19 November 2020

Market snapshot

Equities - India

Sensex

Nifty-50

Nifty-M 100

Equities-Global

S&P 500

Nasdaq

FTSE 100

DAX

Hang Seng

Nikkei 225

Commodities

Brent (US$/Bbl)

Gold ($/OZ)

Cu (US$/MT)

Almn (US$/MT)

Currency

USD/INR

USD/EUR

USD/JPY

YIELD (%)

10 Yrs G-Sec

10 Yrs AAA Corp

Flows (USD b)

FIIs

DIIs

Volumes (INRb)

Cash

F&O

Note: *Average

Close

44,180

12,938

18,924

Close

3,568

11,802

6,385

13,202

10,640

25,728

Close

43

1,872

7,070

1,985

Close

74.2

1.2

103.8

Close

5.9

6.6

18-Nov

0.41

-0.38

18-Nov

723

26,351

Chg .%

0.5

0.5

1.5

Chg .%

-1.2

-0.8

0.3

0.5

0.9

-1.1

Chg .%

0.9

-0.4

0.3

1.2

Chg .%

-0.4

-0.1

-0.4

1MChg

0.00

0.00

MTD

2.92

-2.54

MTD*

630

24,109

CYTD.%

7.1

6.3

10.7

CYTD.%

10.4

31.5

-15.3

-0.4

-4.7

8.8

CYTD.%

-34.9

23.4

15.0

11.4

CYTD.%

3.9

5.7

-4.4

CYTDchg

-0.7

-1.0

CYTD

6.66

6.81

CYTD*

554

17,837

Today’s top research idea

Wipro: Operational restructuring to fund investments

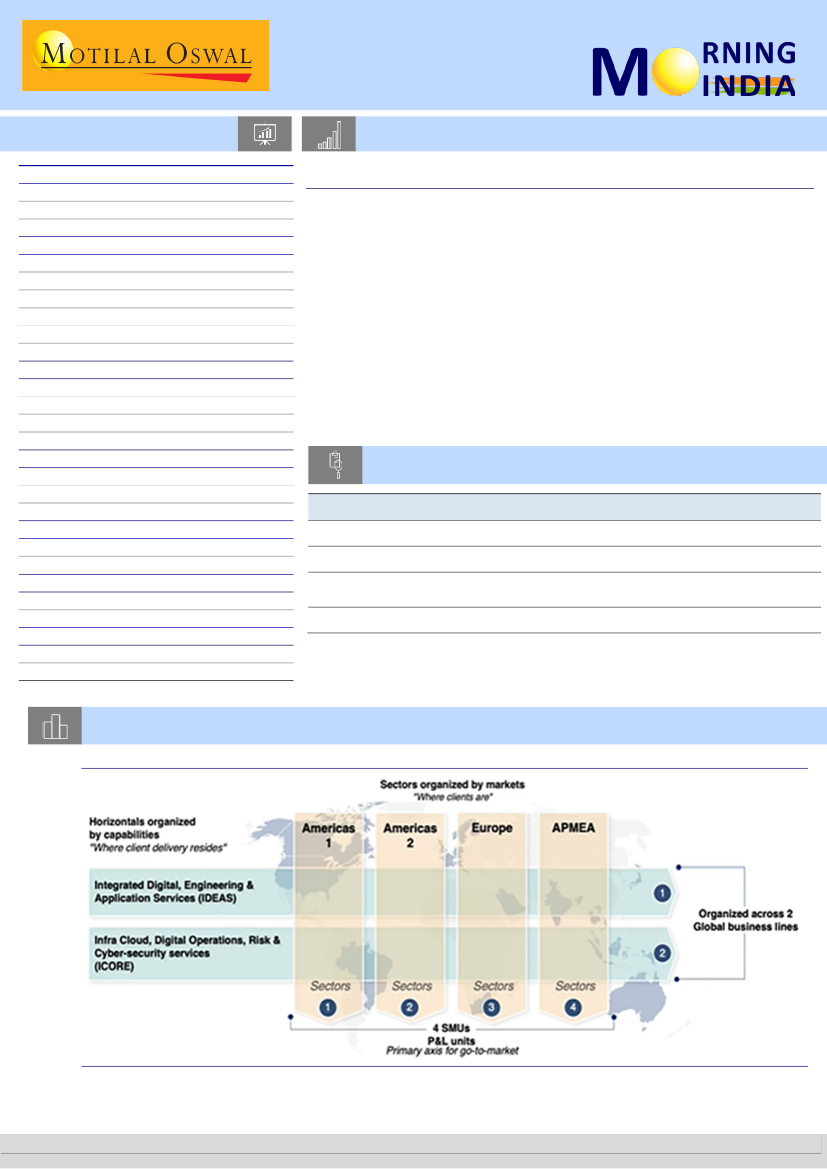

The key focus of Wipro’s Analyst Day was on operational changes and steps

undertaken to accelerate revenue growth. The company expects the shift to four

Strategic Market Units and two Global Business Lines to help streamline

operations and increase its focus outside of the US.

Creation of a global account executive (GAE) role would help WPRO better

address long-standing issue in client mining and retention.

We are less sure of the utility of delineating clients by region (unlike by industry

at peers) as this could impact its ability to tap into global accounts and

seamlessly utilize sectoral strength across regions.

With the new strategy operationalizing from Jan’21, any near-term impact would

be closely monitored and could impact the stock’s valuation.

Research covered

Cos/Sector

Wipro

SBI Life

Gujarat State

Petronet

Textile

Key Highlights

Operational restructuring to fund investments

Protection trends remain robust; cost leadership continues

A decade old – A decade new: a huge opportunity

Earnings visibility improves across players

Chart of the Day: Wipro (Operational restructuring to fund investments)

Simplified operating model of the company

Source: Company, MOFSL

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.