15 January 2015

Sector Update| Healthcare

Sector Update

Healthcare

Indian pharma market – Monthly performance tracker

Sustained growth recovery, expect momentum to pick up

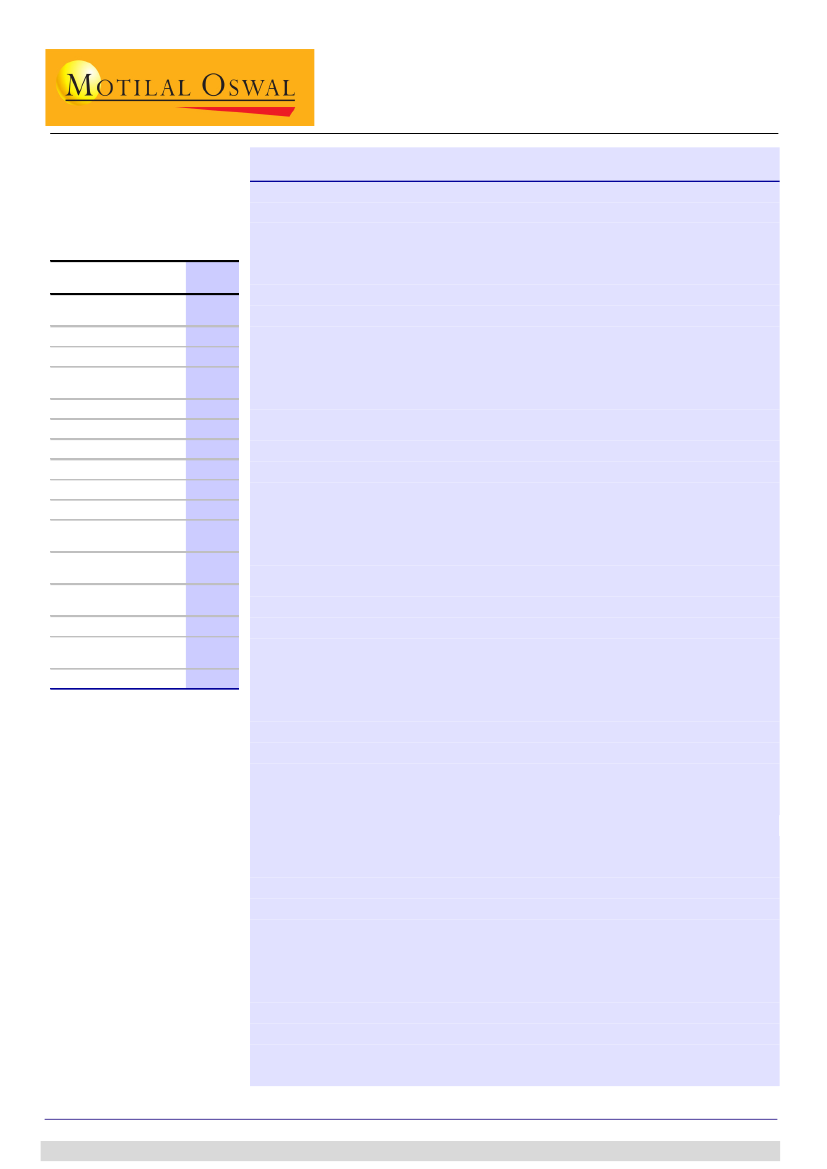

Performance of top companies:

December 2014

Company

Abbott India

Sun Pharma

Cipla

Zydus Cadila

Ranbaxy

Mankind

Alkem

GSK Pharma

Lupin

Sanofi

Torrent

Pharma

Glenmark

Pharma

Dr Reddy Labs

Ipca Labs

Alembic

Pharma

Biocon

MAT gr

(%)

6.9

15.3

11.4

8.7

10.7

12.5

11.1

-4.0

12.2

5.8

10.5

15.2

9.0

18.6

11.5

24.9

3QFY15

gr (%)

9.2

15.3

10.4

8.4

21.2

13.8

4.8

6.2

8.7

15.1

19.7

14.8

8.0

2.9

8.6

0.9

IPM Dec 2014 growth was at 13.6%, 3QFY15 growth at 10.3%

IPM grew 13.6% YoY to INR74b for December, higher than the 11% YoY and 6%

YoY growth registered in November and October respectively.

3QFY15 growth was in double digit for the second consecutive quarter at 10.3%

YoY (12.8% YoY in 2QFY15), reflecting the continued recovery in India pharma

market, aided by price hikes undertaken on NLEM drugs and a favorable base

effect (6.8% YoY in 3QFY14).

Overall on MAT (Moving Annual Total) basis, IPM growth was at 10.2% YoY

(INR830b).

Ranbaxy posted the highest growth at 21.2% YoY in our coverage, attributed to

the price hikes taken in NLEM brands.

Sun Pharma (15.3% YoY) and Glenmark (14.8% YoY) also grew in double digits,

supported by a high volume growth (9% YoY) during the quarter.

Torrent Pharma (19.7% YoY) also grew in excess of 15%, with a price hike taken

in key Elder brands – Shelcal and Chymoral (10% price hike).

In 3QFY15, Anti-Diabetic therapy grew 19.7% YoY, with good growth seen in

drugs like Glargines, Sitagliptins, Vildagliptins and Glimepride+Metformin

products.

Respiratory, 8% of IPM, grew at 15% YoY, with big brands like Allegra, Foracort

and Duolin growing in excess of 15% for the quarter.

Anti-infectives, 16% of IPM, reported double digit growth for this quarter at

12.2% YoY (11.1% YoY in 2QFY15). The resurgence seen in Anti-infectives for the

last two quarters is a combination of – 1) lower base of last year (-2.1% YoY

growth for 3QFY14), 2) price hike taken in NLEM affected brands and 3)

seasonality.

DPCO listed products grew at 8% YoY, while non DPCO products registered

14.8% YoY growth in December.

DPCO and non DPCO category showed unit growth at 0.7% and 3.2%

respectively.

The DPCO 2013 portfolio for Pfizer grew at 13.9% YoY, GSK 1.7% and Ranbaxy

41.9% for December.

3QFY15: Company-wise performance

Anti-diabetic and Respiratory led in therapies

DPCO v/s non DPCO market (Dec 2014)

MAT performance analysis

IPM has grown at 10.2% for MAT Dec 2014. Growth is primarily driven by a

volume growth of 4.6% and new products growth of 2.9%. From therapy

perspective, Acute drugs grew 9% YoY for MAT Dec 2014, while chronic growth

was at 13% YoY.

1

Arvind Bothra

(Arvind.Bothra@MotilalOswal.com); +91 22 3982 5584

Amey Chalke

(Amey.Chalke@MotilalOswal.com); +91 22 3982 5423

Investors are advised to refer through disclosures made at the end of the Research Report.

15 January 2015