MOSt Market Outlook

10th October 2017

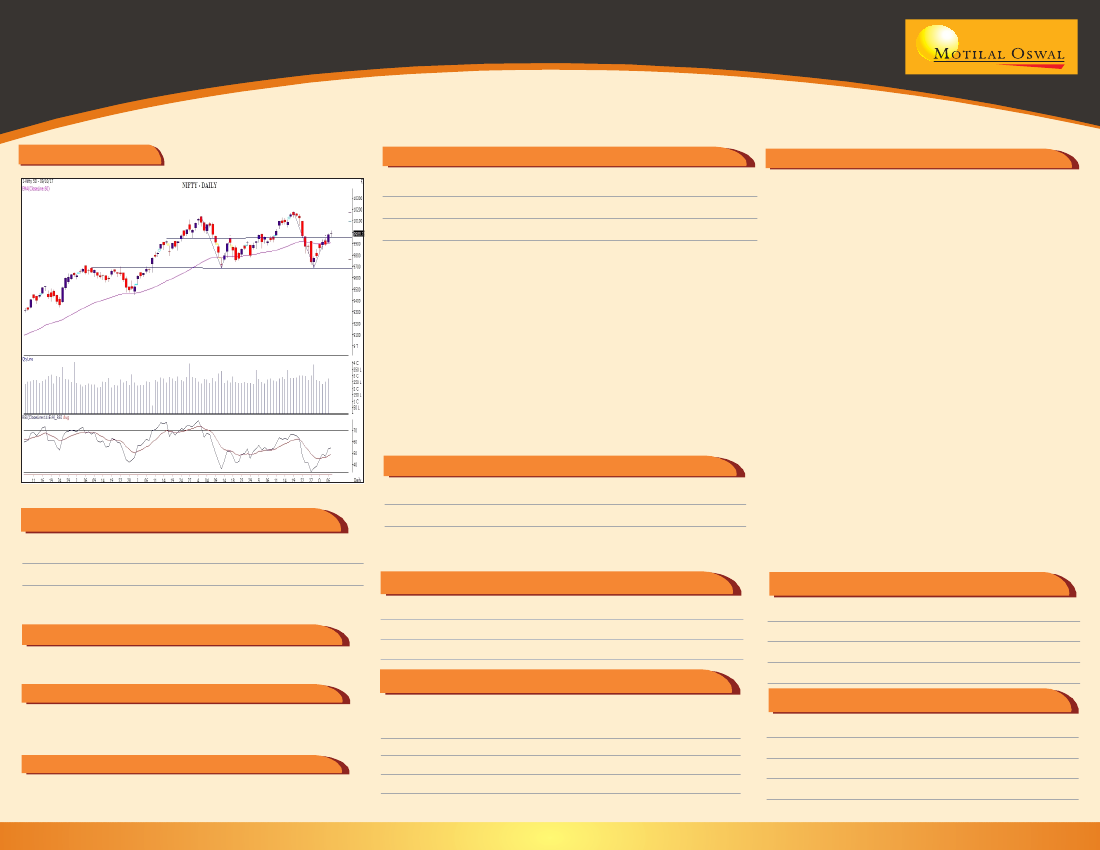

Nifty Chart

Nifty Outlook

Index

Nifty Cash

BankNifty

CMP

9988

24251

R1

10050

24350

R2

10080

24500

S1

9950

24000

S2

9880

23850

Market Drivers

Domestic markets closed marginally higher.

Sectors like financials, metals, real estate,

jewellery players did well. The focus will

continue to be results in the near term. Sectors

like financials, auto, metals, and consumer could

see interest on back of same. Sectors like

infrastructure, Defense, railways could also

remain in focus on expectations of order flow

and improvement in execution. Flows remained

muted with FIIs being net sellers and DIIs

marginal net buyers. Overall domestic market

could consolidate but the bias appears to be

positive.

Nifty index continued its formation of higher highs – higher lows

for sixth consecutive session and headed towards 10015 zones.

However it failed to hold above 10000 zones and formed a Doji

candle as it closed near to its opening levels. Doji candle suggests

that now bears are fighting near to 10k mark after the sharp bounce

back of 328 points in last seven sessions from the support of 9685.

It completed its 61.80% retracement of the entire down leg from

10178 to 9687 and has been hovering near to 9990 zones from last

two sessions. Now it has to continue to hold above 9980-10000

zones to extend its up move towards 10080 then a fresh life highs

while a hold below 9950 could end its pull back to attract a profit

booking towards 9880 then 9850 levels.

Currency (USDINR) Outlook

Trading Idea - Cash & Future

Scrip

Reco

BAJAJ FINANCE Buy

CMP

1941

SL

1910

Target

2000

USDINR

65.52

S1

65.30

S2

65.10

R1

65.70

R2

65.90

Sideways consolidation within 65.30 - 65.90 is likely for the day.

Sectoral Outlook

Sector

NBFC

FMCG

Outlook

POSITIVE

POSITIVE

Highest Call OI

Instrument

Nifty 26 - Oct

Bank Nifty 26 - Oct

Bank Nifty 12 - Oct

Strike

10000

24500

24600

OI

4365000

719240

668240

Chg in OI

281700

-62000

176080

Corporate Action:

HERITGFOOD - Stock Split From Rs.10/- to Rs.5/-

Security in Ban period:

BEML, DHFL, IBREALEST, JPASSOCIAT, JSWENERGY, RCOM,

RELCAPITAL

Trading Idea - Derivatives

STRATEGY UPDATE : SUNPHARMA CALL LADDAR SPREAD

Instrument

B/S

Lot

Reco

CMP

SUNPHARMA 520 CE

SUNPHARMA 540 CE

SUNPHARMA 560 CE

SL : 2000, TRAGET : 5000

Highest Put OI

Instrument

Nifty 26 - Oct

Bank Nifty 26 - Oct

Bank Nifty 12 - Oct

Strike

9800

24500

24000

OI

5782950

1364520

646200

Chg in OI

416175

56640

227160

Today Event

India - Trade Balance

Buy

Sell

Sell

1

1

1

12.95

6.50

3.35

23.40

13.15

6.15