E

CO

S

COPE

The Economy Observer

2 November 2020

Probability of upgrades rising

Expect real GDP to decline only ~5% in 2QFY21

Our in-house Economic Activity Index (EAI) for India’s GVA (called EAI-GVA) posted growth of 2.2% YoY for the first time

in seven months in Sep’20, following decline of 2.2% YoY in Aug’20. This implies EAI-GVA shrank just 1.7% YoY in

2QFY21 v/s -18% YoY in 1QFY21. Industrial activity contracted marginally (by 0.7% YoY), while the Services sector grew

3.1% YoY (for the first time in six months) in Sep’20. Growth in farm activity eased to 5.4% YoY in Sep’20, from the

double digits in the previous three months, due to decline in fertilizer production.

The EAI-GDP index (our in-house measure for official GDP), however, contracted 2.8% YoY in Sep’20, implying decline of

5% YoY in 2QFY21, following a 7.2% decrease a month ago. Notably, fiscal spending declined 37% YoY in Sep’20 (the

worst decline in 18 months), dragging down economic growth significantly during the month. Excluding fiscal spending,

EAI-GDP actually edged up 0.1% YoY during the month, marking growth for the first time in seven months. Following six

straight months of double-digit decline, investment spending shrank only 9% YoY in Sep’20, led by strong growth in

freight traffic and power generation.

Overall, as we had pointed out

earlier,

economic recovery over Aug–Sep’20 was much better than expected and would

likely peak in Oct’20. The base effect, pent-up demand, and hopes of a grand festive season have led to strong recovery,

which would certainly lead to sharp upgrades in FY21 GDP forecasts. Accordingly, we believe real GDP decline could be

only ~5% YoY in 2QFY21, better than

our forecast

of -7.1% and the Bloomberg consensus of -11%. Recovery, however,

remains highly unbalanced – rural

v/s

urban, consumption

v/s

investments, and Services

v/s

Industrial.

Preliminary estimates

reveal India’s EAI for GVA

posted growth of 2.2% YoY

in Sep’20, implying only

1.7% YoY decline in 2QFY21.

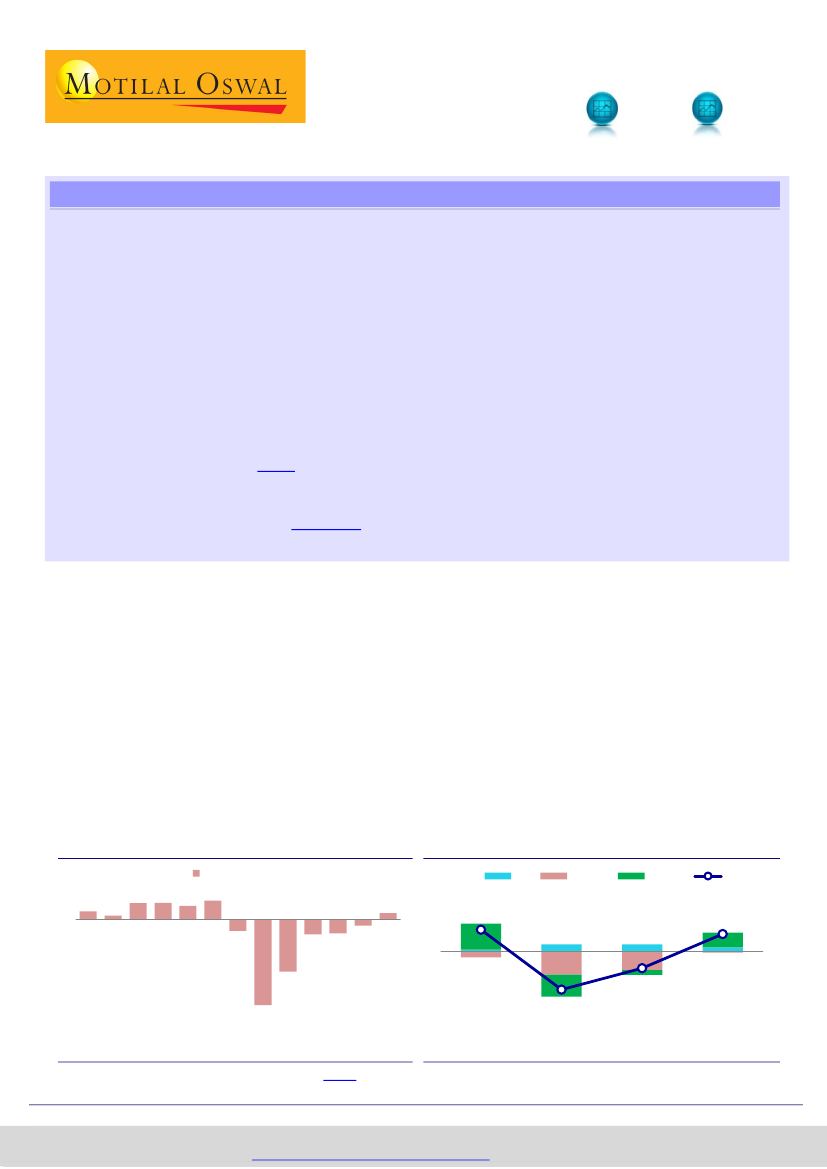

EAI-GVA grew 2.2% YoY in Sep’20:

Preliminary estimates reveal India’s EAI for

GVA posted growth of 2.2% YoY in Sep’20 – for the first time in seven months

following six consecutive declines – implying decline of only 1.7% YoY in 2QFY21

(Exhibit 1).

Although growth in farm activity weakened to 5.4% YoY in Sep’20

(from the double digits in the previous three months), the Services sector

posted growth for the first time in six months (supported by freight traffic and

the Financial sector); industrial activity contracted only marginally during the

month

(Exhibit 2).

EAI-GDP, however, declined during the month:

EAI-GDP fell 2.8% YoY in Sep’20,

marking a 5% YoY contraction in 2QFY21, following decline of 7.2% YoY in

Aug’20

(Exhibits 3, 4).

Fiscal spending was a major drag during the month,

excluding which EAI-GDP actually inched up 0.1% YoY in Sep’20.

Exhibit 2: …supported by strong revival in Services sector

(pp)

2.2

(2.2)

2.8

3.4

0.2

-0.8

-2.9

-5.0

Jun-20

Sep-20

Sep-19

Jul-20

Aug-20

Sep-20

0.9

-3.0

0.9

-2.5

-0.6

Agri

Industry

Services

EAI-GVA

2.2

1.9

0.5

-2.2

-0.2

Exhibit 1: India’s EAI-GVA grew 2.2% YoY in Sep’20…

2.8 1.3

EAI-GVA (% YoY)

5.7 5.8 4.7 6.6

(4.1)

(5.4) (5.0)

(18.5)

(30.3)

Sep-19

Dec-19

Mar-20

Please refer to our earlier

report

for details

Source: Various national sources, CEIC, MOFSL

Nikhil Gupta – Research Analyst

(Nikhil.Gupta@MotilalOswal.com)

Yaswi Agrawal

– Research Analyst

(Yaswi.Agrawal@motilaloswal.com)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.