MOSt Market Roundup

22nd December 2017

EQUITY Market

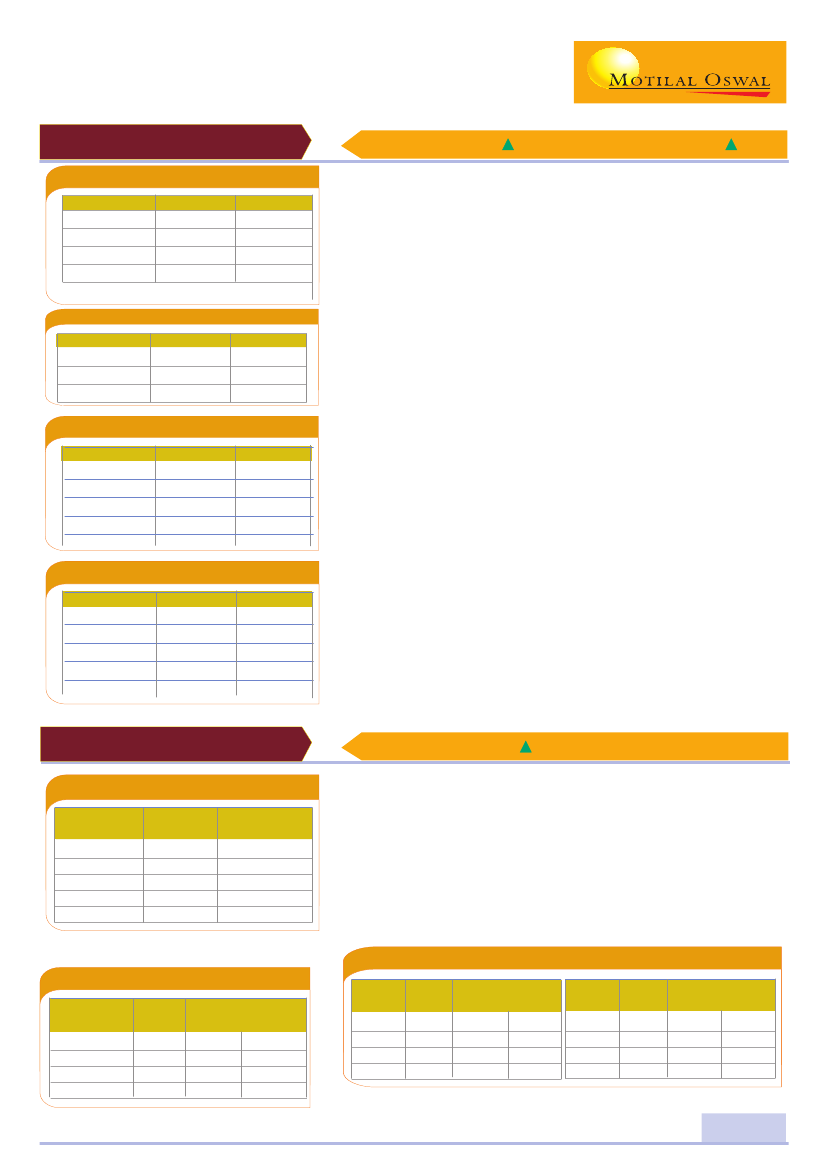

Cash Volumes (INR in Crores)

Exchange

Today

BSE (Cash)

-

BSE (Derivatives)

-

NSE (Cash)

30,475.76

NSE(Derivatives) 4,97,339.94

Pev. Day

4,833.05

0.15

32,497.73

9,77,758.12

Sensex

33940.3

184.02

Nifty

10493.00

52.70

Dealer's Diary

Christmas festival gifted stock market to close on a life time high. Nifty

gained half percent (53 points) to close at 10493. It has touched a new

high of 10501 mark. Sensex gained 184 points to close at 33940. Post

Assembly Election results Gujarat and Himachal Pradesh, Nifty gained

153 points (1.5%) to boosted the market confidence. Moreover, strong

global market and continued government reforms added fuel in the

market. Technology stocks were major gainers today after US listed

Indian tech major Accenture raised FY18 guidance to 6-8% CC from 5-

8% earlier. PSU Banking stocks gained modestly. However, rising 10- G-

Sec Yield is a major concern (10-Year G-Sec Yield at 7.26%). Consumer

Durable, Cement stocks witnessed profit booking. eClerx surged nearly

10% to close at Rs1494. Company says founders to offer to buy back up

to 1.29mn shares at Rs2000 each. Wipro gained over 1% to close at

Rs302. Wipro founders increased holding to 74.33% after buyback versus

73.18% earlier. Other Tech stocks like Infosys , TCS and MindTree (up

4%) gained 1-2%. Upstream oil major ONGC gained 3% to close at Rs193

on account of increased oil price. PSU Banking stocks like SBI, OBC (up

4%), PNB, Bank of Baroda witnessed fresh buying. Among the Auto

stocks Maruti, M&M, Tata Motor and Bajaj Auto witnessed fresh buying.

Hero Motocorp declined marginally to close at Rs3793.

Advance / Decline

Group

Advance

Decline

Unchanged

NIFTY 50

19

31

0

BSE 201

123

76

2

Top Index Gainers

Scrip

ONGC

HINDALCO

TCS

BAJFINANCE

BAJAJ-AUTO

LTP

193.6

268.85

2,641.80

1,776.40

3,340.00

% Change

2.98

2.11

1.78

1.62

1.54

Top Index Losers

Scrip

ULTRACEMCO

LUPIN

COALINDIA

TATASTEEL

DRREDDY

LTP

4,289.00

870.8

265.8

709.4

2,335.00

% Change

-1.01

-0.92

-0.78

-0.73

-0.71

Technical Outlook

Nifty index managed to hold above 10450 and hit a new life time high

of 10501 mark. It formed a Bullish candle on the Daily chart and given

the momentum after the consolidation of last two trading sessions. It

has given the highest daily close with the intraday gains of around 50

points. Now it has to continue to hold above 10450 zones to extend its

move towards 10550 then 10600 zones while on the downside supports

are seen at 10400 zones.

Nifty Futures

10505.45

43.00

Premium

12.45

DERIVATIVE MARKET

Derivative Volumes (INR in Crores)

Exchange

Index Futures

Stock Futures

Index Options

Stock Options

F&O Total

No. of

Contracts

2,03,436

9,89,387

41,27,221

6,98,401

60,18,445

Turn

Over

17,119.96

71,813.50

3,55,899.80

52,396.79

4,97,230.06

Nifty Future closed with gains of 0.41% at 10505. On the option front, maximum

Put open interest is at 10000 followed by 10400 strike while maximum Call OI

is at 10500 followed by 10600 strike. We have seen significant Put writing at

10400, 10450 and 10500 strikes while fresh Call writing is seen at 10550 and

10650 strikes. Option band signifies a broader trading band between 10400 to

10600 for next coming sessions. India VIX fell down by 4.06% at 11.58. VIX has

fallen down by 22.44% in last five sessions and needs to hold below 12.50

zones to get the smooth ride. Built up of long position were seen in Wipro,

Pidilitind, Tatamtrdvr, Mindtree, Voltas, ONGC, Suntv, Engineersin, Hindalco,

Adanipower and BEL while shorts were seen in Kotak Bank, Dishtv, IDBI, Justdial

and Apollohospital.

Most Active Stock Future

Stock

Futures

RELINFRA

RELCAPITAL

INFY

MARUTI

Price

INR

528.5

484.6

1039.4

9700.0

No. of Contract

Vol

OI

27388

24684

21456

19920

7864

18425

55252

25657

Most Active Nifty Calls

Index

Option

10,500

10,600

10,400

10,400

Price

INR

44.6

10.5

120.0

120.0

No. of Contract

Vol

OI

322657

200370

119645

119645

77506

57335

32343

32343

Most Active Nifty Puts

Index

Option

10,400

10,500

10,300

10,200

Price

INR

19.2

41.0

8.8

4.6

No. of Contract

Vol

OI

302366

199342

184109

126435

80283

51198

64758

66212

Motilal Oswal Securities Ltd., Motilal Oswal Tower, Level 2, Sayani Road, Prabhadevi, Mumbai 400 025

1