Indo Count Industries

BSE SENSEX

34,951

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

12M Avg Val (INR M)

Free float (%)

S&P CNX

10,524

ICNT IN

Robust volumes without earnings vigor as currency/mix/RM cost haunt

197

Expect continued margin pressure

12.6 / 0.2

139 / 53

Operating performance disappointing:

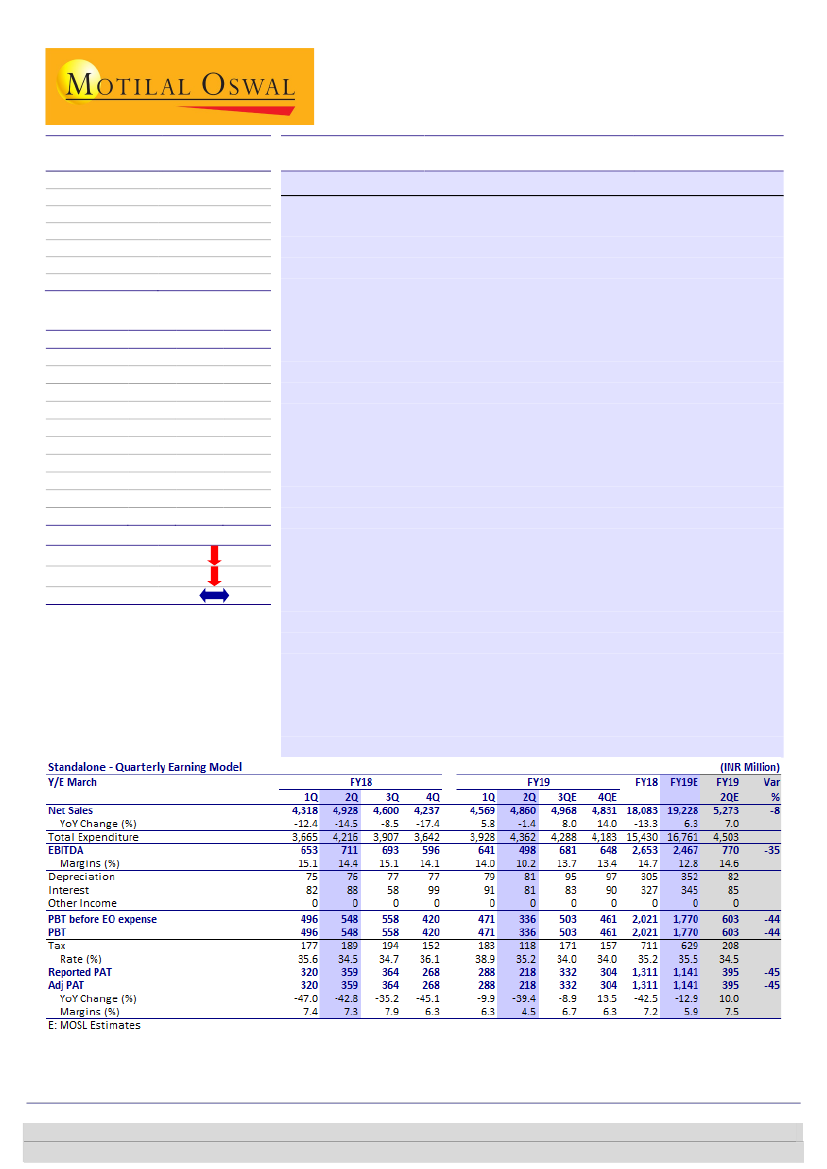

ICNT’s revenue declined 1.4% YoY to

4/-24/-47

INR4,860m (our estimate: INR5,273m) in 2QFY19. EBITDA fell 30% YoY to

108

INR498m (our estimate: INR770m), with the margin contracting 420bp YoY

41.1

5 November 2018

2QFY19 Results Update | Sector: Textiles

CMP: INR64

TP: INR72(+13%)

Neutral

Financials & Valuations (INR b)

2018 2019E

Y/E Mar

Net Sales

19.6

20.5

EBITDA

2.6

2.5

PAT

1.3

1.1

EPS (INR)

6.4

5.8

Gr. (%)

-45.7

-9.5

BV/Sh (INR)

48.4

53.0

RoE (%)

14.0

11.4

RoCE (%)

11.9

10.3

P/E (x)

10.0

11.1

P/BV (x)

1.3

1.2

2020E

21.7

2.7

1.3

6.6

13.6

58.4

11.8

10.8

9.7

1.1

Estimate change

TP change

Rating change

to 10.2% (our estimate: 14.6%). Adj. PAT declined 39.4% YoY to INR218m

(our estimate: INR395m) in the quarter.

1HFY19 performance:

Revenue grew by 2% YoY to INR9,429m. EBITDA

declined 17% YoY to INR1,139m, with the margin contracting 270bp YoY to

12.1%. Adj. PAT declined 25% YoY to INR506m. In 2HFY19, we expect

revenue growth of 11% YoY, with margin contraction of 100bp.

Steady volume growth, but expect pressure on profitability:

ICNT delivered

volume growth of 9% YoY in 2QFY19 and 15% YoY in 1HFY19. The company

is well on track to meet its volumes guidance of 58-60m mtrs in FY19, with

30.2m mtrs already achieved in 1HFY19. However, revenue growth and

profitability were impacted in 1HFY19 on account of currency volatility

(hedged at exchange rate lower than realized translation), product mix

changes and raw material (RM) cost pressure. Going forward too, RM cost

pressure (cotton prices at INR46k/candy v/s expectation of MSP level prices

of 43-44k/candy) and currency volatility are likely to persist.

Valuation and view:

Due to the strong miss on earnings (45%) in 2QFY19

and the likely gross margins pressure in 2HFY19, we cut our

revenue/earnings estimates by 3%/24% for FY19 and by 5%/24% for FY20.

We also note that strong volumes have not translated into robust revenue

growth and operating performance. We value the stock at 11x FY20E EPS

(~10% discount to its five-year average P/E) on account of the continued

muted performance and likely pressure on margins. Our target price of

INR72 implies a 13% upside. Maintain

Neutral.

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Sumant Kumar – Research Analyst

(Sumant.Kumar@motilaloswal.com); +91 22 3078 4702

Aksh Vashishth – Research Analyst

(Aksh.Vashishth@motilaloswal.com); +91 22 6129 1553