2

4 August 2017

1QFY18 Results Update | Sector: Automobiles

CEAT Ltd

Buy

BSE SENSEX

32,325

S&P CNX

10,066

CMP: INR1,734

TP: INR2,029 (+17%)

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2017 for

India Research, Sales and Trading

team. We

request your ballot.

High-cost inventory, destocking impact perf; Pressure likely to ease

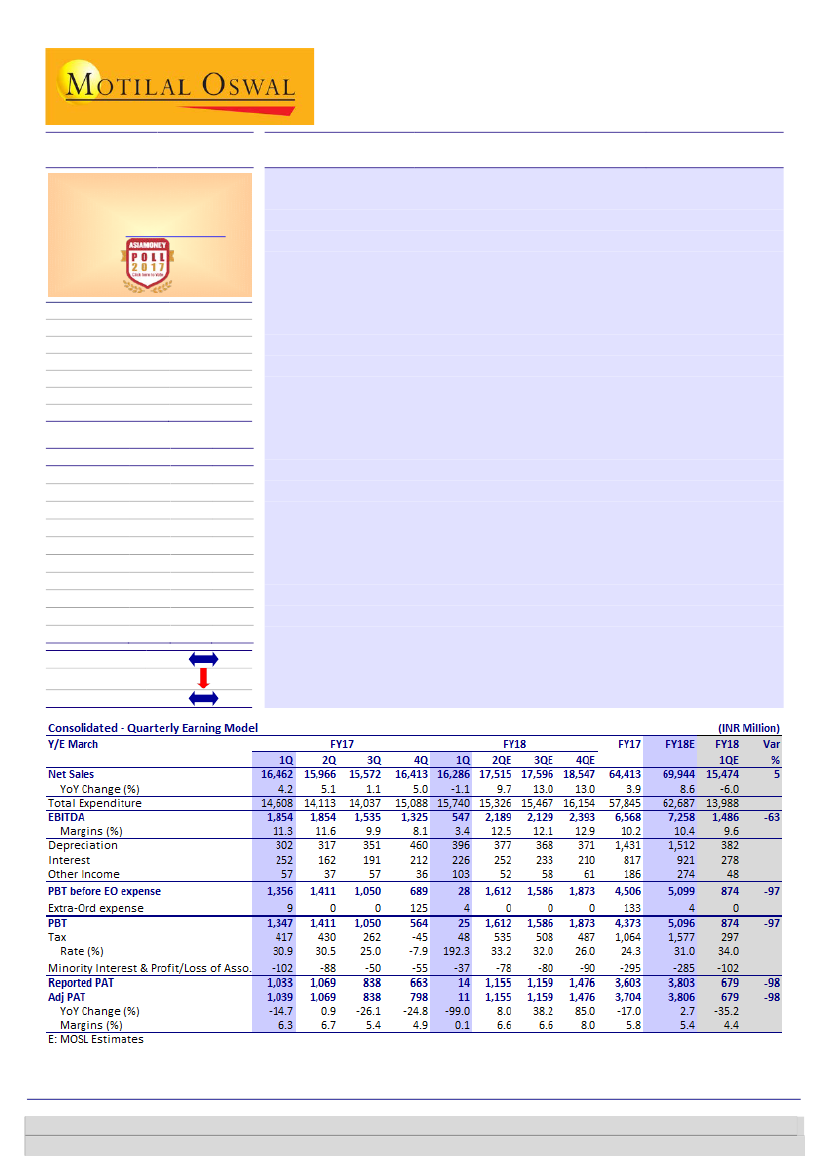

Revenue in line; significant miss on EBITDA and PAT:

CEAT reported overall

revenue of INR16,286m (est. of INR15,474m) in 1QFY18, as against

INR16,462m in 1QFY17, marking a decline of 1.1%. EBITDA stood at INR547m

(est. of INR1,486m) v/s INR1,854m in 1QFY17, with the margin at 3.4% (est.

9.6%) v/s 11.3% in 1QFY17 on account of a significant rise in raw material cost

(up to 59% of net sales v/s est. of 51.5% and 50.8% in 1QFY17). Consequently,

adj. PAT for 1QFY18 stood at INR11m (est. of INR679m) v/s INR1,039m in

1QFY17, marking a decline of 99%.

RM basket to soften in 2QFY18:

1QFY18 witnessed a sharp rise in raw material

cost (+820bp YoY and 260bp QoQ). Price of natural rubber increased 30% YoY,

while that of synthetic rubber rose 50% YoY. This, along with realization

disappointment due to competitive pressure, exerted immense burden on

margin. However, average raw material prices have already come down by

~10% in 2QFY18 and should soften further, bringing margins back on track.

Continued focus on passenger segment:

While commercial segment volumes

declined ~5%, passenger segment witnessed growth of less than 5% in

volumes. However, we expect passenger volumes to grow further on account

of continued initiatives and platform roll-outs (viz., launch of puncture-less

tires and Innova range to provide best mileage).

Valuation and view:

We expect recovery going forward on account of better

volume growth, softening of raw material prices and a recovery in market post

the GST transitional phase. We expect revenue/PAT CAGR of 8%/17% over

FY17-19E. We value the company at a P/E of 16x FY19E EPS, and maintain

Buy

with a target price of INR2,029 (17% upside).

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, (INR m)

Free float (%)

CEAT IN

40.5

76.9/ 1.2

1948 / 836

-10/31/86

1467

49.2

Financials & Valuations (INR b)

Y/E Mar

2017 2018E 2019E

Sales

64.4

69.9

75.3

EBITDA

6.6

7.3

9.0

NP

3.8

3.8

5.1

EPS (INR)

93.3

94.2 126.8

EPS Gr. (%)

-16.9

1.0

34.5

BV/Sh. (INR)

597.0 678.8 788.8

RoE (%)

16.9

14.8

17.3

RoCE (%)

13.5

12.2

14.7

P/E (x)

18.6

18.4

13.7

P/BV (x)

2.9

2.6

2.2

Estimate change

TP change

Rating change

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Niket Shah – Research Analyst

(Niket.Shah@MotilalOswal.com); +91 22 3982 5426

Aksh Vashishth – Research Analyst

(Aksh.Vashishth@MotilalOswal.com); +91 22 6129 1553