 27% YoY to 144.4k units (v/s est. 133.5k)

Domestic recovery back on track post demonetization; Exports lend support

MSIL’s Jan-17 wholesales were above est. at ~144,396 units (v/s est. 133,500, units),

27% YoY growth (+23% MoM). Our FY17 estimates indicate a 10% growth implying a

10% residual growth rate or ~135.9k/month of run rate.

Domestic volumes were up by 26% YoY (+26% MoM) to 133.9k (v/s est 122.5k)

indicating a sharp recovery post demonetization. Almost all segments showed robust

growth.

Mini segment which was under pressure post demonetization recovered with a 11%

YoY growth. This was post successive months of subdued growth.

The compact segment which accounts for ~40% of total domestic volumes increased

by 25% YoY. We expect growth in compact segment to be driven by Baleno (waiting

period of 24 weeks) along with incremental volumes of newly launches Ignis (8-10

weeks)

Dzire Tour declined by 15% YoY to 3001 units (v/s 2559 units in Dec-16).

Mid-size segment was driven by Ciaz with a 20% YoY growth. Ciaz clocked in 6530

units.

UV volumes doubled to ~16k units in Jan-17, primarily aided by incremental volumes

of Vitarra Brezza, which enjoys a waiting period of 18 weeks.

Domestic growth of 26% YoY for MSIL for Jan-17 was broad based with all segments

growing. Recovery in entry level car segment was also seen post demonetization

hiccup.

Export volumes surprised with a ~45% YoY growth to 10,462 units (v/s est 11,000

units)

The stock trades at 19.7x/16.3x FY18E/19E consolidated EPS of ~INR313/379. Maintain

Buy.

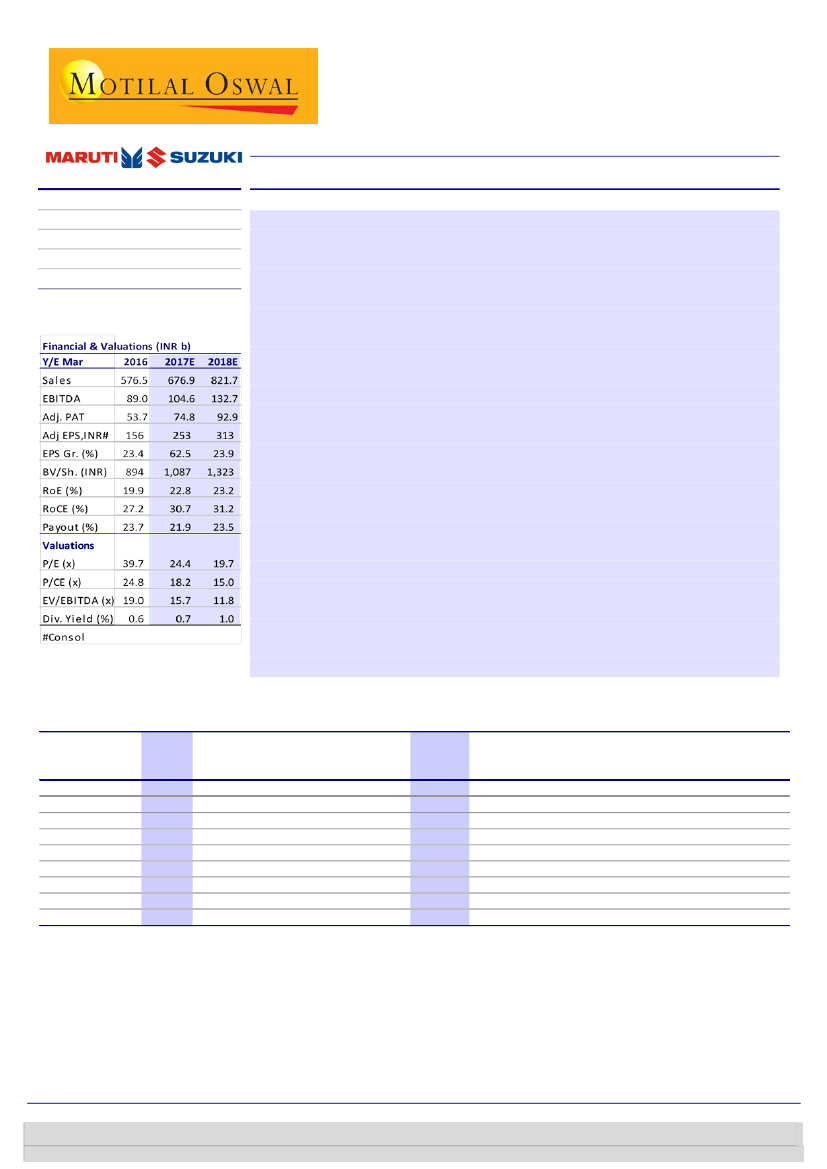

Snapshot of volumes for Jan-17

Jan-17

Jan-16

YoY

(%)

27.1

25.9

0.0

34.9

21.6

6.8

NA

101.0

44.8

Dec-16

117,908

106,414

26

9,224

63,822

17,270

0

16,072

11,494

MoM (%)

22.5

25.9

NA

53.7

23.4

42.0

NA

1.5

-9.0

FY17-YTD

FY16-YTD

Chg

(%)

FY17

estimate

YoY

(%)

Resi-dual Gr.

(%)

10.2

9.8

Residual

Monthly

Run rate

135,924

124,605

Total volume

144,396 113,606

Domestic

133,934 106,383

LCVs

166

0

C (Vans)

14,179 10,512

A2 (Compacts)

78,745 64,781

A3 (Sedan)

24,531 22,976

A4

0

0

UV (Ertiga, S-Cross) 16,313

8,114

Export

10,462

7,223

1,298,560 1,182,452 9.8 1,570,408 9.9

1,195,807 1,078,341 10.9 1,445,018 10.7

460

0

NA

126,186

118,093

6.9

690,895

648,249

6.6

218,699

239,961

-8.9

0

0

NA

159,567

72,038 121.5

102,753

104,111

-1.3 125,390

1.2

14.7

11,319

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Aditya Vora

(Aditya.Vora@MotilalOswal.com); +91 22 3078 4701

3 November 2014

1

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.