MOSt Market Outlook

10th, March 2016

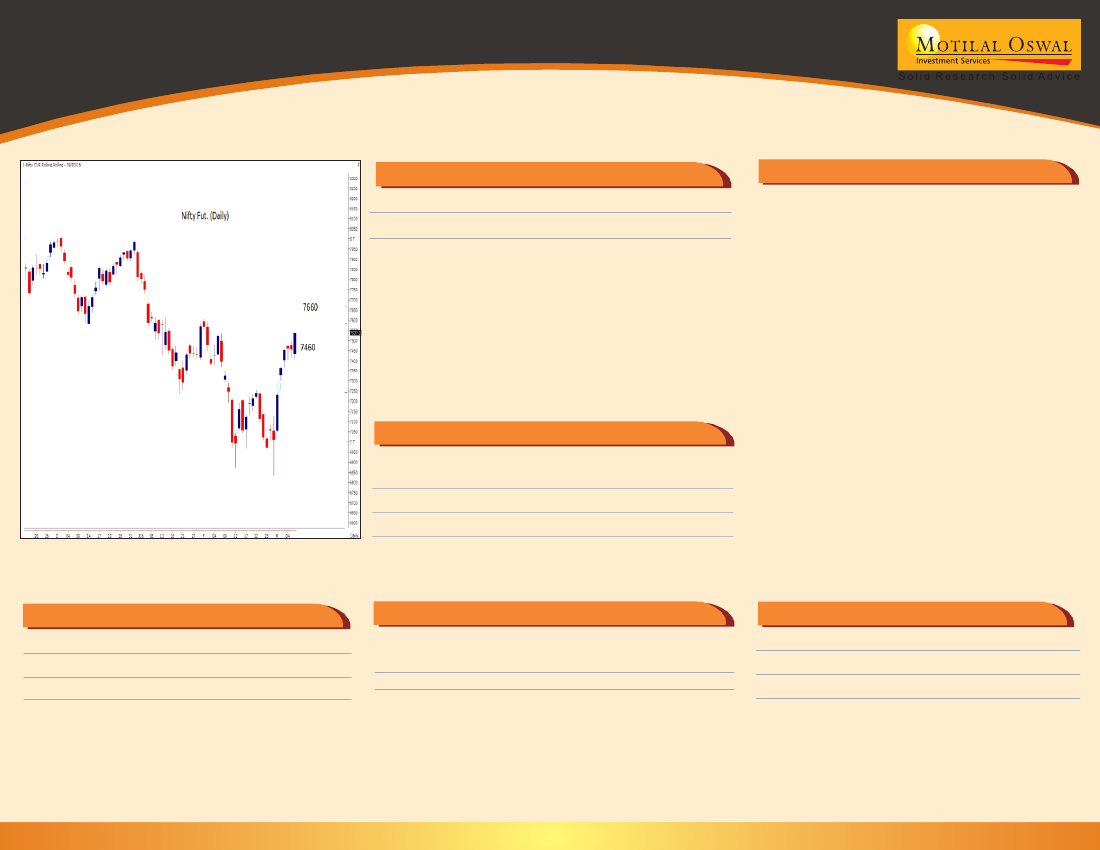

Nifty Outlook

Nifty Fut

7535

Reco

BUY

MBP

7535

Stop Loss

7460

Target

7660

Outlook

3

'Nifty closed above the 7500 level & has resumed its run.

The ongoing momentum is expected to continue

towards the upper end of the weekly channel placed

around 7900. A breach below 7400 could stall this ongoing

momentum & hence serves as a trailing stop for short

term traders.

3

Nifty corrected in line with global cues but

staged a smart recovery to close above 7500 lev-

els. 7400 levels has acted as good supports for

Nifty. Yes Bank, Maruti, Tech Mahindra,Grasim,

Larsen were among the gainers. Metals stock

did see some correction on back of global cues

but did recover from lows. Real estate stocks

were in limelight on back of expectations of

clearance of Real Estate Bill. Reports indicate it

is likely to be taken up today.

Oil prices rebounded after a mild correction.

Brent now trades above $41 levels. INR contin-

ued to see strength and moved closer to 67 lev-

els. Immediate supports for Nifty is seen around

7450/7400 levels while resistance is seen

around 7600/7650 levels. Sustained move above

7500 levels should bring more momentum into

the markets. Private banking, domestic cyclicals

be it cement, auto should continue to do well.

Sectoral Outlook

Sector

Name

BANKS

CEMENT

Sector OUTLOOK

FOR THE WEEK

Positive

Neutral

Trading Idea - Cash & Future

Scrip

ULTRATECH

AXISBANK

Trading Idea - Derivatives

Target

3130

465

Investment Idea

Scrip

Reco

2.35

Reco

Buy

Buy

MBP

3002

419

SL

2960

400

STRATEGY - Hindalco Long Call

Instrument

B/S

Lot

Mar 85 CE

Target Profit

: 5.00

Buy

1

Stop Loss : 1.00

Reco

Buy

Buy

CMP

741

1019

Target

1299

1300

CMP

2.30

HINDPETRO

CANFINHOME