E

CO

S

COPE

Has demonetization led to higher digital payments?

Doubtful; ATM cash withdrawals back to pre-demonetization levels

19 June 2017

The Economy Observer

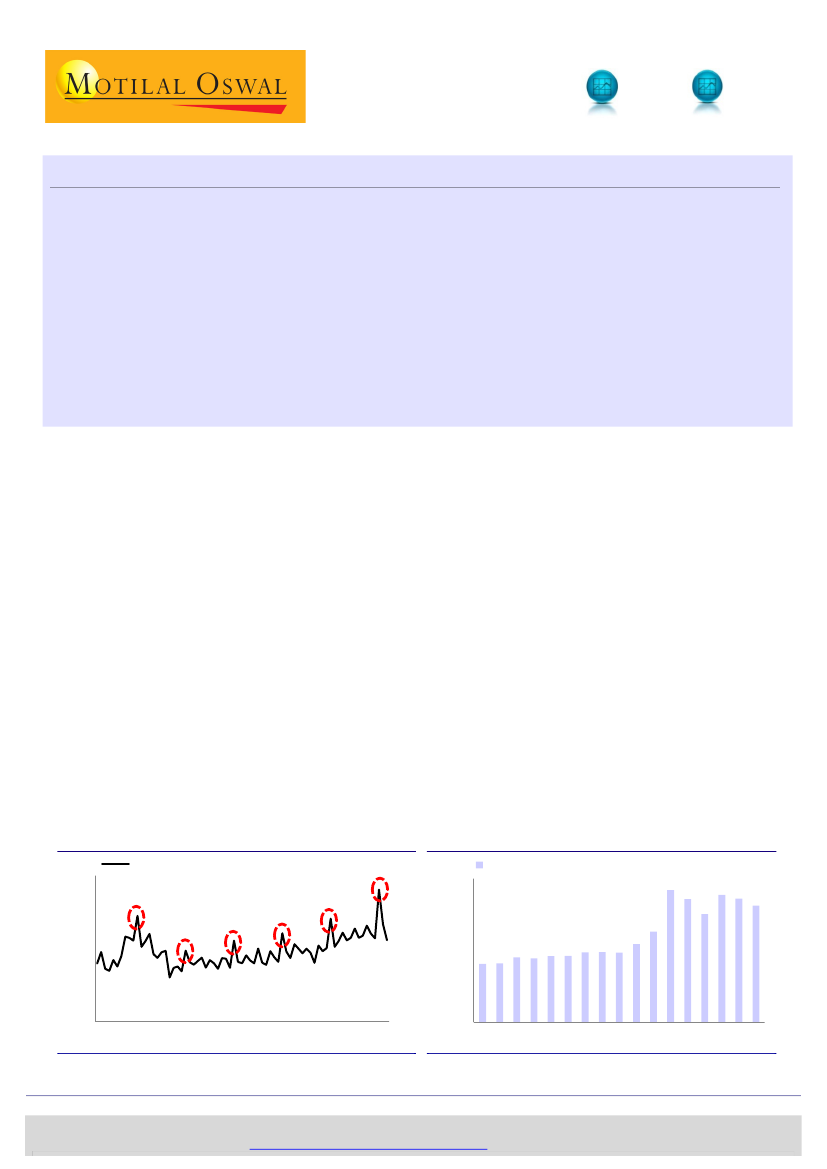

One of the key structural benefits expected from the historic demonetization announced in November 2016 was a shift

towards digital payments. However, the aggregate value of all transactions under electronic payment systems (EPS)

has failed to witness significant increase even six months post demonetization.

Further, while the value of transactions in retail digital modes (PoS, PPIs, IMPS and UPI) increased sharply in December

2016, it has stabilized at higher levels since then (up to May 2017). Similarly, while the volume of retail digital

transactions doubled by December 2016, there are no new net additions since then.

Finally, after falling by more than 60% in the last months of 2016, cash withdrawals from ATMs have moved back to

pre-demonetization levels. All these data points raise doubts over the desired structural shift towards digital payments

post demonetization.

Demonetization was seen as a boost to digital payments, since ~90% of transactions

were believed to be taking place in ‘cash’. Eventually, digitalization was expected to

help reduce tax evasion and corruption. However, available/estimated data up to

May 2017 raises doubts over the increased digitalization in the economy.

The total value of all

transactions under EPS

(electronic payment

system) has been broadly

unchanged since

demonetization, barring a

seasonal spike in March

2017

What do the aggregate numbers tell us?

One of the crudest ways to find out if digitalization has increased is to analyze the

aggregate value of transactions under electronic payments system (EPS) released on

weekly/monthly basis by the Reserve Bank of India (RBI). The total value of

transactions under EPS [consisting of eight (8) modes: Real Time Gross Settlement

(RTGS), National Electronic Funds Transfer (NEFT), Cheque Truncation System (CTS),

Immediate Payment Service (IMPS), National Automated Clearing House (NACH),

Unified Payments Interface (UPI), Debit/Credit Cards at Points of Sale (POS), and

Prepaid Payment Instruments (PPIs)) has been broadly unchanged since

demonetization

(Exhibit 1).

The spike in March 2017 could be explained as seasonal.

However, the volume of transactions has witnessed a durable increase

(Exhibit 2),

implying a significant fall in the value per transaction.

Exhibit 2:

… however, total volume of digital payments has

stabilized at higher level

1,600

1,200

800

400

Total volume of electronic payment systems (EPS)

(Unit m)

Exhibit 1:

Aggregate value of all digital payment transactions

didn’t witness any increase post demonetization…

200

150

100

50

(INR t)

0

May-11 May-12 May-13 May-14 May-15 May-16 May-17

Combined value of POS, PPIs, IMPS, RTGS, NEFT, UPI, CTS and NACH

Total value of electronic payment systems (EPS)

0

Jan-16

May-16

Sep-16

Jan-17

May-17

Source: Reserve Bank of India (RBI), CEIC, MoSL

Nikhil Gupta

(Nikhil.Gupta@MotilalOswal.com); +91 22 3982 5405

Madhurima Chowdhury

(Madhurima.Chowdhury@motilaloswal.com)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.