F

UEL

R

E

NGINES

8 December 2017

F

RIEND

O

F

T

HE

E

CONOMY

Indian economy witnessing much-needed twin transition

1HFY18 GDP growth, though slower, driven by highly sustainable factors

2QFY18 GDP growth –

released last week

– witnessed some very interesting trends, which, if sustained for a few more

quarters, could set the stage for sustainable growth in the economy. Our analysis reveals that while private spending

(consumption + investments) grew at the fastest pace in three years in 2QFY18, fiscal spending (center + state governments)

grew at the slowest pace in 13 quarters. Moreover, fiscal capex declined for the first time in 11 quarters in 2QFY18. The latter

confirms that

fiscal policy is reaching its limits

in providing support to domestic economic recovery. Almost the entire growth

in 1HFY18 was driven by private spending, which was offset by rising trade deficit. These trends, if sustained beyond FY18,

bode well for the much-needed twin transition we have been talking about in the last two years (a)

GDP growth shifting from

consumption-driven to investment-led,

and (b) the private (households + corporate) sector taking the mantle from the

government in driving investment growth. Since we expect the transition to continue in 2HFY18 as well, we expect real GDP

growth also to remain muted – average 6.6% YoY in 2HFY18 versus 6% in 1HFY18.

The wide gap between

consumption and

investments has narrowed

considerably in 1HFY18

Some exciting details about 2QFY18 GDP growth:

The credibility of India’s

GVA/GDP numbers is doubted for one reason or the other. The Central Statistics

Office (CSO), the agency responsible for publishing India’s national accounts

statistics, believes that GVA estimation is more robust than GDP data, and thus, the

former is the basis for headline GDP growth. This is in stark contrast to the

international practice, wherein headline GDP is estimated from its components

(consumption, investments and external trade), which also explains the existence of

highly volatile ‘discrepancies’ in India’s GDP estimates. Nevertheless, the

components of quarterly GDP – consumption and investments – provide useful

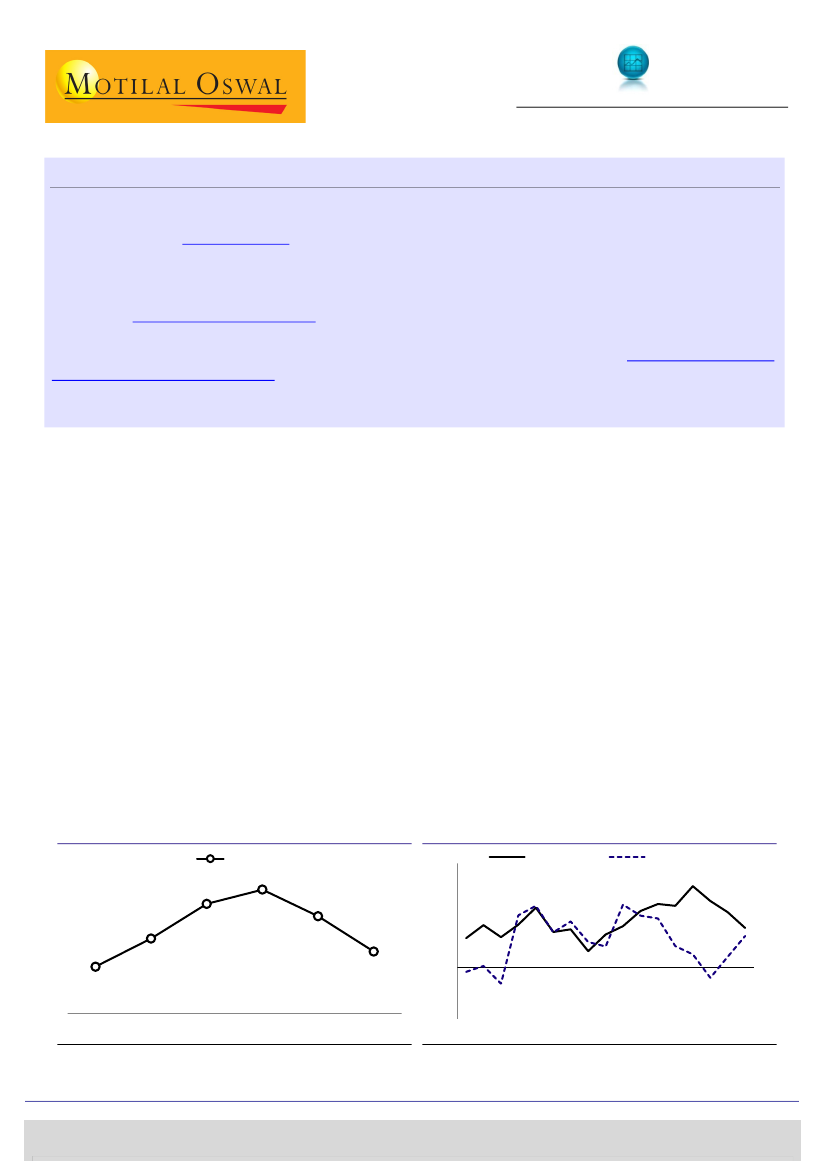

information about the key domestic activities in the economy. From its recent peak

of 8% in FY16, real GDP growth has weakened to 6% in 1HFY18

(Exhibit 1).

However,

a look at the trends in consumption and investments reveals that the wide gap

between the two economic activities has narrowed considerably in 1HFY18. While

consumption (private + government) grew 10.5% in FY17, investments (GFCF +

change in stocks) grew only 2.6%. In 2QFY18, however, while consumption growth

slowed to 6%, investments grew 4.8%

(Exhibit 2).

We expect investments to grow

faster than consumption in 2HFY18.

Exhibit 2: However, the driver of growth has shifted from

consumption to investments

16

12

7.1

6.0

8

4

0

(4)

Consumption*

(% YoY)

Investments#

Exhibit 1: India’s real GDP growth has weakened

considerably in the past two years

(% YoY)

7.5

6.4

5.5

Real GDP

8.0

FY13

FY14

FY15

FY16

FY17

1HFY18

(8)

Q2 FY14

Q2 FY15

Q2 FY16

Q2 FY17

Q2 FY18

Source: Central Statistics Office (CSO), MOSL

* Private + Government

# GFCF + change in stocks

Nikhil Gupta

– Research analyst

(Nikhil.Gupta@MotilalOswal.com); +91 22 3982 5405

Rahul Agrawal

– Research analyst

(Rahul.Agrawal@motilaloswal.com); +91 22 3982 5445

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.