MOSt Rollover Report

Date:

Friday, April 26, 2013

Nifty Rollovers at 63%, Stock Rollovers at 80%

Nifty Rollovers

Exchange

NSE

SGX

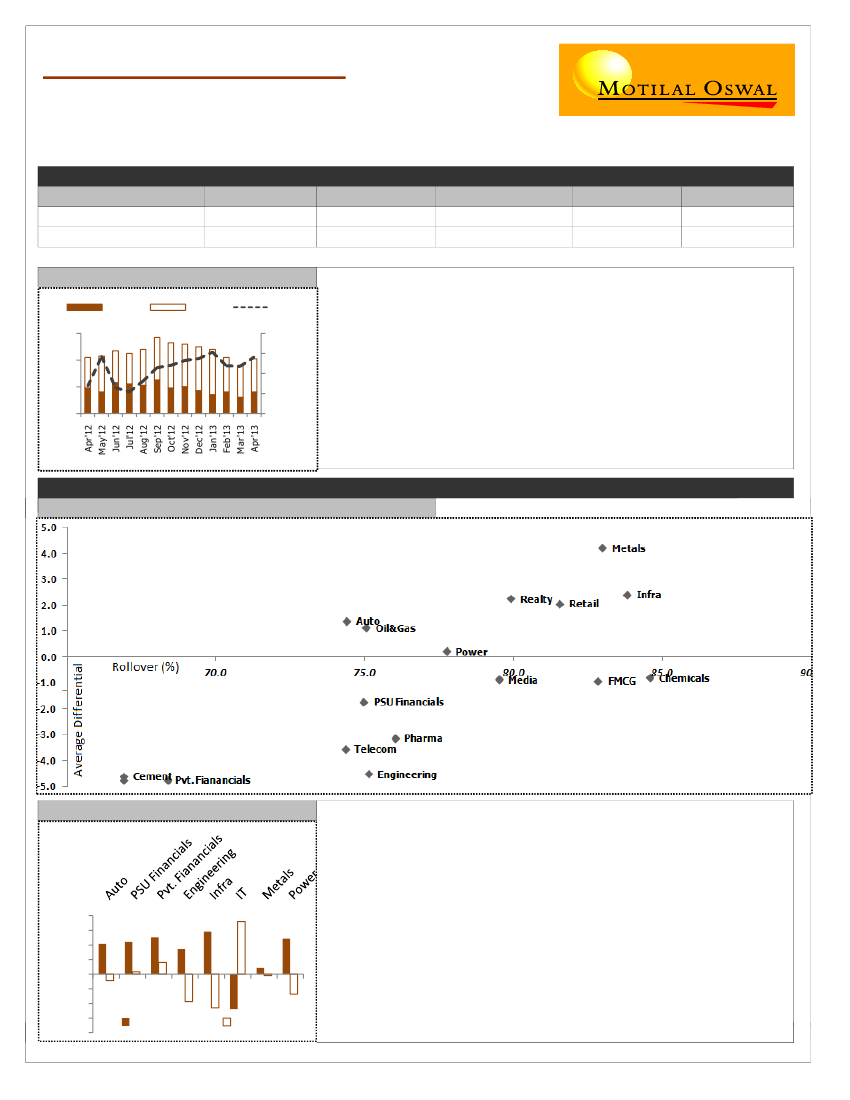

Nifty OI Vs Index

NSE OI

SGX OI

Nifty

Rollovers(%)

63%

71%

3M Avg.

53%

81%

Roll Spread (3MA)

20bps (60bps)

25bps (87bps)

Open Interest

15.8mn

25mn

OI Ch.

+31%

+2%

Nifty rollovers saw late expiry pickup, ending up with stellar lead over avrg.

Lower SGX Rollovers leads to just 2% jump in EoE open interest and a drop in SGX’s

share in Nifty futures to 1.5X from 2X of NSE in previous expiry.

Interestingly the rollover cost on Nifty futures on both the exchanges have been

excessively low, indicating creation of short hedges along the rally in index futures,

eventually being rolled over.

Hence, the view remains cautiously bullish. Even on options front while the OIPCR is

just above the average signalling moderately bullish bias, the IVIX near its lower

bounds indicates over optimism.

60

40

20

0

6500

6000

5500

5000

4500

Stock Rollovers

Sector Rollovers Vs. 3M Avg.

Notble Sectors EoE

Auto:

Short Covering in the sector, except for Maruti which saw fresh longs.

PSU Financials:

Smalller Banks saw longs, larger ones saw short covering.

Pvt. Financials:

Mix of Longs and Short Covering.

Engineering:

Short covering in the entire sector.

20.0

15.0

10.0

5.0

0.0

-5.0

-10.0

-15.0

-20.0

Infra:

Short covering in Relinfra, JP Associates. Longs in GMR & IVRCL.

IT:

Fresh Shorts in the sector except Fintech which saw short covering.

Metal:

Shorts continue to roll into May.

EoE Price(%)

EoE OI (%)

Power:

Majority of stocks saw short covering.