Hexaware Technologies

BSE SENSEX

28,091

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val. (INR m)

Free float (%)

S&P CNX

8,691

HEXW IN

301.8

61.1 / 0.9

274 / 178

5/-25/-22

271

28.8

25 October 2016

3QCY16 Results Update | Sector: Technology

CMP: INR202

TP: INR230 (+14%)

Neutral

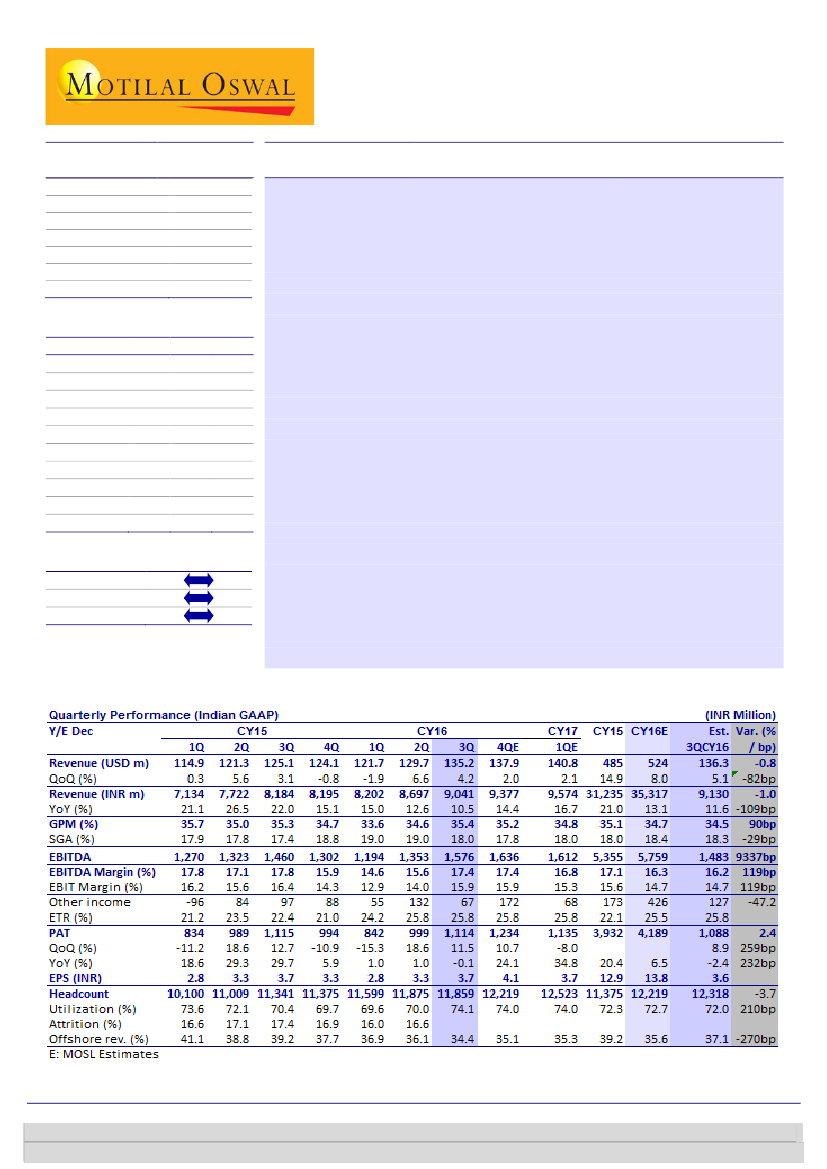

Top-5 clients drive revenues; Profit beat on utilization

Revenue in-line; but lopsided:

HEXW’s 3QCY16 revenue growth of 4.8% QoQ

CC was in line with estimates, and well ahead of peers. However, this was

driven by Top 5 clients (+13.7% QoQ). Revenue from remaining clients declined

2.9% QoQ. New deal wins continued to show strength as it clocked a TCV of

USD42m in the quarter (USD98m in 9MCY16), compared to USD120m in CY15.

Margin beat despite onsite skew:

EBITDA margins excluding ESOP charges

expanded by 210bp QoQ to 18.2% (against our expectation of +100bp QoQ to

17.2%). Profitability beat estimates despite higher onsite composition – largely

led by higher utilization (+410bp QoQ), absence of visa expenses and SG&A

rationalization (-100bp QoQ).

Announces buyback:

HEXW cut dividend payout last quarter to INR1 per share

(30% payout vs 67% in CY15). However, it announced a buyback amounting to

INR1.4b (at INR240 per share) this quarter, in addition to the INR1/share of

dividend. It identified buyback as the best means of returning cash to

shareholders, potentially indicating continuation of the same in the future.

Valuation and view:

While high payout is a positive for valuations, top-line

traction remains a function of few accounts for now, and overall growth is still

in single digits YoY. Near term outlook is comforting as HEXW expects next

couple of quarters to better the performance of corresponding quarters last

year, despite elevated furloughs. We expect USD revenue CAGR of 10.3% and

EPS CAGR of 11.4% over CY15-17E. Our target price of INR230 discounts

forward EPS by 14x. Maintain

Neutral.

Financials & Valuations (INR b)

2015 2016E

Y/E Dec

31.2

35.3

Net Sales

5.4

5.8

EBITDA

3.9

4.2

NP

12.9

13.8

EPS (INR)

22.1

6.4

EPS Gr. (%)

47.4

51.5

BV/Sh. (INR)

28.9

27.9

RoE (%)

27.7

25.3

RoCE (%)

64.5

38.5

Payout (%)

4.3

2.7

Div. Yield

2017E

41.0

7.0

4.9

16.0

16.6

62.2

28.2

27.1

24.0

2.0

Estimate change

TP change

Rating change

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 6129 1530

Sagar Lele

(Sagar.Lele@MotilalOswal.com); +91 22 6129 1531