MOSt Market Outlook

8th, March 2016

Nifty Outlook

Nifty Fut

7460

Reco

BUY

MBP

7480

Stop Loss

7420

Target

7600

Outlook

Global markets have held out well post the rally.

Indian markets have also seen a swift move back

to 7500 levels. Budget not having any of the

feared negatives, positive global cues, FII flows,

recovery in commodity prices all have played a

part. Dow has moved above 17000 level and S&P

over 2000 level. Expectations are of rate cut ac-

tion by RBI post the budget. Banks, real estate,

commodities have been the biggest gainers.

Technically Nifty could see consolidation.

3

Brent crude has moved above $40 level. US pro-

ducers cut rig count. Rupee is back to 67 levels.

Commodities have continued to see recovery.

Iron Ore prices saw sharp jump. China reiter-

ated that the GDP growth targeted is in the re-

gion of 6.5 percent. Commodities will continue

to see interest.

3

Gyansangam meet did not bring out anything

specific. The discussions as reported revolved

around NPA issue, consolidation in the psu bank-

ing space. The govt intends to consolidate the

27 PSU banks into six large banks.

3

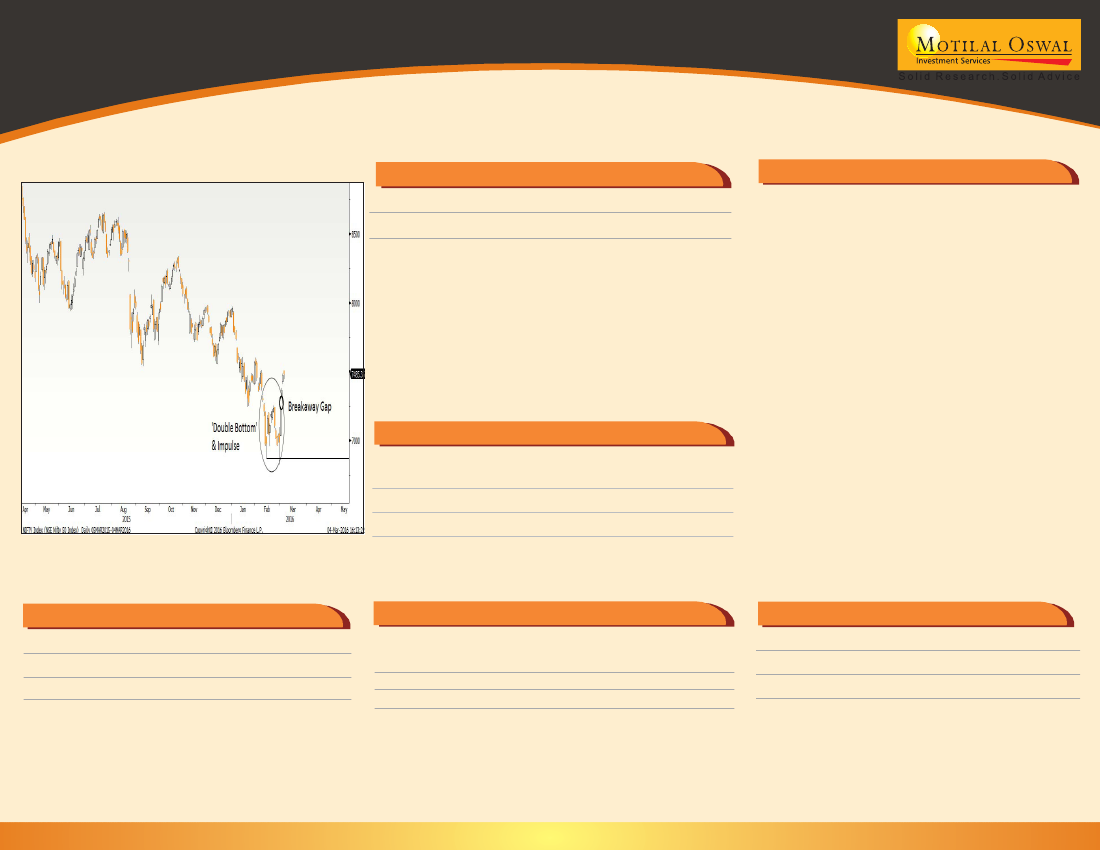

'A breach above 7250 with a 'Breakaway Gap' resulted

into a 'Double Bottom' formation . The reversal wave is

in line with the 'Impulse Wave' characteristics & indicates

a change in trend after the prolonged weakness. Declines

from hereon would serve as an additional opportunity

to create longs as the impending move could stretch up

to the upper end of the weekly channel placed near 7900.

Sectoral Outlook

Sector

Name

ENERGY

BANKS

Sector OUTLOOK

FOR THE WEEK

Positive

Positive

Trading Idea - Cash & Future

Scrip

AXISBANK

HEROMOTO

Trading Idea - Derivatives

Target

465

3320

Investment Idea

Scrip

CMP

20.0

8.15

Reco

Buy

Buy

MBP

416

2835

SL

393

2640

STRATEGY - Hindpetro Call Ratio Spread

Instrument

B/S

Lot

Reco

Mar 760 CE

Mar 800 CE

Target Profit

: 8500

Buy

Sell

1

2

20.0

8.15

Reco

Buy

Buy

CMP

748

1015

Target

1299

1300

HINDPETRO

CANFINHOME

Stop Loss : 2000