MOSt Market Roundup

1st August 2017

EQUITY Market

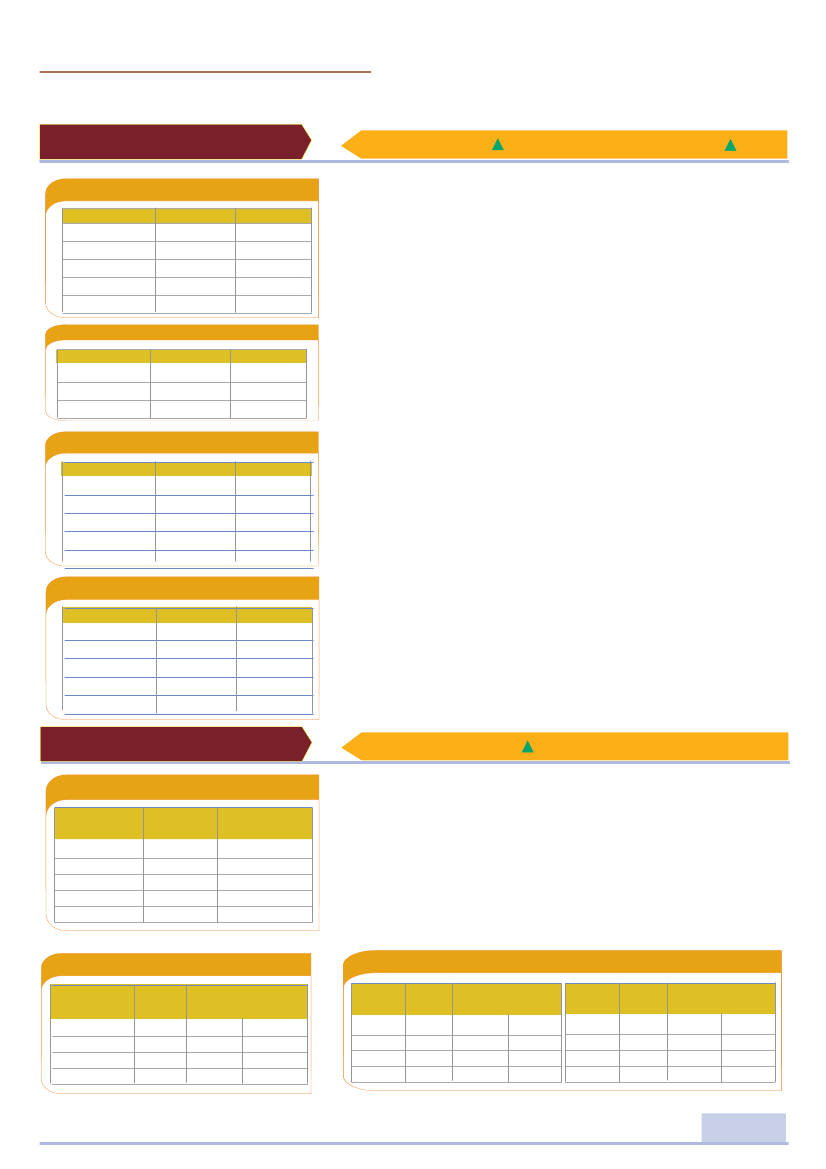

Cash Volumes (INR in Crores)

Exchange

BSE (Cash)

BSE (Derivatives)

NSE (Cash)

NSE(Derivatives)

Total

Today

3199

0.38

25776

341280

370255

Pev. Day

3689

0.16

28680

338648

371017

Sensex

32575.17

60.23

Nifty

10114.65

37.55

Dealer's Diary

Nifty gained to a record high lead by Auto and select NBFC stocks despite

overall broader market being negative. Strong global markets have

also lifted market. Good quarterly results, impressive July Auto monthly

sales data and above normal monsoon have a positive sentiment in

the market. However, PSU Banking stocks witnessed profit booking as

traders wait quantum of rate cut by RBI in tomorrow's credit policy.

Nifty gained 37 points (0.4%) to close at 10114 and Sensex gained 60

points to close at 32575. Both Asian and European market gained half

to one percent as China reported better than expected July

Manufacturing PMI data. Metal and Oil & Gas stocks gained while Capital

Goods stocks witnessed profit booking.

Shriram Transport Finance gained 2% to close at Rs1034 as the company

reported better than expected Q1 result. Marico declined over 2% to

close at Rs326. Company announced disappointing Q1 result.Eicher

Motor climbed up 5% to close all time high of Rs31505 as the company

reported 21% YoY growth in July monthly sales. Escorts surged 4% to

close at Rs701. Company reported 34% jump in its July tractor sales.

Advance / Decline

Group

Advance

Decline

Unchanged

NIFTY 50

35

16

0

BSE 201

91

108

2

Top Index Gainers

Scrip

EICHERMOT

IBULHSGFIN

TECHM

BPCL

BOSCHLTD

LTP

31,550.00

1,232.00

401.65

484.95

24,875.00

% Change

4.88

4.83

4.09

2.93

2.88

Technical Outlook

Nifty index continued its up move and made a new record life time

high of 10128 by surpassing its previous high of 10114. It formed a Bullish

candle with long lower shadow which indicates that every small decline

is being bought in the market. It closed the session with the gains of 37

points and registered a highest ever daily close above 10100 mark. It

has been respecting to its rising support trend line by connecting the

recent swing lows of 9543, 9646, 9838 and 9944. Now index has to

continue to hold above 10050 to witness a fresh up move towards 10200-

10250 zones while support are shifting higher to 10020 and 9950 mark.

Nifty Futures

10147.35

44.35

Premium

32.70

Top Index Losers

Scrip

BANKBARODA

ONGC

LUPIN

SBIN

KOTAKBANK

LTP

163.60

167.05

1018.95

309.25

1011.25

% Change

-1.48

-1.39

-1.26

-1.04

-1.02

DERIVATIVE MARKET

Derivative Volumes (INR in Crores)

Exchange

Index Futures

Stock Futures

Index Options

Stock Options

F&O Total

No. of

Contracts

116950

630956

2800215

369080

3917201

Turn

Over

10224

47694

254339

29022

341280

Nifty Future closed with the gains of 0.44% at 10147. On the option front,

maximum Put OI is at 10000 followed by 9800 strike while maximum Call OI is

at 10500 followed by 10400 strike. However Call OI concentration is scattered

at different strikes but shifting higher Call strike is giving the scope for a further

upside. Fresh Put writing was seen at 10100 and 10000 strike which suggests

that Put writers are keeping the tight grip on the market to push it to higher

zones. India VIX remained flattish at 11.90. Built up of long position were seen

in Techm, Heromotoco, Voltas, Eichermotor, Tvsmotor, Hindalco, Ashokley,

Maruti, M&M, BPCL, Ibulhsgfin, Hindunilvr, etc. while shorts were seen in

Marico, Godrejcp, PNB, Dabur, NIIT Tech, Lupin, etc.

Most Active Stock Future

Most Active Nifty Calls

Stock

Futures

MARUTI

YESBANK

TECHM

SBIN

Price

INR

7856.1

1827.3

402.5

309.0

No. of Contract

Vol

OI

17284

17116

16865

16469

12276

26444

10299

21144

Index

Option

10,200

10,300

10,100

10,400

Price

INR

91.0

51.9

148.0

26.7

No. of Contract

Vol

OI

112976

89341

71151

64294

35916

30704

39544

40379

Most Active Nifty Puts

Index

Option

10,000

9,900

10,100

9,800

Price

INR

72.0

51.0

105.3

35.8

No. of Contract

Vol

OI

126941

90403

69153

61995

66166

55494

27511

55275

Motilal Oswal Securities Ltd., Motilal Oswal Tower, Level 2, Sayani Road, Prabhadevi, Mumbai 400 025

1