BSE SENSEX

28,339

S&P CNX

8,792

Dewan Housing Finance

CMP: INR304

TP: INR405(+33%)

Monetizing value from life insurance business

BV accretion of ~30%; Dilution-free growth for next three years

n

14 February 2017

Company Update

| Sector:

Financials

Buy

Stock Info

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

M.Cap. (INR b)

M.Cap. (USD b)

Avg Val, INRm

Free float (%)

DHFL IN

299.8

337 / 142

8/14/75

91.1

1.4

618

60.7

n

n

n

Financials Snapshot (INR b)

Y/E March

2016 2017E 2018E

NII

14.8

17.7

20.7

PPP

12.8

15.8

18.7

Adj. PAT

7.3

9.2

10.7

EPS (INR)

25.0

30.7

35.6

EPS Gr. (%)

17.2

22.9

16.0

BV (INR)

172

202

228

RoAA (%)

1.2

1.2

1.2

RoE (%)

15.1

16.6

16.6

Payout (%)

46.1

23.2

23.2

Valuations

P/E (x)

12.2

9.9

8.5

P/BV (x)

1.8

1.5

1.3

P/ABV (x)

1.8

1.5

1.3

Div. Yield (%)

6.6

2.0

2.3

Shareholding pattern (%)

As On

Dec-16 Sep-16 Dec-15

Promoter

39.3

39.3

34.9

DII

6.0

3.9

2.0

FII

26.4

29.5

35.5

Others

28.4

27.3

27.6

FII Includes depository receipts

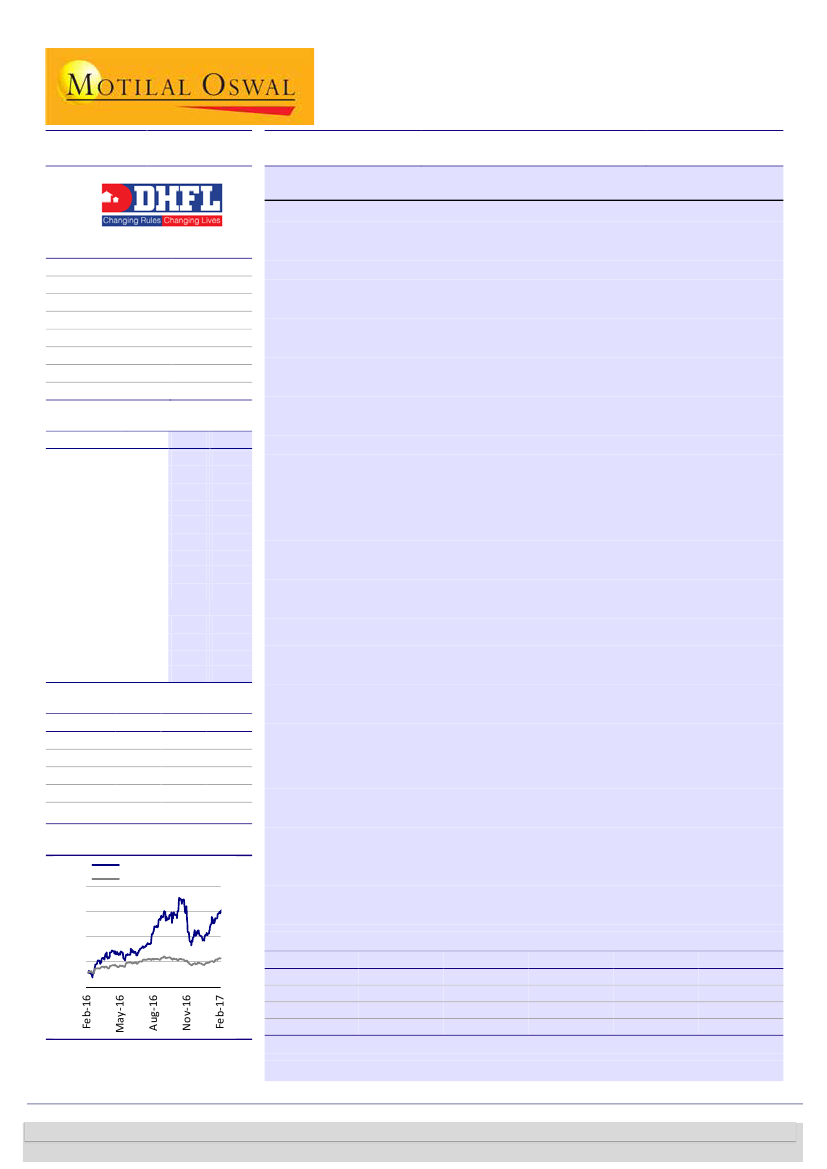

Stock Performance (1-year)

Dewan Hsg. Fin.

Sensex - Rebased

360

300

240

180

120

DHFL has entered into an agreement with the promoters to sell its 50% stake

in DHFL Pramerica Life Insurance JV (DPLI) for an amount in the range of

INR16.9-20.2b.

The DPLI stake will be sold to its wholly owned subsidiary DHFL Investment

Ltd (DIL). To fund this transaction, DIL will issue compulsorily convertible

debentures (CCDs) to the promoters’ entity (Wadhawan Global Capital).

Monetization of the stake will help the company to reduce the leverage on its

balance sheet to ~13x from ~10x FY18. Strong net worth addition (~30%) will

ensure dilution-free growth until FY20, in our view.

We await further details on maturity of CCDs, taxation related to the deal

and any specific clause related to the deal between the promoters and DHFL.

The deal adds ~INR60/share to BV, although RoE could reduce by ~150bp

over the near term.

Significant accretion to net worth

The current book value of DHFL’s investment in the insurance JV is a mere

INR310m. Thus, virtually the entire proceeds from the stake sale will be capital

gains. Our current estimate for the company’s FY18 net worth stands at INR68.3b.

Post the stake sale, the net worth could increase to as much as INR88.5b (at the

upper end of the valuation range without factoring in taxation). This implies ~30%

increase in the book value for FY18.

Sharp improvement in capital adequacy without equity dilution

We believe that the transaction would shore up the tier I ratio by 350-400bp. As a

result, the tier I ratio would be more than 15%, the highest in past five years.

More

importantly, this would be achieved without any equity dilution (our calculations

suggest that if it were to achieve a 15% tier I ratio by raising equity capital, the

dilution would be more than 20%).

This will help sustain strong loan growth for

next three years.

Valuation and view:

DEWH continues to capitalize on its mortgage lending

expertise in an underpenetrated market. We expect AUM growth to remain higher

than industry average at 18-19%+. Margins will improve further with a higher share

of builder loans and lower cost of funds. Also, management’s continued focus on

lowering operating cost should improve investor sentiment and lead to a re-rating.

Further, the insurance deal assuages concerns about capital raise for growth.

Reiterate

Buy

with a target price of INR405 (1.6x FY19E BV). Our estimates do not

factor in capital gains.

Exhibit 1: Brief snapshot of the financials post the stake sale

FY18 (INR m)

Net worth

PAT

EPS

BVPS

Base Case Sale at INR17b Sale at INR18b Sale at INR19b Sale at INR20b

68,366

86,360

87,419

88,477

89,536

10,674

11,668

11,727

11,785

11,844

36

39

39

39

40

228

288

292

295

299

Source: MOSL, Company

We will revise our estimates post the completion of the stake sale.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415

Piran Engineer

(Piran.Engineer@MotilalOswal.com); +91 22 6129 1539

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.