MOSt Market Outlook

24th April 2017

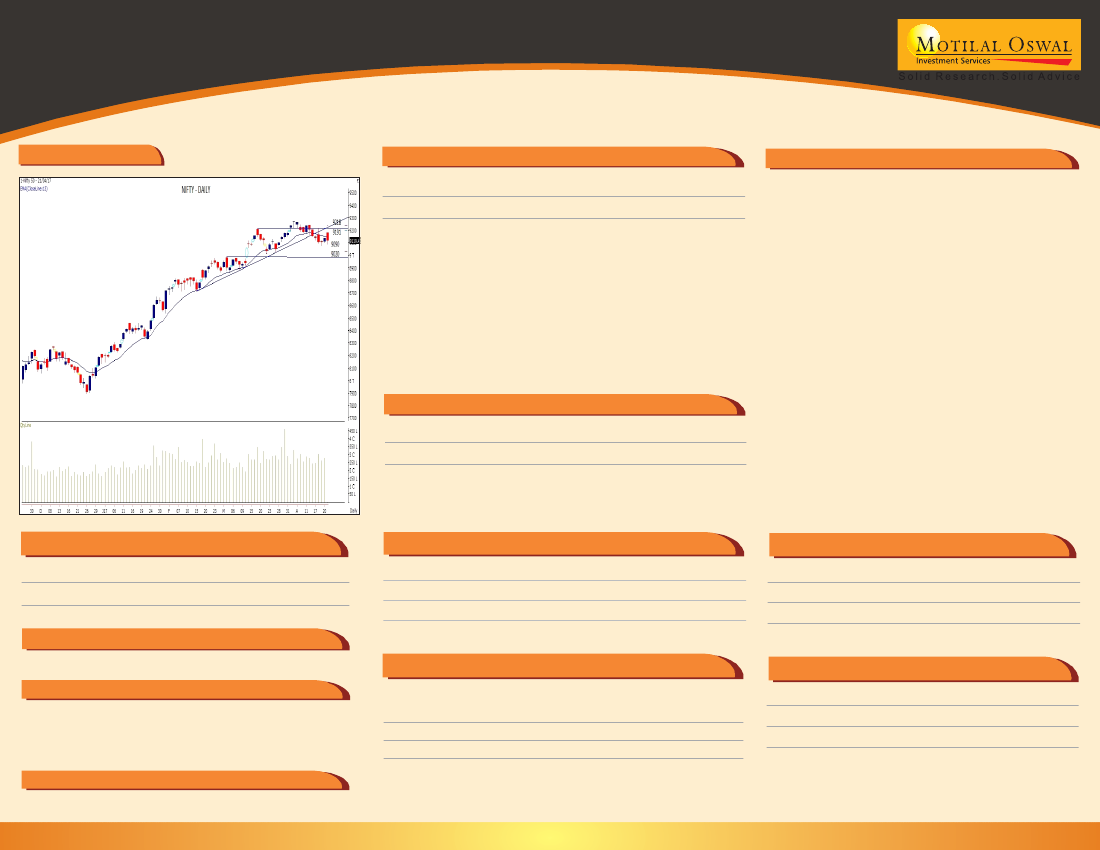

Nifty Chart

Nifty Outlook

Nifty Cash R1

R2

S1

S2

9119

9191

9218

9090

9020

'Nifty index opened positive but failed to hold its gain

and corrected sharply towards 9088 mark. However it

recovered from lower levels but closed with the loss of

around 15 points. Index has got stuck in a broader trading

range and sustained selling pressure is being witnessed

at higher zone. Now if it sustains below 9090 then it may

drift down towards 9020 while a move above 9135 may

attract buying interest towards its next multiple hurdle of

9191 and 9218.

Currency (USDINR) Outlook

USDINR

64.64

S1

64.55

S2

64.30

R1

64.85

R2

65.00

Market Drivers

3

The pair is likely to trade in a range between intraday

resistance at 64.85 and support at 64.55 level with a

sideways bias.

Global cues will continue to be relevant in the

near term. French elections are being closely

monitored. Reports indicate a lead for

Emannual Macron who is seen as more for con-

tinuity while the opponent is seen as disrup-

tive. Win for Macron could bring a relief rally.

On the other hand North Korea continued to

make aggressive statements which will also

keep market participants watchful. On the do-

mestic front, focus remains on results. HDFC

Bank posted strong set of numbers. Loan growth

was strong driven by loans to corporates. Op-

erating profits saw a best of almost 10 percent

which is substantial. Mid-caps in sectors like

infra, real estate, auto ancillary continued to

see interest. Overall focus will remain on re-

sults and global cues.

Trading Idea - Cash & Future

Scrip

BHARAT FORGE

Sectoral Outlook

SL

Target

1040 1150

Highest Call OI

Outlook

POSITIVE

POSITIVE

Instrument

Nifty 27-Apr

Bank Nifty 27-Apr

Strike

9200

22000

OI

6125025

866800

Chg in OI

963975

101920

Reco

BUY

CMP

1074

Sector

NBFC

AUTO

Corporate Action:

NA

Security in Ban period:

BHARATFIN, DLF, INFIBEAM, IRB, JINDALSTEL, JISLJALEQS,

JPASSOCIAT, JSWENERGY, ORIENTBANK, RCOM, RELCAPITAL,

TV18BRDCST, UJJIVAN

Today Event

NA

Trading Idea - Derivatives

STRATEGY UPDATE : MARUTI Bull Call spread

Instrument

B/S Lot

Reco

MARUTI 27 Apr 6200 CE

MARUTI 27 Apr 6350 CE

Buy

Sell

1

1

71

25

Highest Put OI

Instrument

Strike

9000

21500

OI

5147625

725120

Chg in OI

-77925

-16840

CMP

58.00

19.15

Nifty 27-Apr

Bank Nifty 27-Apr

Target: Rs 15000; SL: Rs.5000; Margin: approx Rs. 112000