MOSt Market Outlook

27th January 2017

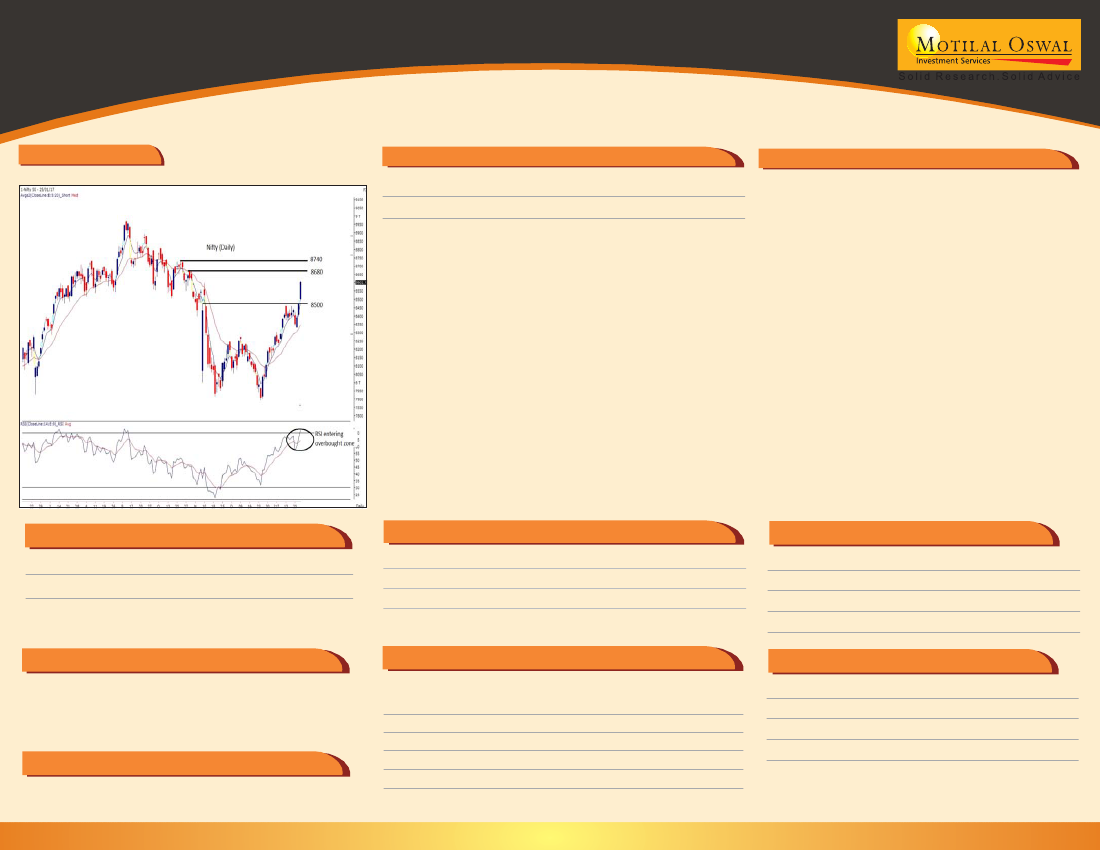

Nifty Chart

Nifty Outlook

Market Drivers

3

Indian markets closed on a strong note on

Nifty Fut. R1

R2

S1

S2

Wednesday. Sectors like financials, banking,

8614

8655

8675

8625

8600

auto, cement did well. Bank Nifty gained over 2

'Nifty surged during the final lap of the F&O Expiry & closed

percent led by strong gains in Kotak. Nifty has

above 8600. Though the momentum oscillators have

now rallied by about 9 percent in a month. Glo-

entered the overbought territory there is no sign of any

bal cues have been quite strong as well. With

weakness or indication of loss in strength. The ongoing

expectations of budget getting built up and con-

momentum could extend towards 8740 while a breach

sumption scenario returning to normal, domes-

below 8500 would distort the momentum.

tic consumption stocks, housing finance, infra

stocks could continue to remain in focus. FII flows

also turned positive and this could continue to

fuel positive sentiment. Near term resistance is

expected around 8700 levels.

Trading Idea - Cash & Future

Scrip

HUL

Reco

BUY

CMP

869

SL

860

Target

885

Sectoral Outlook

Sector

ENERGY

FMCG

Outlook

POSITIVE

NEUTRAL

Highest Call OI

Instrument

Nifty 23-Feb

Bank Nifty 23-Feb

Bank Nifty 02-Feb

Strike

9000

19500

19500

OI

3060525

488120

270240

Chg in OI

883950

227720

130800

Corporate Action:

NIL

Trading Idea - Derivatives

STRATEGY UPDATED : TATAMOTORS Long Call Condor

Instrument

B/S

Lot

Reco

CMP

23 FEB 560 CE

23 FEB 580 CE

23 FEB 600 CE

23 FEB 620 CE

Buy

Sell

Sell

Buy

1

1

1

1

15

9

5

2.75

16.75

10.15

5.75

2.95

Highest Put OI

Instrument

Nifty 25-Jan (imm.)

Bank Nifty 23-Feb

Bank Nifty 02-Feb

Strike

8400

18000

19000

OI

3236475

335080

305080

Chg in OI

1643850

31920

257560

Security in Ban period:

NIL

Target Profit: Rs.8000 SL: Rs.4000