MOSt Market Roundup

Date: Monday October 17, 2011

Daily Technical Analysis

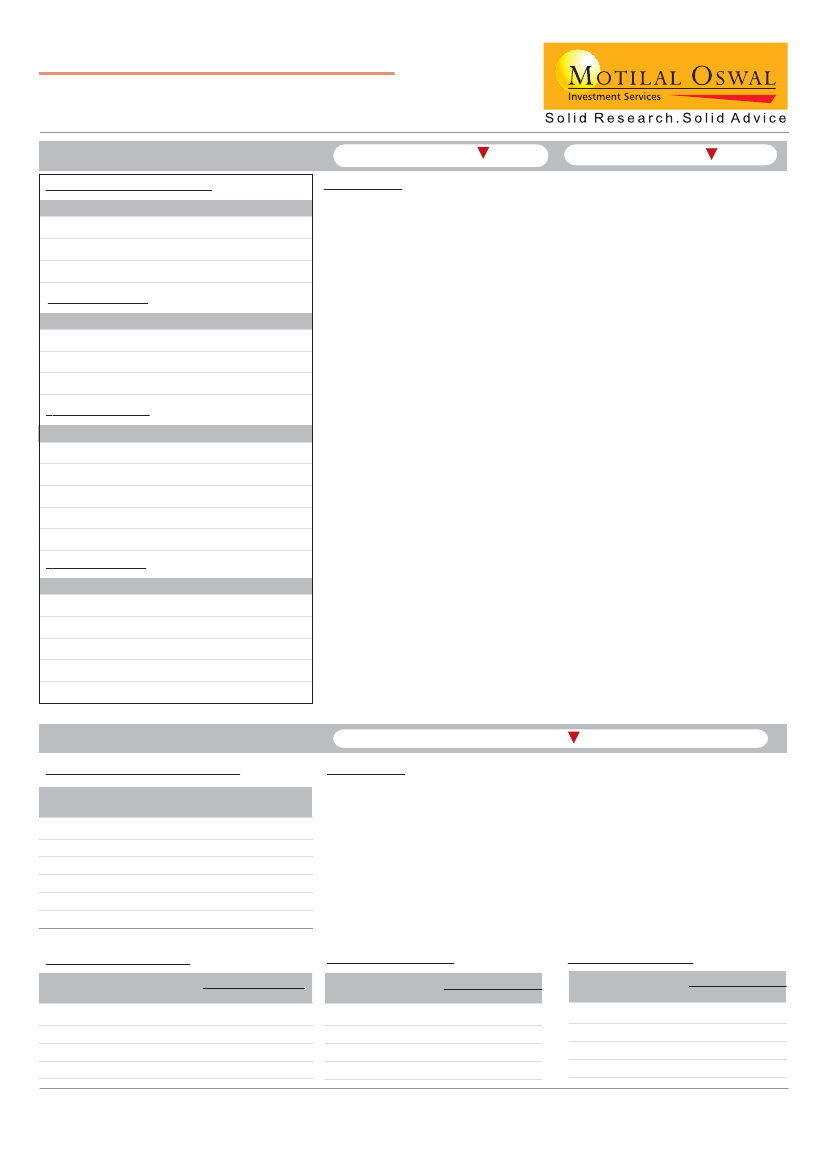

Equity Market

Cash Volumes (Rs in Crores)

Exchange

BSE (Cash)

NSE (Cash)

Derivatives (NSE)

Advance / Decline

Group

Advance

Decline

Unchanged

Top Index Gainers

Scrip

TATAMOTORS

CAIRN

MARUTI

AMBUJACEM

DLF

Top Index Losers

Scrip

RELIANCE

BPCL

NTPC

BHEL

SIEMENS

LTP

832.85

630.80

167.50

325.25

824.50

% Change

-3.93

-3.76

-3.12

-2.42

-2.40

LTP

187.55

299.40

1056.00

152.90

236.00

% Change

4.17

3.96

2.80

2.51

1.90

Sensex

17

13

00

BSE 200

83

112

00

Today

2444

9143

107899

Pev. Day

2698

9930

112440

Sensex

Dealer's Diary

17,025.09

57.60

Nifty

5,118.25

14.05

The Sensex declined by 58 points to close at 17025. There was profit booking in the

market after rally worth 800 points during the last week. Reliance was the biggest loser

in the Sensex to pull down the market. The scrip declined by 4% due to lower than

expected Q2 GRM. There was stock specific buying amid thin volumes. Small cap

index ended with marginal gains and traders witnessed some focus in mid-cap and

small counters.

Global markets witnessed smart rally with Asian markets surging over 1% and European

markets advanced over 1% on expectation of some stability in the European nations

after G20 finance chiefs endorsed parts of a plan to contain Europe's debt crisis. Oil &

Gas, Capital Goods and Power stocks witnessed profit booking while Auto, Consumer

Durable and Bank stocks gained modestly.

Oil & Gas stocks witnessed (Index down 2.3%) biggest loser today due to Reliance

declined by 4%. Oil marketing companies like HPCL, BPCL and IOC slipped by 4%

while oil producing company Cairn India surged by 4% due to uptrend Brent Crude

which is hovering at $112/bbl, up by 2%.

Capital Goods stocks (Index down 1.5%) witnessed sharp declined due to poor order

inflow. L&T slipped by 2% to close at 1380. Others like BHEL and BGR Energy declined

by 2% each.

Auto stocks (Index up 1.6%) witnessed fresh buying. Maruti recovered by 4% from

the intra-day low of 1010 after the report of Gurgaon plant has stared operation. Tata

Motors surged over 4% to close at Rs188 due to impressive 42% YoY JLR sales

growth during the month of September.

Select Banking stocks witnessed fresh buying (Index up 0.6%). Private Banks major

Axis Bank and ICICI Bank gained by 1-2%. HDFC reported Q2 net profit of Rs9.71bn,

up 20% YoY. The scrip gained by 1% to close at Rs673.

Nifty Futures Oct (LTP)

Dealer's Diary

5,122.00

21.35

Premium

3.75

Derivative Market

Daily Technical Analysis

Derivative Volumes (Rs in Crores)

Exchange

Index Futures

Stock Futures

Index Options

Stock Options

F&O Total

Total

No. of

Contracts

456792

496093

3157466

145813

4256164

8512328

Turn

Over

10891

12478

80786

3762

107916

215831

Put Call

Ratio

-

-

1.12

0.56

1.09

Nifty ended down 14 points at 5118 as Reliance results failed to cheer markets with

stock ending down 3.8%, highest loser in Nifty in today's trade Cairn India moved up

3.5% on higher crude prices in the last week. Nifty 5100 and 5200 CE OI increased by

30% and 16% indicating upisdes capped at 5250-5300 levels in the current expiry. If

Nifty fails to cross 5170-5200 levels in next few days than we can head again for 4900

levels in the downward move.

Most Active Stock Future

Stock

Futures

RIL OCT FUT

ICICI OCT FUT

SBI OCT FUT

Price

435.6

895.0

1887.0

No. of Contracts

Vol

OI

26407

18463

32752

26455

53554

48416

47508

42944

Most Active Nifty Calls

Index

Option

OCT 5100 CE

OCT 5200 CE

OCT 5400 CE

Most Active Nifty Puts

Index

Option

OCT 5100 PE

OCT 5000 PE

OCT 4900 PE

OCT 4800 PE

Price No. of Contracts

Vol

OI

79.70

34.70

3.70

431388 109432

405012 147921

247012 124638

105891

83443

Price

60.55

31.10

15.85

8.45

No. of Contracts

Vol

OI

498336

308490

178535

178083

86534

130738

122071

176456

OCT 5300 CE 11.65

TATA MOTOR OCT FUT186.6