3 February 2021

3QFY21 Results Update | Sector: Consumer

Tata Consumer Products

Estimate change

TP change

Rating change

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

12M Avg Val (INR M)

Free float (%)

CMP: INR576

TP: INR661 (+15%)

Buy

Gross margin contraction weighs on EBITDA

Adjusted PAT above our estimates

TATACONS IN

922

530.4 / 7.4

635 / 214

-8/2/29

2218

65.3

2023E

134.7

22.2

14.3

16.4

15.5

16.5

176

(0.2)

9.1

11.5

34.9

37.2

23.2

2.6

5.7

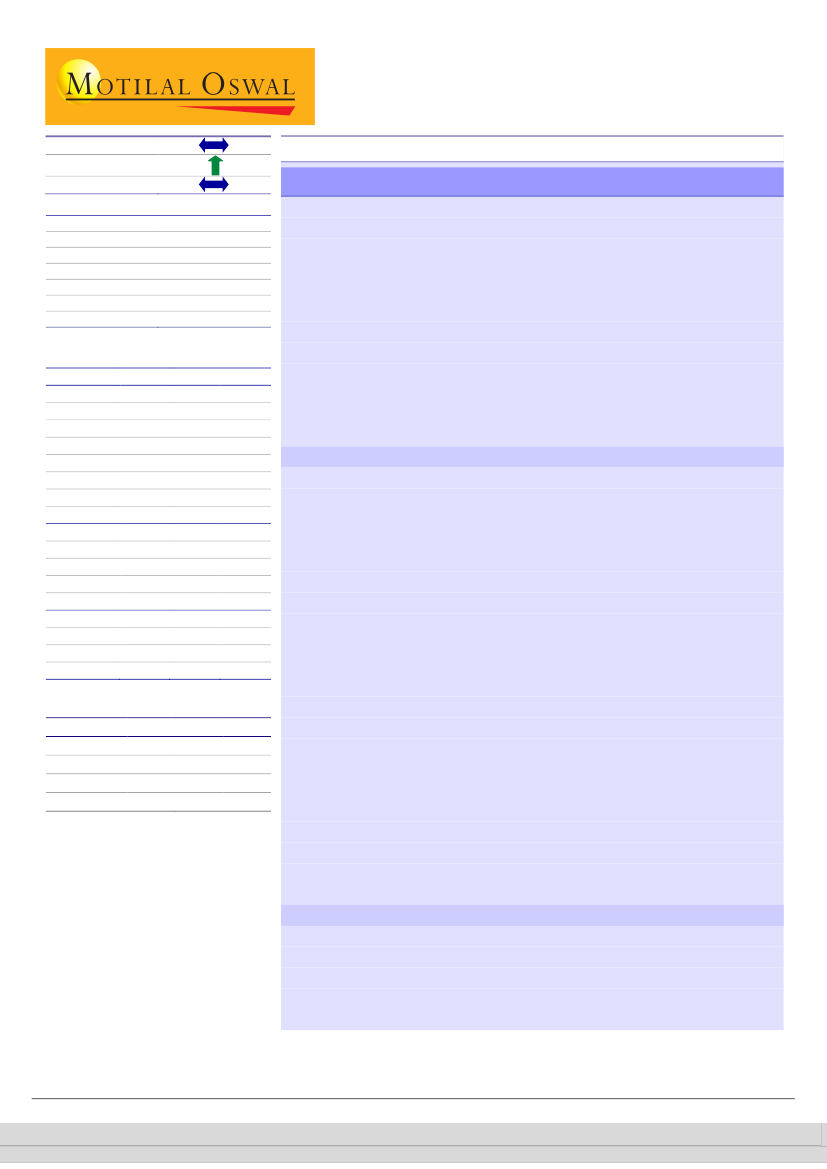

Financials & valuations (INR b)

Y/E Mar

2021E

2022E

Sales

114.3

121.9

EBITDA

15.8

19.5

PAT

9.7

12.3

EBITDA (%)

13.9

16.0

EPS (INR)

10.5

13.3

EPS Gr. (%)

32.1

26.3

BV/Sh. (INR)

157

167

Ratios

Net D/E

(0.1)

(0.2)

RoE (%)

6.9

8.2

RoCE (%)

8.4

10.4

Payout (%)

27.2

24.8

Valuations

P/E (x)

54.7

43.3

EV/EBITDA (x)

32.5

26.4

Div Yield (%)

1.4

1.6

FCF Yield (%)

3.0

5.7

Higher tea price impacted standalone gross margin by 840bp YoY to 30%.

The consolidated EBITDA margin was impacted by 100bp YoY to 11.8%.

Consolidated EBITDA grew 14% YoY on the back of 23% revenue growth.

Performance across business segments has improved (Tata Coffee

standalone and overseas operations and overseas Tea). India Food and

Beverage business showed double-digit volume growth.

Factoring in its performance in 3QFY21, we decrease our FY21E

EBITDA/adjusted PAT estimates by 6%/2%, but maintain our FY22E/FY23E

earnings estimates, and arrive at an FY23E SoTP-based TP of INR661.

Maintain

Buy.

Double-digit volume growth in India Foods/Beverages business

Shareholding pattern (%)

Promoter

DII

FII

Others

Dec-20 Sep-20 Dec-19

34.7

34.7

34.5

13.6

17.7

14.9

25.8

21.7

26.0

26.0

25.9

24.6

Note: FII includes depository receipts

Revenue was up 23% YoY to INR30.7b (v/s our estimate of INR29.9b).

EBITDA grew 14% YoY to INR3.6b (v/s our expectation of INR3.9b). EBITDA

margin contracted 100bp YoY to 11.8% due to 570bp gross margin

contraction (to 37.8%). Adjusted PAT stood at INR2.2b (v/s our estimate of

INR2b), up 31% YoY, aided by EBITDA growth and a lower tax rate. In

9MFY21, revenue/EBITDA/adjusted PAT grew 18%/26%/39%.

India Branded Beverages/Foods revenue grew 46%/19% YoY to

INR12.8b/INR6.3b. India Beverages/Foods EBIT declined/increased by

38%/41% YoY to INR793m/INR934m. International Branded Beverages

witnessed 9% revenue growth to INR9.3b, with EBIT growth of 55% YoY to

INR1,226m. India Branded Beverages/Food volumes grew 10%/12% YoY.

Standalone revenue grew 34% YoY to INR19.6b and EBITDA stood at INR2b,

down 5%. Gross margin contracted 840bp YoY to 30.1% on the back of

higher Tea prices. Adjusted PAT stood at INR1.4b, down 2% YoY.

Tata Coffee:

Consolidated revenue grew 6% YoY to INR5.3b, with 13%

EBITDA growth to INR964m.

Standalone

revenue declined 5% to INR1,578m,

with 28% YoY EBITDA growth to INR190m.

Overseas

(Tata Coffee

consolidated less standalone operations) revenue grew 12% YoY to INR3.8b,

with EBITDA growth of 10% to INR773m.

TCP Overseas Tea:

Revenue/EBITDA grew 9%/160% to INR5.7b/INR679m.

Highlights from the management commentary

Tea prices are 25-30% higher as compared to last year and is likely to cool

off once the new crop comes into the market, i.e. by Apr-May’21. Thus, Tea

prices are likely to normalize by 1QFY22.

Tata Sampann: Revenue is up 40% in 9MFY21. The portfolio grew in high

double-digits during 3QFY21, with in-home consumption normalizing.

Sumant Kumar - Research Analyst

(Sumant.Kumar@MotilalOswal.com)

Research Analyst: Darshit Shah

(Darshit.Shah@motilaloswal.com) /

Yusuf Inamdar

(yusuf.inamdar@motilaloswal.com)

hvs

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.