MOSt Market Outlook

23rd May 2017

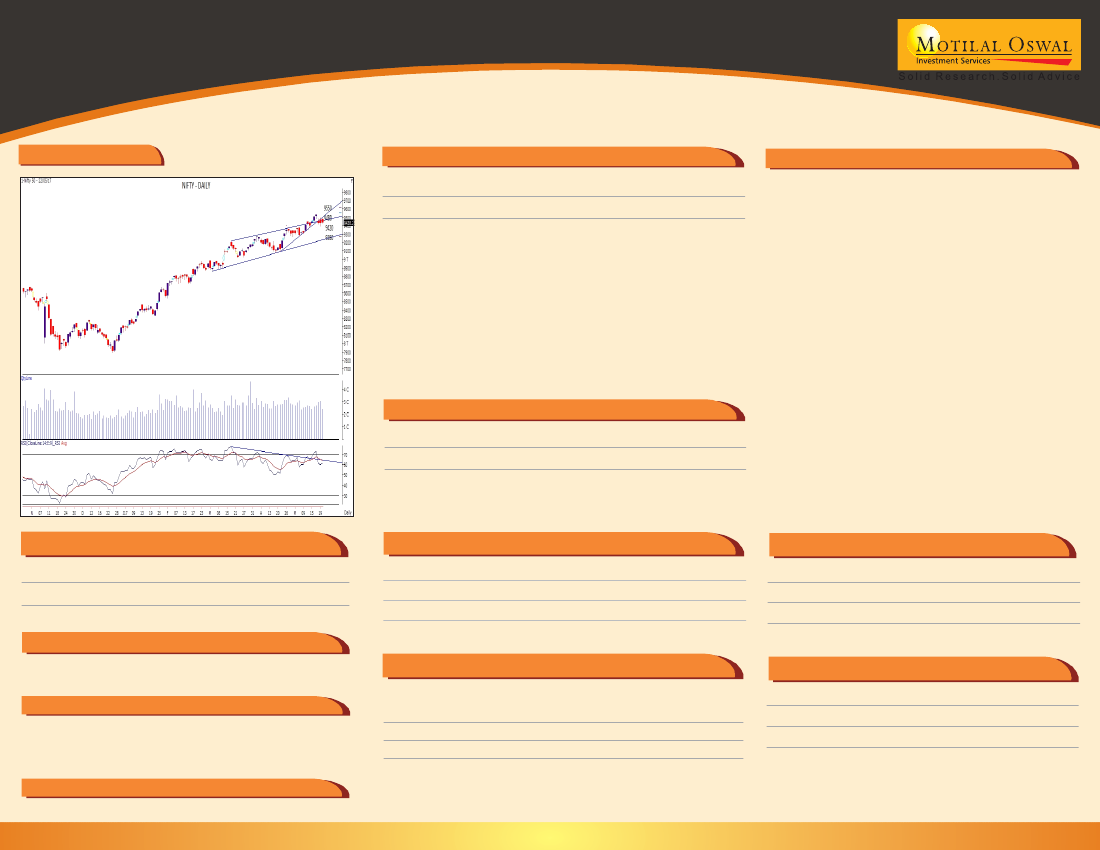

Nifty Chart

Nifty Outlook

Nifty Cash R1

R2

S1

S2

9438

9480

9550

9420

9380

'Nifty index opened positive but failed to surpass 9500

zone and lost most its gains then finally closed the session

on a flat to positive note. It formed an “Inside candle” as

traded inside the trading range of last session. Now if it

sustains below 9420 zones then only weakness could drag

the index towards 9380 and 9350 zone while on the upside

a hold above 9480-9500 would nullify the immediate

weakness to start the next leg of rally.

Currency (USDINR) Outlook

USDINR

64.59

S1

64.45

S2

64.25

R1

64.70

R2

65.00

Market Drivers

Indices ended marginally higher thanks to ITC

which saw strong gains but the overall market

depicted signs of sluggishness. Select sectors

saw sharp correction. Psu Banks, airline stocks

were among the losers. SBI corrected post num-

bers. Bank of India reported weak set of num-

bers and saw sharp declines. Overall market as

well as industries are trying to understand the

implications and implementation of GST. Do-

mestic institutions were strong net buyers. Glo-

bal cues are stable to positive. Overall results

season has been generally better than expec-

tation on the profitability front and that should

be supportive. Market will remain focussed on

results and to some extent on global cues as

well.

Consolidation within 64.25 - 65.00 is likely with bullish

bias.

Trading Idea - Cash & Future

Scrip

LT

Sectoral Outlook

SL

Target

1725 1810

Highest Call OI

Outlook

Positive

Negative

Instrument

Nifty 25 - May

Bank Nifty 25 - May

Strike

9500

23000

OI

6552675

1443080

Chg in OI

412200

183000

Reco

BUY

CMP

1752

Sector

Capital Goods

Banks

Corporate Action:

NA

Security in Ban period:

BANKINDIA; BHARATFIN; CAPF; CEATLTD;CESC;HDIL;IBREALEST

IDBI;INFIBEAM;JINDALSTEL;JISLJALEQS;JPASSOCIAT;JSWENERGY

ORIENTBANK;TV18BRDCST;UJJIVAN

Today Event

NA

Trading Idea - Derivatives

STRATEGY UPDATE : NIFTY- Bear Put Spread

Instrument

B/S

Lot

Reco

NIFTY 9500 PE

NIFTY 9400 PE

Buy

Sell

1

1

51.00

21.00

Highest Put OI

Instrument

Strike

9300

22000

OI

6457425

1086080

Chg in OI

-104400

200

CMP

72.50

26.50

Nifty 25 - May

Bank Nifty 25 - May

Target: INR 5250, SL: INR 2250,