4 November 2020

A

nnual

R

eport

T

hreadbare

TORRENT PHARMACEUTICALS FY20

Torrent Pharma's FY20 Annual Report analysis highlights modest revenue

growth of 3.5%, led by decline in the US (4.2%) and Germany (6.1%).

However, businesses in India/ROW registered growth of 8.8%/12.8%.

EBITDA margins expanded 150bp to 27.3% due to higher gross margins,

lower R&D spends (at 6.2% of revenue v/s 7.0% in FY19), containment of

employee expenses (at 18.0% of revenues v/s 18.3% in FY19) with

reduced manpower (by 750 people), and capitalization of part employee

expenses during upgradation of the Levittown facility. PAT excluding

exceptional items increased 29.2% to INR10.2b, supported by lower ETR

(at 13.6% v/s 22.3% in FY19) due to one-time tax benefit provided

through Coronavirus Aids, Relief and Economic Security Act (CARES) in

the US, certain deductions allowed under the Income Tax Act, and higher

other income at INR1.2b (FY19: INR0.6b) owing to forex gains.

Intangibles, primarily due to acquisitions done in prior years, remained

high at INR45.8b, (33% of total assets (TA) /95% of net worth (NW)).

However, goodwill amongst this is a mere 7.5%, which has been tested

for impairment. Unlike its peers, Torrent amortizes most of the

intangible. Earnings to cash flow conversion declined to 77% on

increased working capital (WC) intensity (primarily inventory). Higher net

profit margin led to rise in ROE to 21% (FY19: 17%).

The

ART

of annual report analysis

EBITDA margins expanded

150bp due to cost synergy

on integration of Unichem

portfolio and higher

employee productivity.

Earnings-to-cash conversion declined to 77% –

the lowest in five years – due to increase in WC

intensity of the business.

Intangibles including goodwill remain high at

INR45.8b (33% of TA/95% of NW).

Stock Info

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

12M Avg Val (INR M)

Free float (%)

TRP IN

169

436.1 / 5.8

3040 / 1619

-13/-9/43

1517

28.8

Muted operating performance:

EBITDA grew 9.4% to INR21.7b

as revenue inched up a mere 3.5% to INR79.4b. EBITDA margin

expanded by 150bp to 27.3%. We note that over FY15-20,

revenues have posted 11.3% CAGR, largely led by acquisitions.

While revenue/EBITDA grew exponentially in the years after

the acquisition (FY16 and FY19), the same remained muted

post those years (FY17 and FY20).

Earnings to cash conversion declines:

Earnings to cash

conversion declined to 77% (lowest in five years) due to

increased investment of INR3.9b in WC (v/s release of INR1.0b

in FY19), which led to 30% decline in operating cash flows post

interest to INR9.1b (FY19: INR12.9b). Cash conversion cycle

(CCC) rose by 47 days to 88 days in FY20, majorly due to (a)

11% increase in inventory levels to INR21.5b, leading to

increase in inventory days to 362 (FY19: 318), and (b) increase

in trade receivables by 14.8% to INR16.5b, leading to rise in

receivables days to 76 (FY19: 68).

Intangibles remain high:

Torrent’s intangibles remain high at

INR45.6b. It mainly consists of brands and product licenses

acquired. However, Torrent’s accounting of intangibles seems

conservative as over the last five years, it has amortized

intangibles at 8.0% (average), higher than most of its peers.

Leverage moderates:

Torrent’s gross borrowings reduced by

3.3% to INR58.4b in FY20 (v/sINR60.4b in FY19) while net debt

increased to INR51.9b (v/s 49.1b in FY19).Net D/E increased to

1.1x from 1.0x in FY19.

Cash tax significantly exceeds tax expense recognized:

The cash

tax paid (INR2.8b) remains higher than the tax expense

recognized in P&L (INR1.7b) on account of recognition of

deferred tax assets, which stood at INR4.3b, 9% of NW.

Shareholding pattern (%)

As on

Promoter

DII

FII

Others

Sep-20

71.3

8.4

12.2

8.1

Jun-20

71.3

9.7

11.0

8.1

Sep-19

71.3

13.1

7.7

8.0

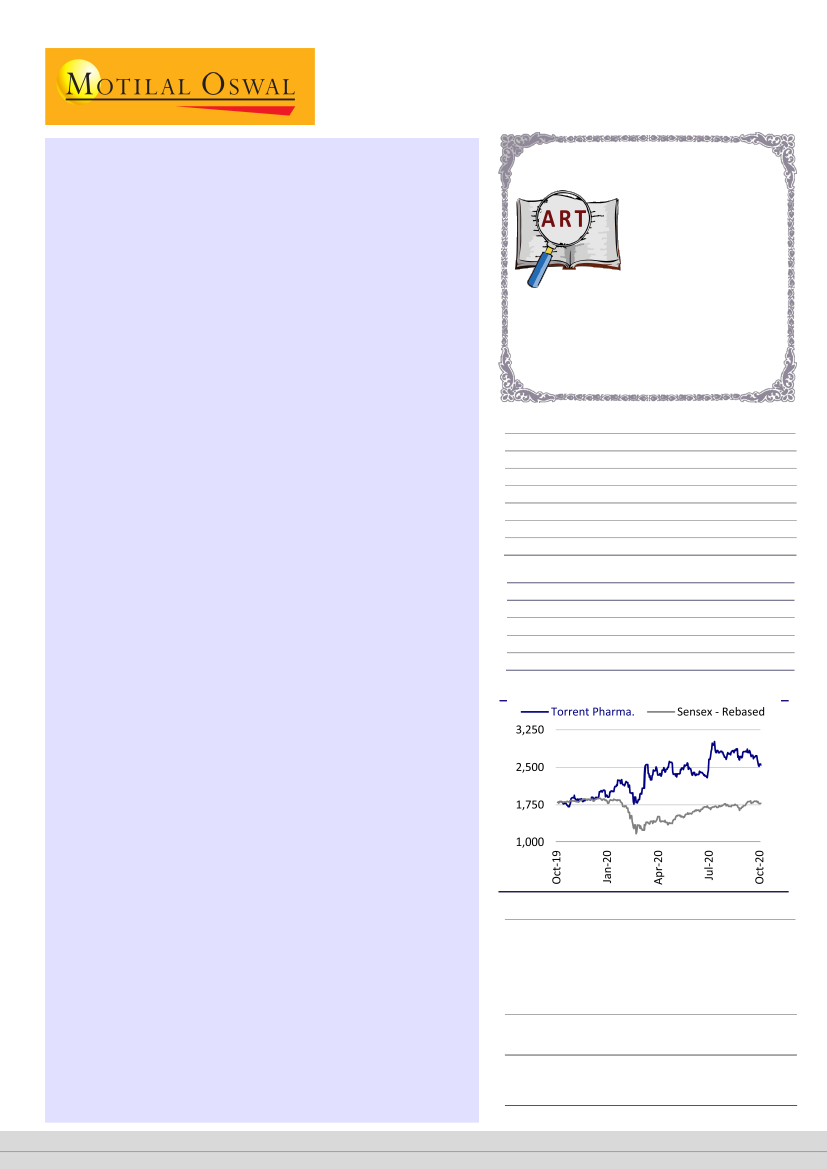

Stock Performance (1-year)

Auditor’s name

BSR & Co LLP

Kirit Mehta & Co

M C Gupta & Co

Research analyst

Sandeep Ashok Gupta

(S.Gupta@MotilalOswal.com)

Umesh Jain

(Umesh.Jain@MotilalOswal.com)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.