HCL Technologies

Estimate change

TP change

Rating change

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

12M Avg Val (INR M)

16 January

2021

3QFY21 Results Update | Sector: Technology

CMP: INR989

TP: INR1,300 (+31%)

Buy

Product driven 3Q beat should ease viability concerns

All round performance; expect mid-teen growth for FY22

HCLT IN

2,714

2684.9 / 38.2

1074 / 376

6/25/49

5192

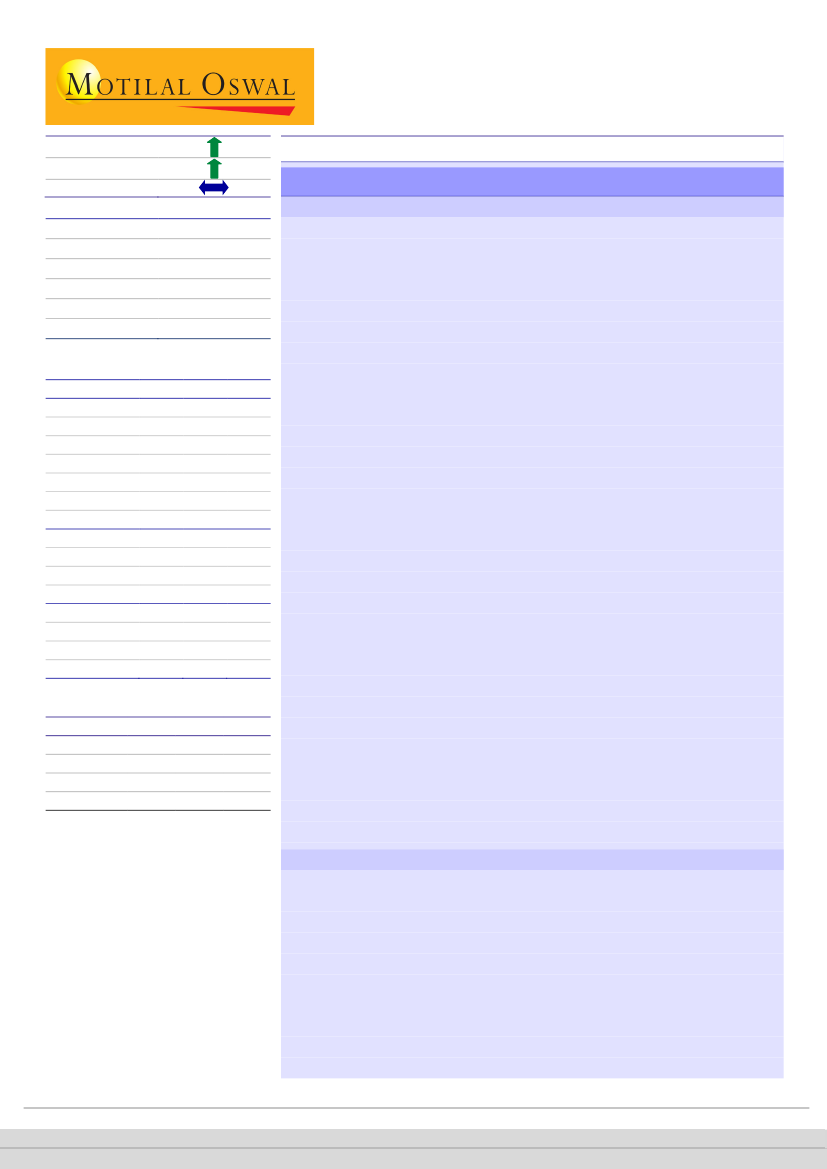

Financials & Valuations (INR b)

Y/E Mar

2021E 2022E 2023E

761

875

990

Sales

21.6

21.8

22.1

EBIT Margin (%)

130

153

176

PAT

48.0

56.5

65.0

EPS (INR)

18.0

17.5

15.1

EPS Gr. (%)

217

241

260

BV/Sh. (INR)

Ratios

RoE (%)

RoCE (%)

Payout (%)

Valuations

P/E (x)

P/BV (x)

EV/EBITDA (x)

Div Yield (%)

23.6

20.8

37.5

20.6

4.6

12.4

1.8

24.6

21.7

50.0

17.5

4.1

10.6

2.9

25.9

22.9

60.0

15.2

3.8

9.3

3.9

Shareholding pattern (%)

As On

Promoter

DII

FII

Others

Dec-20 Sep-20 Dec-19

60.3

60.3

60.0

10.3

10.7

8.5

24.9

24.9

27.7

4.5

4.1

3.9

FII Includes depository receipts

HCL Technologies (HCLT) delivered strong revenue growth (3.5% QoQ CC) in

3QFY21, above our expectation and its guidance, led by stronger than

expected seasonality in the Products and Platforms vertical (P&P, +8.3%

QoQ in CC) and continued traction in Mode 2 services (+10.9% QoQ in CC).

We expect HCLT to return to mid-teens growth in FY22 (14% YoY in CC USD)

as continued strength in P&P – due to improving deal wins and new client

additions – complements improving demand environment in IT Services and

R&D verticals. The P&P business should deliver low teen USD revenue

growth over the next two years.

We view the improvement in deal wins (+13% YoY), robust deal pipeline, and

large ER&D exposure (~16% of revenue) as positive. It should also continue

to benefit from high demand for Cloud migration (Digital foundation) work.

EBIT margin expanded by 130bp QoQ to 22.9%, driven by lower SG&A

spends (+80bp) and increased offshoring (+50bp), despite a partial wage

hike impact (-50bp). While we see a wage hike and sales investments as

margin headwinds in FY22, it should also benefit from growth led positive

operating leverage. We expect the company to report 21.8% EBIT margin, up

20bp YoY, but still 110bp below the peak delivered in 3QFY21.

We expect HCLT to deliver 4Q revenue growth and FY21 EBIT margin at the

upper end of its guidance band of 2-3% and 21-21.5%, respectively.

For 9MFY21 it delivered sales (USD)/EBIT/PAT growth of 1.2%/21.2%/20.1%.

Along with robust operational performance, cash conversion (percentage)

for the company more than doubled in 9MFY21 with FCF/PAT at 150% as

against 63% in FY20.

HCLT is our preferred pick in IT Services space, and also a part of our model

portfolio.

We upgrade our EPS estimate for FY21E/FY22E/FY23E by

4%/4%/7%. Maintain

Buy

as we expect HCLT to re-energize its Products

business, while keeping positive traction in the Services business, driven by

higher IMS/Cloud focused deals. Our TP of INR1,300 per share implies 20x

FY23E EPS (~20% discount to TCS).

In constant currency (CC), revenue grew 3.5% QoQ in 3QFY21, above our

estimate of 2.2%.

Mode 1 (61% of business) grew 0.1% QoQ, Mode 2 (23%) grew 11% QoQ,

and Mode 3 (16%) was up 7.1% QoQ CC. Growth in Mode 2 was led by good

traction seen in Cloud native and Digital programs.

Growth was driven by Telecom/Media/Entertainment vertical, up a

significant 12% QoQ CC. Other key contributors were Technology and

Services (+6.8% QoQ CC) and Manufacturing (+5.6% QoQ CC).

HCLT won 13 large deals across industry verticals, including Life Sciences and

Healthcare, Technology, and Financial Services.

Performance ahead of estimates

Mukul Garg – Research analyst

(Mukul.Garg@MotilalOswal.com)

Research analyst: Anmol Garg

(Anmol.Garg@MotilalOswal.com) /

Heenal Gada

(Heenal.Gada@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.