10 February 2014

3QFY14 Results Update | Sector:

Metals

NMDC

BSE SENSEX

20,334

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

6,053

NMDC IN

3,964.7

154/93

6/27/-6

CMP: INR144

TP: INR177

Buy

Strong results; dividend payout ~90% YTD

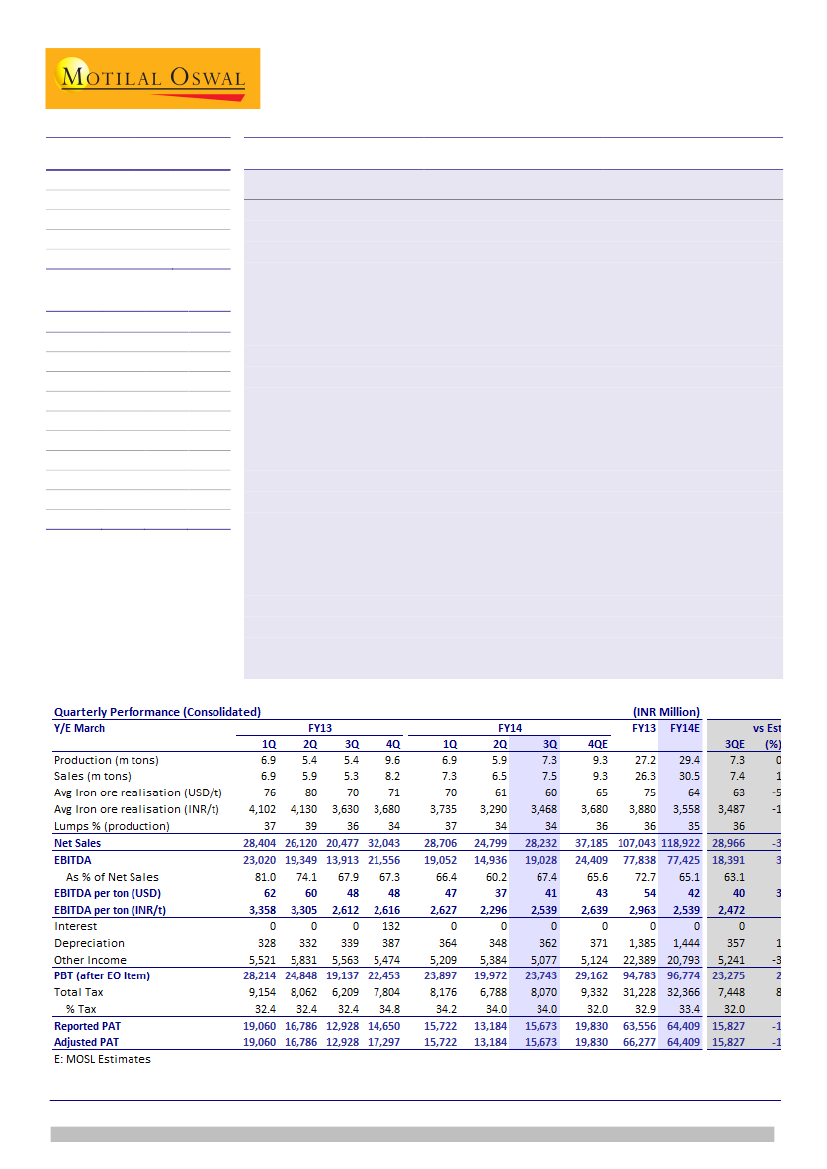

NMDC reported strong results. Adjusted PAT for 3QFY14 increased 21% QoQ to

INR15.7b driven by 15% growth in volumes and 5% higher realization. EBITDA

increased 27% QoQ (+37% YoY) to INR19b, 3% ahead of estimate. EBITDA per ton

increased 11% QoQ to INR2,539. Capital allocation is improving with quantum jump

in dividend payout.

Price hikes and e-auction premiums benefited realization:

Average iron ore

realization in the domestic market increased 5% QoQ to INR3,468/t, reaping the

benefits of price hikes and superior e-auction premiums. Exports declined 39%

QoQ to 0.43mt, which fetch lower margins, too helped overall EBITDA per ton.

Quantum jump in interim dividend:

The two interim dividends together are

significantly higher at INR8.5 v/s INR3/share last year, which implies payout ratio

of ~90% for 9MFY14. We are expecting INR9/share (payout of 64.8%, yield of

6.2%) for FY14E. Capex remains low as implied by segmental capital employed.

Raise estimates:

We continue to believe that iron ore supply is getting tighter in

India, which will help domestic iron ore prices despite headwinds in international

market. NMDC has taken a price hike of ~INR100/t for iron ore fines from Feb 1,

2014. Volumes have picked up further in January 2014 with re-start of Essar slurry

pipeline. We raise the volume expectation from 8.5/29.6mt to 9.3/30.5mt for

4Q/FY14. Hence, EPS is raised 1.5/2.3% for FY14E/FY15E.

Valuations attractive; maintain Buy:

We expect NMDC to deliver ~11% volume

CAGR to 35.5mt over FY13-16E. Stock is trading at attractive 1.8x FY15E BV (RoE

of 21.7%), EV of 4.4x FY15E EBITDA and dividend yield of >6%. We value the stock

at INR177 (23% upside) based on 5.5x EV/EBITDA. Reiterate

Buy.

M.Cap. (INR b) / (USD b) 572.1/9.2

Financials & Valuation (INR Billion)

Y/E Mar

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr (%)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

EV/EBITDA

( )

2014E 2015E 2016E

118.9

77.4

64.4

16.2

-2.8

22.5

33.7

8.9

1.9

4.7

130.6

83.7

69.8

17.6

8.3

22.6

33.1

8.2

1.8

4.4

136.3

87.3

71.5

18.0

2.5

21.6

31.6

8.0

1.7

4.4

Sanjay Jain

(SanjayJain@MotilalOswal.com); +91 22 3982 5412

Investors are advised to refer through disclosures made at the end of the Research Report.