31 October 2017

2QFY18 Results Update | Sector: Healthcare

Strides Shasun

Buy

BSE SENSEX

33,213

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm/ Vol m

Free float (%)

S&P CNX

10,335

STR IN

89.5

73.9 / 1.2

1259 / 803

-13/-31/-40

423

68.9

CMP: INR827

TP: INR1,201(+45%)

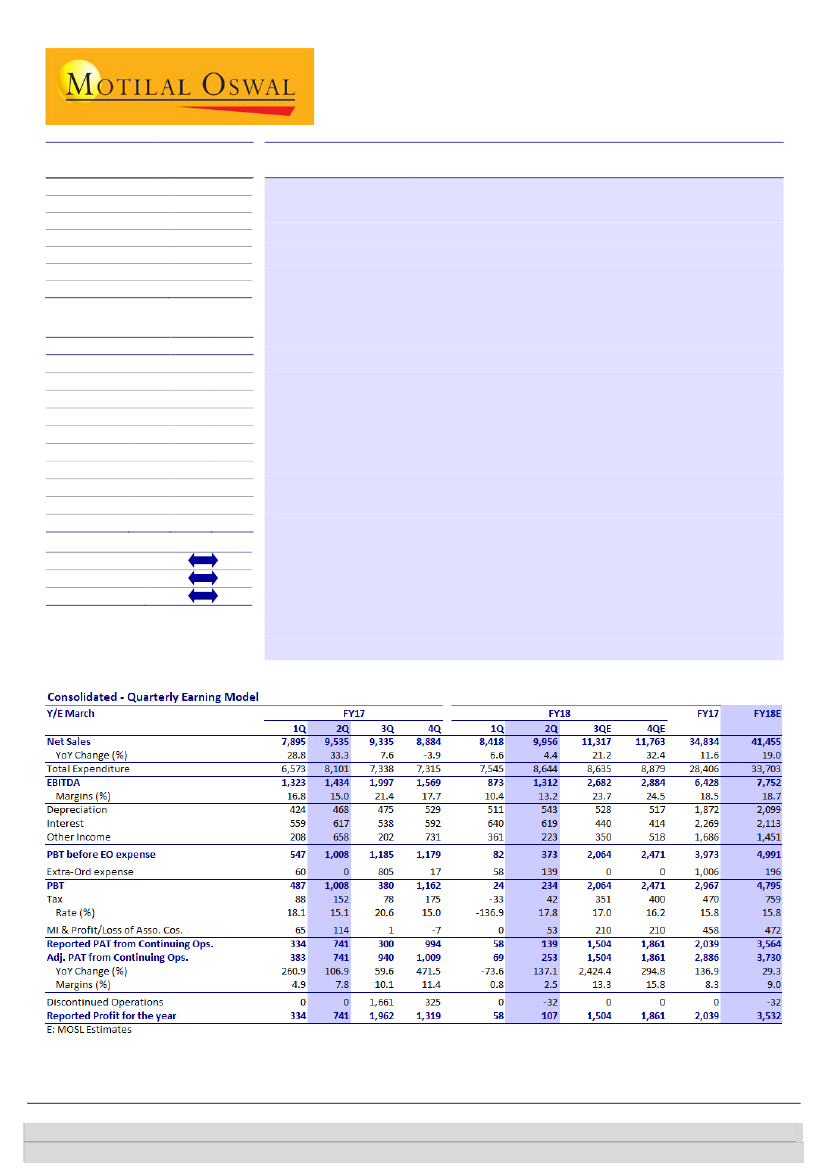

Gradual sequential improvement in operating performance

Strides Shasun’s (STR) 2QFY18 sales of INR10b were better than our estimate of

INR8.9b. EBITDA margin of 13.2% missed our estimate of 14.5%. Adjusted PAT of

INR253m too was lower than our estimate of INR439m.

Regulated market and branded generics drive sales growth:

Sales grew 4.4%

YoY (+18.2% QoQ) to INR10b for the quarter. With a trough formed in 1QFY18,

there has been increased business from the regulated market, and also from

branded generics in the emerging market. Weak institutional business in the

emerging market affected overall growth for the quarter.

Sequential improvement in financial performance:

Gross margin improved

120bp QoQ to 51.4% due to a superior product mix. In addition, higher

operating leverage led to a sequential 280bp improvement in EBITDA margin.

Accordingly, adjusted PAT improved from INR69m in 1QFY18 to INR253m in

2QFY18. EBITDA margin remained lower on a YoY basis. Lower other income

and a higher tax rate led to a further YoY fall in PAT for 2QFY18.

Valuation view:

For FY18/19/20, we reduce sales estimates by 5.6%/4.7%/4.1%

and PAT estimate by 12%/8.7%/8.9% to factor in a delay in key ANDA approvals,

postponement of institutional anti-malaria tender business, and increased cost

associated with marketing spend in the consumer healthcare segment. Accordingly,

we revise our SOTP-based TP to INR1,201. We continue to like STR due to its

differentiated product pipeline for the US, consistent compliance track record, and

better-than-industry growth in the Australia business and also the branded

generics business in the emerging market. Maintain

Buy.

Financials & Valuations (INR b)

Y/E Mar

2017 2018E 2019E

Net Sales

34.8

41.5

51.9

EBITDA

6.4

7.8

10.3

PAT

2.9

3.7

6.1

EPS (INR)

32.3

41.7

68.3

Gr. (%)

77.6

29.2

63.7

BV/Sh (INR)

303.1 344.5 412.8

RoE (%)

10.8

12.9

18.0

RoCE (%)

8.3

9.1

11.5

P/E (x)

25.6

19.8

12.1

P/BV (x)

2.7

2.4

2.0

Estimate change

TP change

Rating change

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Tushar Manudhane – Research Analyst

(Tushar.Manudhane@MotilalOswal.com); +91 022 6129 1536

Rajat Srivastava – Research Analyst

(Rajat.Srivastava@motilaloswal.com); +91 22 3010 2511