Sector Update |

Update | Financials

Sector

25 October 2017

Financials - Banks

Technology

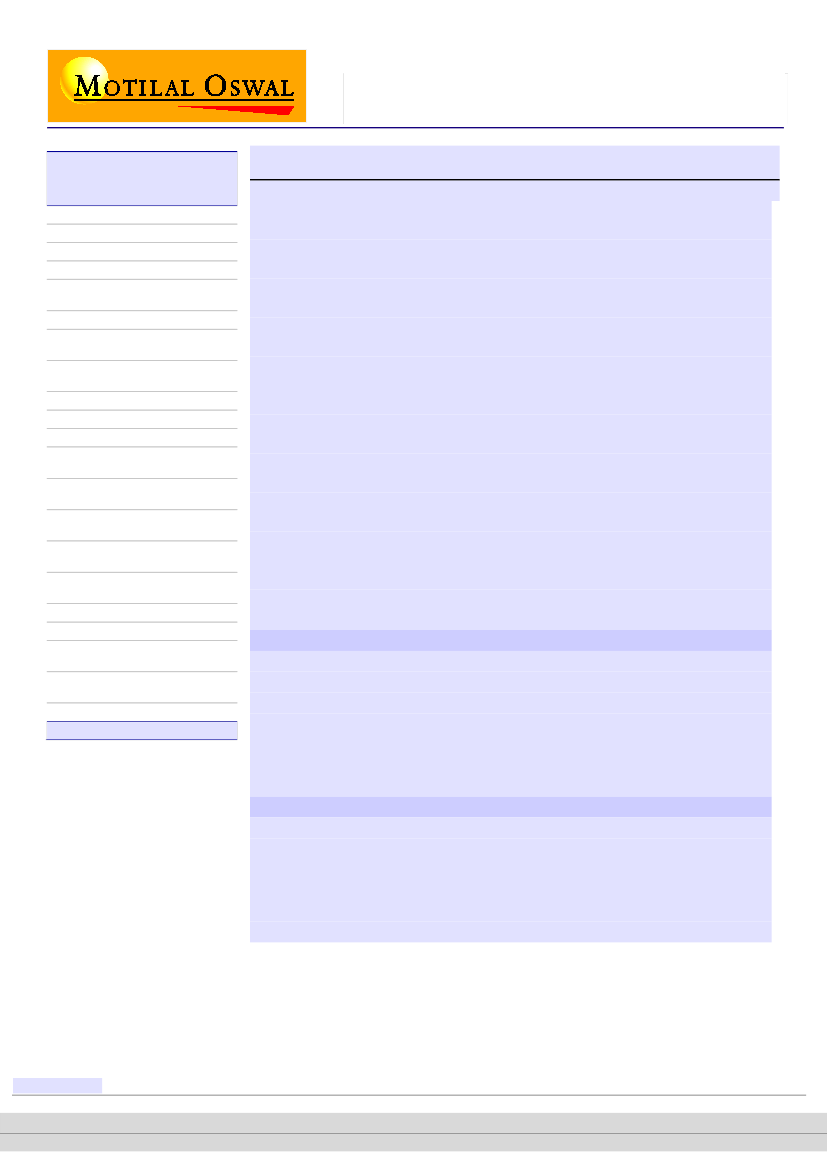

Particulars

Allahabad Bank

Andhra Bank

Bank Of Baroda

Bank Of India

Bank Of

Maharashtra

Canara Bank

Central Bank Of

India

Corporation

Bank

Dena Bank

IDBI Bank Ltd.

Indian Bank

Indian

Overseas Bank

Oriental Bank

Of Commerce

Punjab & Sind

Bank

Punjab

National Bank

State Bank Of

India

Syndicate Bank

UCO Bank

Union Bank Of

India

United Bank of

India

Vijaya Bank

Total

O/s

PCR

(%)

39

43

58

52

38

35

45

32

40

41

46

43

39

33

40

43

40

52

44

40

30

43

Revised

PCR (%)

57

61

76

71

56

54

63

50

58

60

64

62

58

51

59

61

58

71

63

59

48

62

Government announces big bang capital infusion plan for PSBs

Too big to fail!

In an unexpected development (more because of the quantum) the government has

announced a PSU Bank recapitalization plan amounting to INR2.1t (48% of PSU

banks’ current market cap). This will comprise - (i) front-ended capital infusion of

INR1.35t to be funded via recapitalization bonds and (ii) INR760b of capital infusion

from budgetary support and proposed capital raisings by the PSU banks, of which

INR180b will be infused this year as part of the ‘Indradhanush’ plan.

The government will allocate funds to the banks after analyzing their performance,

size and capital requirements. While the details on the recapitalization bonds are yet

to be announced, we believe that this move will help address the perennial capital

constraints facing the PSU banks and also enable these banks to make the required

provisions, thereby expediting the NPL resolution process.

Of the total allocation of INR2.1t, we believe that INR750-800b will go toward

meeting the Basel III capital requirements and supporting business growth, while the

remaining ~INR1.3t can be utilized to make higher provisions. The government intent

to clean up the banks and kick-start the lending process appears very strong, and

thus, we believe that the recapitalization/clean-up initiative would remain a

recurring theme over the next few quarters. Against this backdrop, we turn

constructive on PSU banks, and will soon review our estimates/target prices.

We believe that the banks that are short on capital and have higher quantum of bad

loans stand to benefit more. We reiterate our Buy rating on PNB, SBIN and BOB.

Balance sheet clean-up to account for higher share of infusion at ~60%

We have assessed the individual bank's capital requirement in order to comply

with Basel-III regulations as we believe this is going to be foremost important. We

have then attempted to model the remaining capital allocation to respective banks

taking into account their outstanding bad loans. We believe that the requirement

towards Basel-III compliance will be relatively lower while balance sheet clean-up

will consume ~60% of proposed allocation.

Provisioning coverage to improve ~1900bp to 62%

On the basis of our modelled capital allocation (described above) we estimate that

provisioning coverage ratio of the banks will improve sharply as they begin

cleansing their bad loans. We thus estimate coverage ratio for PSU banks to

improve to an average level of 62% vs 43% currently. This will have a positive

impact on ABVs and we estimate FY18E/19E ABVs to improve by 13%/10%

respectively on completion of this exercise.

Research Analyst: Nitin Aggarwal

(Nitin.Aggarwal@MotilalOswal.com); +91 22 3982 5540 |

Anirvan Sarkar

(Anirvan.Sarkar@MotilalOswal.com); +91 22 3982 5505

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415

| Piran Engineer

(Piran.Engineer@MotilalOswal.com); +91 22 3980 4393

25 October 2017

are advised to refer through important disclosures made at the last page of the Research Report.

1

Investors

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.