MOSt Market Roundup

27th September 2017

EQUITY Market

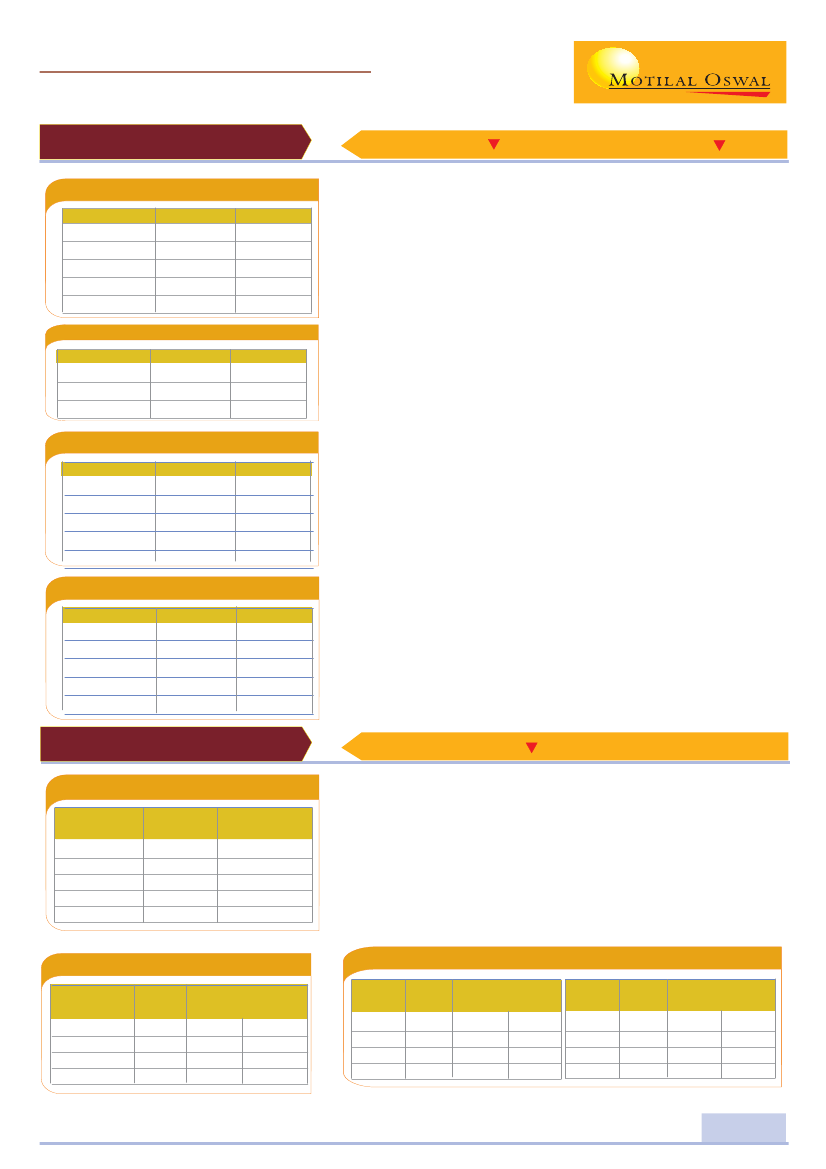

Cash Volumes (INR in Crores)

Exchange

Today

BSE (Cash)

NA

BSE (Derivatives)

NA

NSE (Cash)

29627

NSE(Derivatives) 1158706

Total

1188333

Pev. Day

4002

0.20

26491

736825

767318

Sensex

31159.81

439.95

Nifty

9735.75

135.75

Dealer's Diary

There was bloodbath in Dalal Street. Nifty nosedived over 4% (417

points) in seven consecutive days. Nifty slipped 136 points (1.4%) to

close at one month low at 9736 and Sensex lost 440 points to close at

31160. There was across the board selling in the market in Banking,

Auto, Metal, Cement, Pharma, Mid-cap, Small Cap ETC. NSE 500 stocks

advance decline ratio was at 1:6. Continuous FIIs selling, rising USDINR,

rising Crude oil and cautious stance by investors awaiting outcome of

Q2'18 results after implementation of GST are the major reasons that

pulled down the market. Moreover, media news that the border tension

between India and Myanmar also added to negative sentiment in the

market. USDINR surged to 6-month high of 65.69 and 10-Year yield 3-

month high of 6.67%. Global markets were stable after reduced geo-

political tension. Asian markets closed on a mixed note while European

markets opened on a positive note. Divi's Lab slipped nearly 10% to

close at Rs851after the news that the US FDA issues form 483 with 6

observations . Shriram Transport Finance gained 4% to close at Rs1050

after the media news that the IDFC and the Shriram Group have decided

to abandon the merger plan worked out in July this year.

Advance / Decline

Group

Advance

Decline

Unchanged

NIFTY 50

5

46

0

BSE 201

26

175

0

Top Index Gainers

Scrip

INFRATEL

TCS

TECHM

AMBUJACEM

GAIL

LTP

383.55

2495.10

450.00

261.75

399.00

% Change

1.90

0.83

0.59

0.17

0.05

Technical Outlook

Nifty continued its selling pressure for seventh consecutive trading

sessions and corrected towards 9714 levels. It formed a Bearish Belt

Hold candle on the daily chart and fell by around 200 points from its

intraday highs. It failed to hold 9880 and witnessed sustain selling

pressure till the end of session ahead of Sep. derivatives settlement

day. It nullified the effect of Dragon Fly Doji on daily scale and also

forming a bearish Belt hold on the weekly chart. Now till it remains

below 9820 zones, weakness could continue towards 9685 and 9550

zones while on the upside hurdles are seen at 9777 then 9820 zones.

Nifty Futures

9741.25

125.70

Premium

5.50

Top Index Losers

Scrip

ADANIPORTS

SBIN

BANKBARODA

SUNPHARMA

ULTRACEMCO

LTP

372.00

250.25

138.30

492.55

3804.00

% Change

-4.75

-3.10

-3.05

-2.96

-2.83

DERIVATIVE MARKET

Derivative Volumes (INR in Crores)

Exchange

Index Futures

Stock Futures

Index Options

Stock Options

F&O Total

No. of

Contracts

444291

1510776

11718438

602225

14275730

Turn

Over

35840

106769

968591

47506

1158706

Most Active Stock Future

Stock

Futures

DIVISLAB

RELIANCE

HDFCBANK

SUNPHARMA

Price

INR

860.6

798.4

1780.6

492.6

No. of Contract

Vol

OI

37703

26194

24709

24694

7142

24936

24473

26598

Nifty future closed negative by 1.27% at 9741. On the option front, maximum

Put OI shifted to 9700 followed by 9600 strike while maximum Call OI is shifted

to 9900 and 10000 strike. We have seen significant Call writing at all the

strikes from 9750 to 9900 while fresh Put writing activities was seen at all the

lower strike below 9700 zones. Sustained Call writing and Put unwinding is not

given any sign of pause in the selling pressure. India VIX moved up sharply by

7.21% at 13.86 and again jump in volatility is a cause of concern for the short

term market movement. Built up of shorts were seen in Siemens, Pidilitind,

Grasim, Kotak Bank, Drreddy, Bharatforg, Jswsteel, Hindzinc, Yes Bank, M&M,

Havells, Cadila, BEL, BHEL, etc. while longs were seen in Infratel, TCS, Techm,

Ambujacem, OFSS, NIIT Tech, Srtransfin, etc.

Most Active Nifty Calls

Index

Option

9,900

9,800

10,000

9,850

Price

INR

2.2

13.0

0.7

4.5

No. of Contract

Vol

OI

943612

578926

532321

403877

82126

53407

69686

36904

Most Active Nifty Puts

Index

Option

9,800

9,700

9,900

9,600

Price

INR

68.0

22.9

152.0

7.6

No. of Contract

Vol

OI

777036

560573

360255

262257

36971

61469

22618

43832

Motilal Oswal Securities Ltd., Motilal Oswal Tower, Level 2, Sayani Road, Prabhadevi, Mumbai 400 025

1