Sector Update | 22 January 2018

Steel

Company name

NMDC

JSP

Tata Steel

Sail

JSW Steel

Pg. no.

9

13

18

22

26

Upgrading earnings on improving long product prices

Expect bumper 4QFY18; JSP and NMDC are our top picks

Steel sector outlook has turned positive, with growth in industrial production across

the world and supply-side discipline, despite slowing fixed asset investment. Steel

mills’ spreads are at new highs.

Indian long product prices have spiked in the last few months, bridging the gap with

flat products, driven by improvement in domestic demand and tightening of iron ore

supply. JSP, SAIL and NMDC are the biggest beneficiaries.

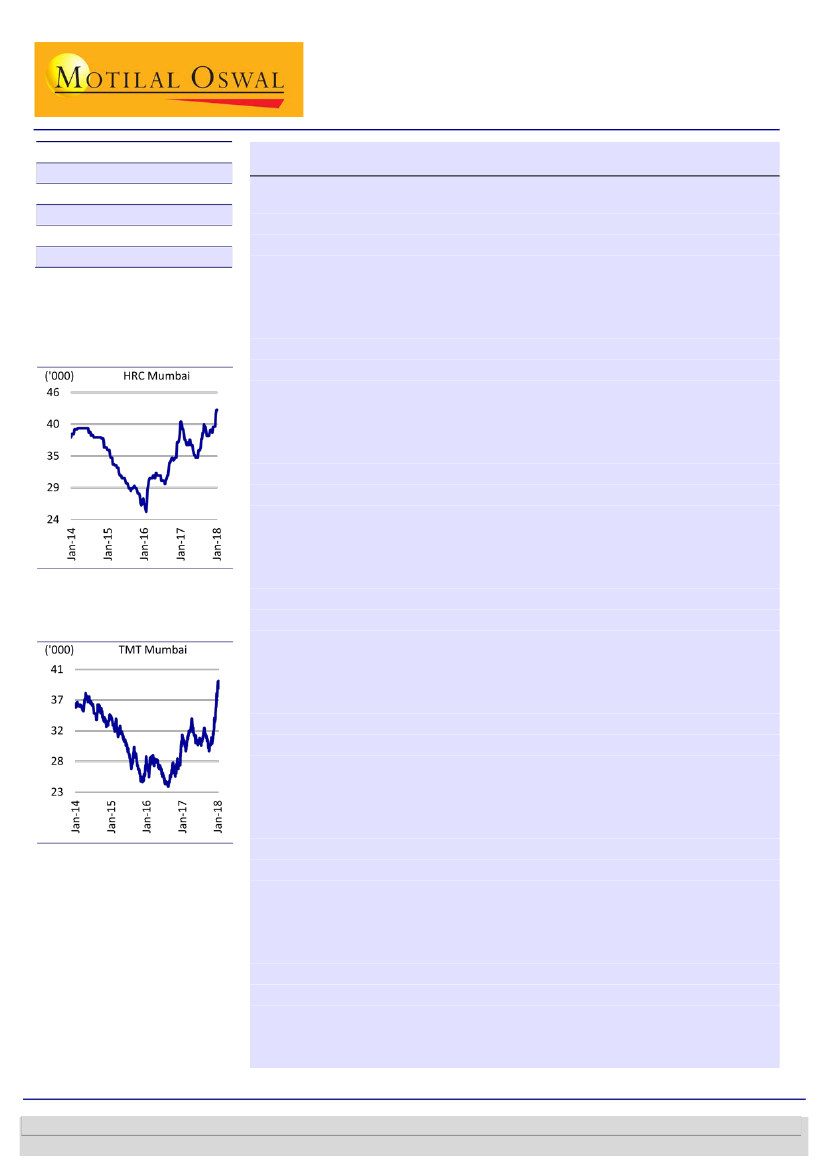

HRC prices in India – INR/t

Margins of Indian steel mills are on the uptick. We expect Indian steel mills to report

very strong numbers in 4QFY18. We are raising our EBITDA estimates by 10-15% for

FY19 and rolling over our target price to FY20E earnings. JSP and NMDC are our top

picks. We continue to like JSW Steel.

Source: SteelMint, MOSL

Steel market outlook across the world has turned positive,

with industrial

production growing in most of the developed (Exhibit 4, Exhibit 5, Exhibit 6) and

BRIC countries (Exhibit 7). Although China’s fixed asset investment (Exhibit 9) and

industrial production growth continue to decelerate, its trade (Exhibit 10) with the

rest of the world (RoW) is growing, benefiting from industrial growth in RoW.

China’s steel exports (Exhibit 8) have been declining all through CY17 on supply-side

discipline, which has tightened steel markets across RoW and boosted steel prices.

Steel mills’ spreads (Exhibit 11) are at new highs, despite modest demand growth.

This is driven by large-scale closure of unorganized producers in China, triggered by

pollution control and raw material oversupply. Even large mills in China are focused

on productivity, pollution, and deleveraging rather than volume growth. Plenty of

iron ore and coking coal supply has allowed steel mills to buy high grade material to

improve furnace productivity and reduce pollution. This has pushed out a lot of low

grade iron ore supply from the market. Prices of low grade iron ore supply, which

accounts for 15-20% of global seaborne supply, are at steep discount. In absolute

value, the realizations are USD20-30/ton on fob basis – a range seen before 2002.

Indian steel market has reaped the benefit only partially

due to sluggish domestic

demand. Flat product prices (Exhibit 14) moved up all through CY16-17, in line with

the international trend. However, long product prices (Exhibit 15) underperformed

flat products by ~USD100/ton due to sluggish construction. Large mills with high

share of flat products in the mix – JSW Steel (JSTL), Tata Steel (TATA), Essar Steel,

and Bhushan Steel – witnessed significant margin expansion, but steel producers

with large share of long products and plates in the mix benefitted only marginally.

Indian long product prices (Exhibit 15) have spiked in the last few months,

bridging

the gap with flat products. This is driven by improvement in domestic demand

(Exhibit 12) and tightening of iron ore supply in the local market after many mines in

Odisha couldn’t pay the penalties (imposed by the Supreme Court (SC) of India for

Long product prices in India –

INR/t

Source: SteelMint, MOSL

21

Oswal research

1

Motilal

November 2017

is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Sanjay Jain - Research analyst

(SanjayJain@MotilalOswal.com); +91 22 3982 5412

Dhruv Muchhal - Research analyst

(Dhruv.Muchhal@MotilalOswal.com); +91 22 3027 8033