30 October 2021

2QFY22 Results Update | Sector: Consumer

Emami

Buy

Estimate change

TP change

Rating change

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

12M Avg Val (INR M)

HMN IN

454

235.2 / 3.1

621 / 344

-9/-15/-4

388

Margin to come under pressure, but sales traction to

continue

CMP: INR529

TP: INR650 (+23% )

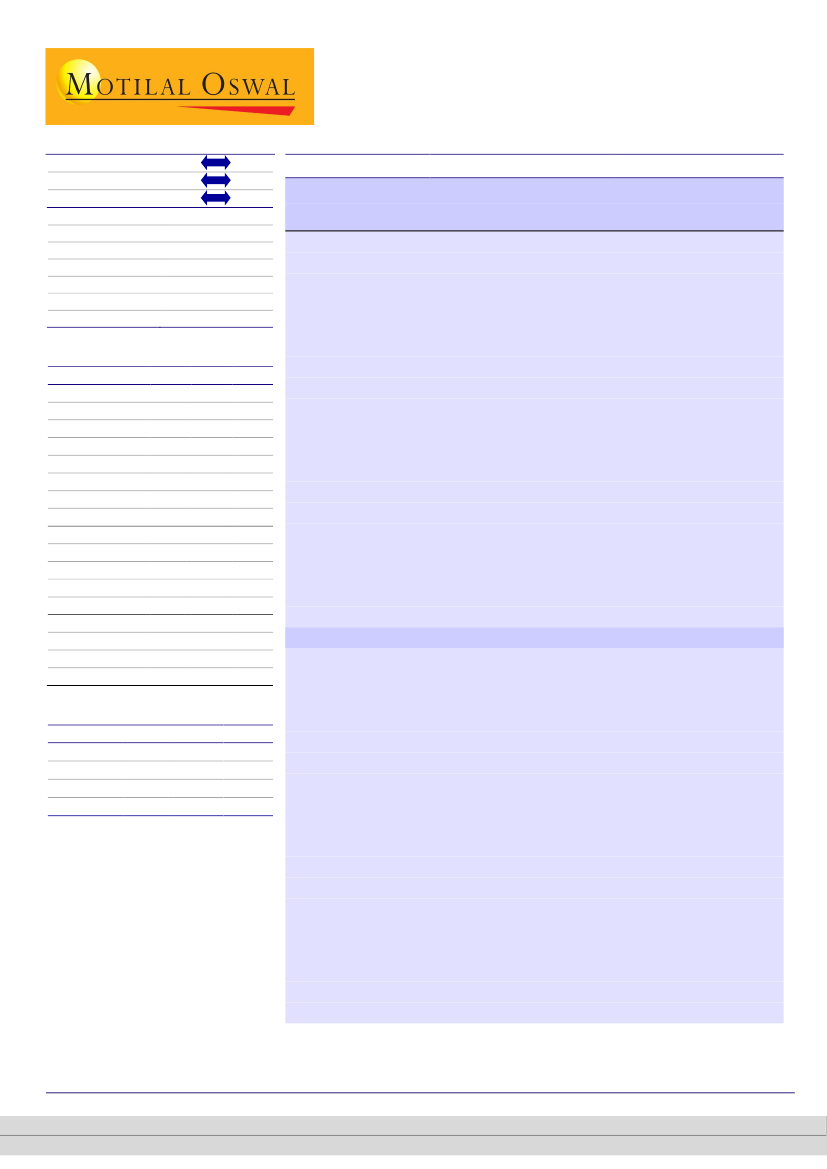

Financials & Valuations (INR b)

Y/E March

2021 2022E 2023E

Sales

28.8 32.4 36.0

Sales Gr. (%)

8.5 12.4 11.2

EBITDA

8.8

9.8 11.0

EBIT Margin (%)

30.7 30.3 30.6

Adj. PAT

7.2

7.9

8.3

Adj. EPS (INR)

16.3 17.8 18.7

EPS Gr. (%)

31.1

9.6

5.1

BV/Sh.(INR)

39.7 45.7 46.5

Ratios

RoE (%)

40.3 41.7 40.6

RoCE (%)

40.0 44.6 47.0

Payout (%)

49.2 64.6 69.5

Valuation

P/E (x)

32.7 29.8 28.4

P/BV (x)

13.4 11.6 11.4

EV/EBITDA (x)

26.1 23.2 20.5

Div. Yield (%)

1.5

2.2

2.4

Shareholding pattern (%)

As On

Sep-21 Jun-21

Promoter

53.9

53.9

DII

24.2

24.5

FII

12.7

12.5

Others

9.3

9.2

FII Includes depository receipts

HMN’s 2QFY22 sales were in line with our expectations. Domestic sales/

volumes grew 9%/6.2% YoY. With a pickup in the pace of vaccination and

diminishing fears of a severe third COVID wave, Healthcare grew only 5%

YoY. Nevertheless, the segment was still up 26% on a two-year CAGR basis.

On a positive note, revival in mobility led to double-digit growth in

discretionary categories – BoroPlus, Kesh King, and Male Grooming.

While there has been some recent moderation in rural demand, its

fundamentals are intact. The outlook for winter demand is positive.

The International business (~15% of sales) declined by 6% YoY owing to the

second COVID wave and a higher base of Personal Hygiene.

Margin performance in 2QFY22 was better than expected due to price

hikes, cost savings, and lower A&P spends. However, the management

expects gross margin compression in 2HFY22, led by continued RM

pressure. A&P spends are also expected to pick up, leading to a pressure on

EBITDA margin in 2HFY22.

The key to a further re-rating would be whether sales growth, after a period

of extremely weak performance (3.7% CAGR over FY16-20), can revive to

double-digit levels on a sustainable basis. We maintain our

Buy

rating.

Sales in line; margin outperforms

Sep-20

53.9

28.6

9.0

8.6

Consolidated net sales grew 7.4% YoY to INR7.9b

(in line). EBITDA/PBT/

adjusted PAT before amortization grew 7.8%/20.1%/18.7% YoY to INR2.8b/

INR2.9b/INR2.5b (est. INR2.5b/INR2.3b/INR1.9b).

Domestic volumes grew 6.2% YoY in 2QFY22.

Gross margin fell 150bp YoY to 68.8% (est. 67.3%).

EBITDA margin expanded by 20bp YoY to 35.1%

(est. 32%) due to lower

employee costs (-30bp), ad-spends (-140bp), and flat other expenses as a

percentage of sales.

Absolute ad-spends declined by 2.6% YoY to INR1.1b.

Sales/EBITDA/adjusted PAT before amortization grew 19.2%/17.6%/26.7%

YoY in 1HFY22.

The domestic business

grew 9% YoY, with a two-year CAGR of 11%.

International sales

declined by 6% YoY, but clocked a two-year CAGR of 2%.

Institutional business

(3% of sales) grew 29% YoY, with a two-year CAGR of

12%.

Within domestic,

HMN reported a YoY sales growth in all categories –

Healthcare (+5%), BoroPlus (+29%), Kesh King (+15%), Pain Management

(+6%), and Male Grooming (+15%), except Navratna (-9%), in 2QFY22.

Krishnan Sambamoorthy – Research Analyst

(Krishnan.Sambamoorthy@MotilalOswal.com)

Research Analyst: Dhairya Dhruv

(Dhairya.Dhruv@MotilalOswal.com)/Kaiwan

Jal Olia

(kaiwan.o@motilaloswal.com)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

6 November 2020

1