2 May 2017

4QFY17 Results Update | Sector: Financials

RBL Bank

Under Review

BSE SENSEX

29,921

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg. Val, INR m

Free float (%)

Financials & Valuations (INR b)

Y/E March

2017

2018E

NII

12.2

15.8

OP

9.2

12.3

NP

4.5

6.6

NIM (%)

3.0

3.1

EPS (INR)

11.9

17.6

EPS Gr. (%)

32.0

48.4

BV/Sh. (INR)

113.4

127.9

ABV/Sh. (INR)

112.7

127.0

RoE (%)

12.3

14.6

RoA (%)

1.0

1.2

Valuations

P/E(X)

49.2

33.2

P/BV (X)

5.2

4.6

P/ABV (X)

5.2

4.6

Div. Yield (%)

0.3

0.5

S&P CNX

9,314

RBL IN

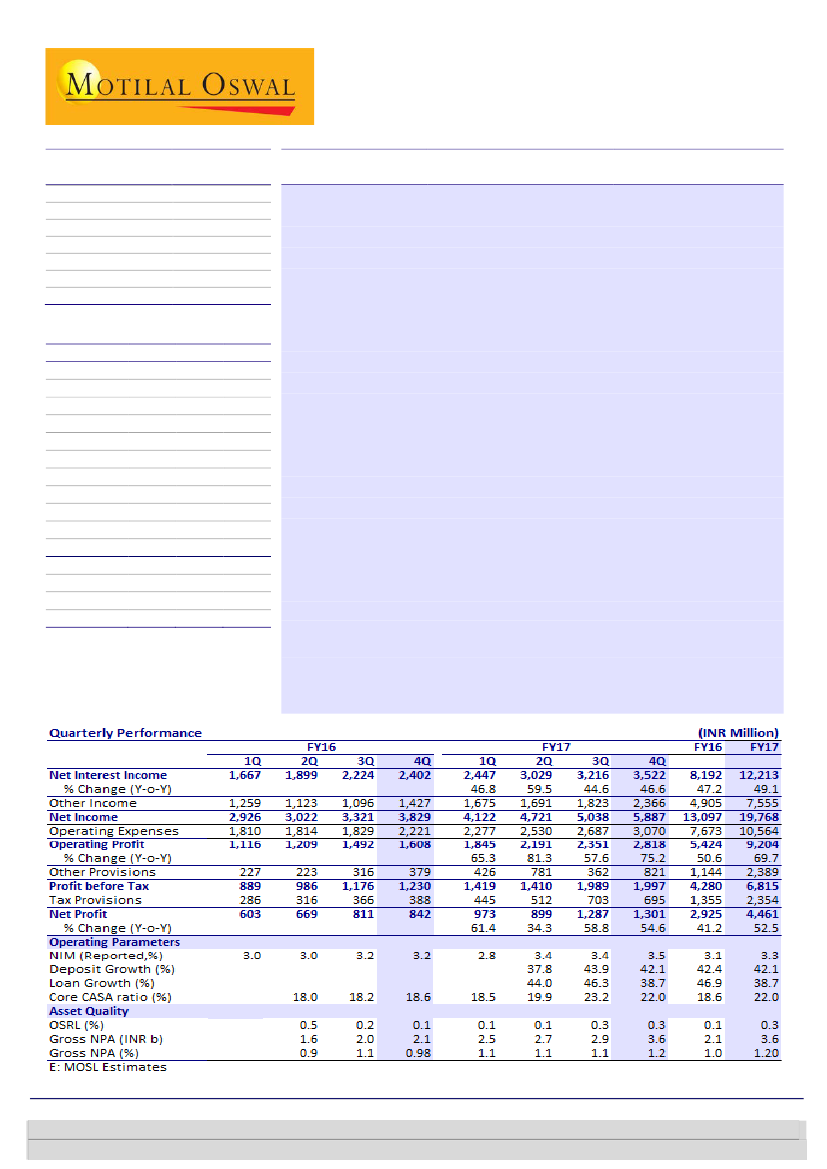

Strong growth continues; Capital consumption faster than expected

375.2

4QFY17 PAT rose 55% YoY (10% miss). Despite PPoP beat of 8% (+75%/20%

291.5 /3.4

YoY/QoQ), the spike in provisioning led to PAT exceeding estimate. Key

599 / 274

positives: a) Loan growth of 10% QoQ and 39% YoY. b) Fee income growth of

17 /44 /-

1,092

45% YoY and 33% QoQ. c) NIM improvement of 10bp QoQ to 3.5%.

100.0

Absolute GNPAs rose 24% QoQ (+72% YoY) to 1.2% of loans. Led by the RBI’s

CMP: INR585

2019E

21.1

16.8

8.9

3.2

23.8

35.0

147.5

146.2

17.3

1.3

24.6

4.0

4.0

0.6

directive, five accounts slipped into NPA, of which four were closed and

recovered completely in FY17 itself. The remaining one account (EPC sector)

amounted to INR660m (22bp impact on GNPA), 50% of which has been

provided for in Q4. Adjusted for this, GNPAs would have been at 0.98%

(stable YoY).

FY17 highlights:

a) Loan growth was broad-based, with wholesale and non-

wholesale growth of 39% YoY each. b) Strong CASA growth of 68%; CASA

ratio improved 340bp YoY to 22%. c) Fees to assets improved 15bp to 1.45%

d) Decline in C/I ratio by 550bp to 53.5%, despite branch addition of 21%

YoY. e) High share of off-balance sheet growth, leading to a rise in RWA to

TA to 76% v/s 68% a year ago.

Other highlights:

a) PAR >90d in micro-banking stood at 3.9% (largely

covered as 90% of portfolio is via BCs). b) CET 1 ratio fell ~70bp QoQ to

11.4%%.

Valuation and view:

With a diverse product portfolio, no legacy issues, highly

capable management and low market share, RBL should report industry-leading

loan CAGR of ~35% over FY16-19E. We expect stable/improving margins due to a

changing loan mix toward high-yielding loans, a sharp fall in cost of bulk deposits

and improvement in CD ratio. Strong balance sheet growth is expected to drive

operating leverage. We expect RoAs to reach 1.3% by FY19.

Under Review.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 6129 1526

Subham Banka

(Subham.Banka@MotilalOswal.com); +91 022 6129 1567

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.