28 May 2015

4QFY15 Results Update | Sector:

Metals

NMDC

BSE SENSEX

27,507

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Free float (%)

S&P CNX

8,319

NMDC IN

3,964.7

196/123

2/-4/-37

20.0

n

n

CMP: INR131

n

TP: INR105 (-20%)

Sell

EBITDA beat; off-take weak, price cut unavoidable

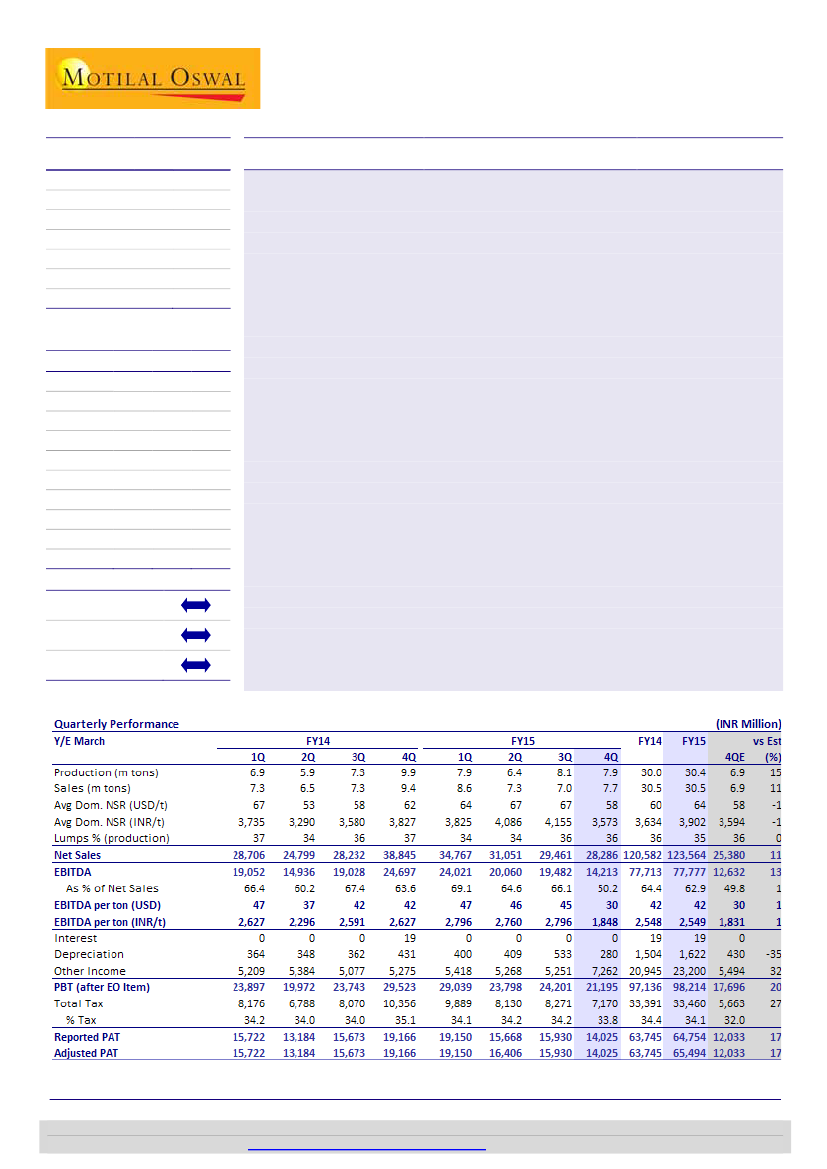

EBITDA beat largely due to change in revenue recognition:

NMDC 4QFY15 EBITDA

declined 42% YoY to INR14.1b, but was 13% ahead of our estimates. The beat was

driven by higher sales volume at 7.7mt (v/s. est. of 6.9mt). E-auction sales are now

accounted immediately as against earlier practice of recognizing the same on

dispatch. The revenues were boosted by change in reorganization of revenue by

INR943.5m toward iron ore and INR115m toward diamonds.

PAT stood at INR14b (-17% YoY/; -12% QoQ), as lower operating profit, which was

partly offset by higher other income (38% YoY increase to INR7.3b).

We expect further price cut:

NMDC has already cut prices by ~INR1,100/t since

December 2014. We expect additional cut of INR600/t on further easing of

domestic supply, sluggish domestic demand, expected DMF at 100% of royalty and

weak international iron ore price INDEX of USD50/dmt for 62% Fe.

Volumes under pressure:

Despite a price cut in April, dispatches continue to suffer

as RINL & Essar have cut steel production due to poor demand and margins. On

the positive side, JSW has resumed off-take with marginal purchases for Dolvi.

Capex accelerating:

Investment in 3mtpa steel plant at Nagarnar is accelerating.

Capex will increase from INR31b in FY15 to INR35b FY16. NMDC has signed an

MoU to set up ultra mega size steel plants in Bastar. Capital allocation in low-RoI

and high capital-intensive projects will de-rate the stock.

Maintain Sell:

Although NMDC paid the highest-ever dividend (in its history) of

INR8.55/share in FY15, we expect it to cut dividend in FY16 on fall in profit and

increase in capex. Our estimates are largely unchanged. We expect NMDC’s

EBITDA/t to decline to INR1,280/INR1,170 in FY16/17E (from INR1,848 in 4QFY15)

on lower realization. Maintain

Sell.

M.Cap. (INR b) / (USD b) 519.4/8.1

Avg Val (INRm)/Vol ‘000 466/2,967

Financials & Valuation (INR Billion)

Y/E MAR

Sales

EBITDA

Adj. PAT

Adj.EPS(INR)

EPS Gr(%)

RoE (%)

RoCE (%)

P/E (x)

P/BV

EV/EBITDA(x)

2015 2016E 2017E

123.6

77.8

65.9

16.6

3.1

20.8

20.8

7.9

1.6

4.3

75.6

43.4

41.4

10.4

-37.2

16.0

16.0

12.5

1.5

7.7

78.9

44.4

41.1

10.4

-0.9

11.5

11.5

12.7

1.4

7.9

n

n

Estimate change

TP change

Rating change

n

Sanjay Jain

(SanjayJain@MotilalOswal.com); +91 22 3982 5412

Dhruv Muchhal

(Dhruv.Muchhal@MotilalOswal.com); +91 22 3027 8033

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.