26 October 2016

2QFY17 Results Update | Sector: Financials

HDFC Bank

Buy

BSE SENSEX

28,091

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

12M Avg Val (INR M)

Free float (%)

S&P CNX

8,691

HDFCB IN

2,528.2

3,105 / 46.2

1318 / 929

-3/3/11

1638

78.7

CMP: INR1,250

TP: INR1,500 (+20%)

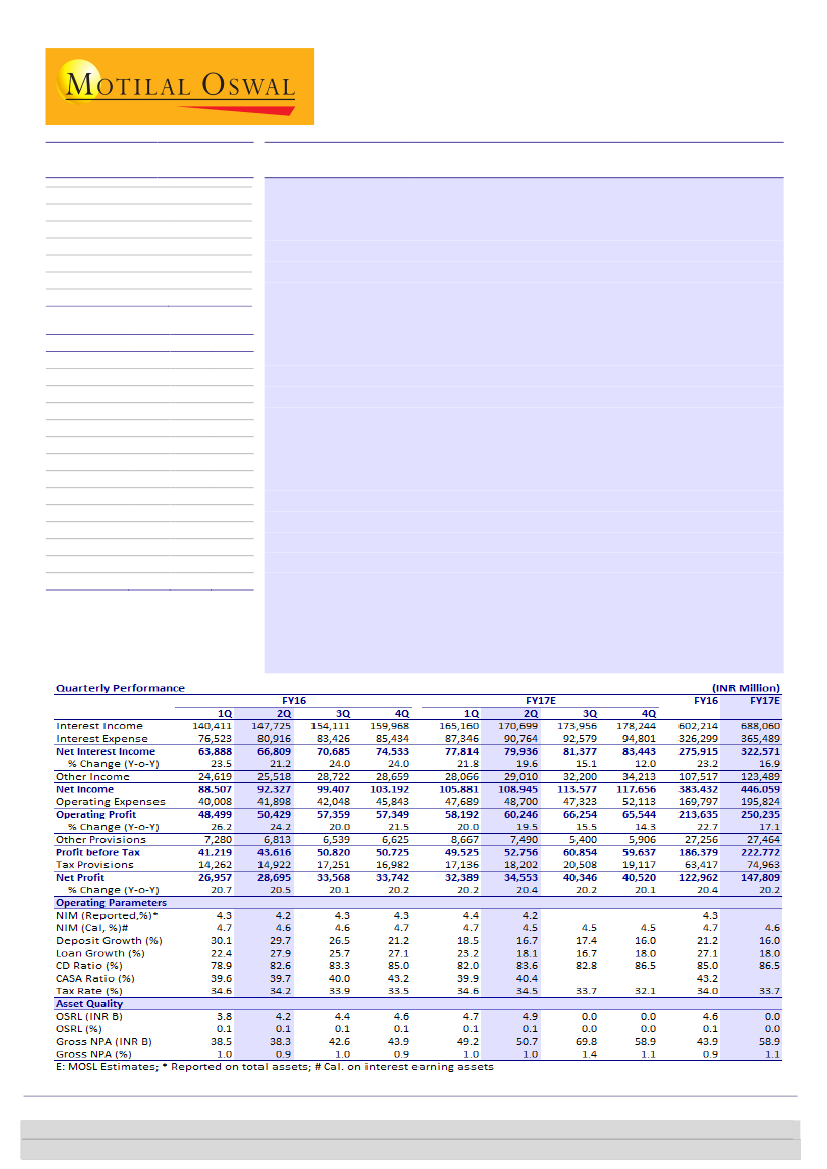

Loan growth moderates to 18% YoY; RoA steady at 1.8%

HDFC Bank's (HDFCB) 2QFY17 PAT grew 20% YoY (in-line) to INR34.6b, driven

by healthy core PPoP growth (+20% YoY). Key highlights of the quarter were: a)

corporate loan growth slowed to 13% YoY on account of higher repayments of

short-term loans; b) reported NIM declined 20bp QoQ to 4.2%; c) strong retail

loan growth (+24% YoY); and d) moderation in fee growth (12.6% YoY).

Retail loan book grew robustly by 23.5% YoY, driven by strong growth in auto

loans (23% YoY), personal loans (40% YoY) and agricultural loans (35% YoY).

Growth in business banking (15% YoY) picked up after a lackluster 1Q.

However, intense competition in the retail segment impacted fee income

growth.

CASA deposits grew 19% YoY, driven by SA (+22% YoY). CASA ratio was largely

stable YoY at ~40%. Over past one year, branch count has grown 8%.

Other highlights:

a) Absolute GNPA increased 3% QoQ, with slippage ratio

declining to 1.4%; b) CET1 ratio remained healthy at 13.3% (stable QoQ); and c)

NSL remained the lowest at 40bp. d) HDFCB opened 7 branches in the quarter,

compared to 506 branches opened in FY16.

Valuation and view:

HDFCB is well positioned in the current environment with

~40% CASA ratio, growth outlook of at least 1.3x industry and least asset quality

risk. With CET1 of ~13.3%, strong capacity building amid moderate growth cycle

(branches at 4,548 v/s 1,412 in FY09) and significant digitalization initiatives, the

bank is well placed to benefit from the expected pick-up in economic growth cycle.

RoE is expected to be ~19-20% in FY17-19. Maintain

Buy

with a target price of

INR1,500 (3.6x Sep 2018E BV) based on RI model.

Financials & Valuation (INR b)

Y/E Mar

2016 2017E 2018E

NII

275.9 335.5 399.2

OP

213.6 256.8 306.3

NP

123.0 147.8 177.6

NIM (%)

4.7

4.8

4.7

EPS (INR)

48.6

58.4

70.2

EPS Gr. (%)

19.3

20.2

20.2

BV/Sh. (INR)

287

332

386

ABV/Sh. (INR)

284

326

379

RoE (%)

18.3

18.9

19.6

RoA (%)

1.9

1.9

1.9

P/E(X)

25.2

21.0

17.5

P/BV (X)

4.3

3.7

3.2

P/ABV (X)

4.3

3.8

3.2

Div. Yield (%)

0.8

1.0

1.1

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415

Sohail Halai

(Sohail.Halai@MotilalOswal.com); +91 22 3982 5505

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.