22 August 2017

A

nnual

R

eport

T

hreadbare

RELIANCE FY17

RIL’s FY17 annual report analysis highlights an improvement in adjusted

operating cash flows post interest to INR370b (FY16: INR293b). This was

largely on the back of increased payables of INR309b, of which 50%+ are

non-trade. High capex (>INR1t, of which ~60% pertains to Jio) led to FCF

post interest (adjusted) remaining negative at INR396b. With INR3.2t of

assets under development (CWIP+ITUD), RoCE remained subdued at

7.5%. Operating performance was muted. Consolidated PAT grew just

1% to INR299b due to aggregate losses at subsidiaries, despite

capitalizing project development expenses and non-amortization of

assets at Jio. Adjusted debt increased to INR2,693b (FY16: INR2,334b),

with INR155b of interest and forex (7.4% borrowing cost) being

capitalized and INR38b (2% borrowing cost) being expensed. Cash and

investments declined to INR787b; yield of 10.3% on these led to positive

carry in the income statement. Expenses paid to related parties remain

high at INR84b, 22% of opex.

The

ART

of annual report analysis

At the current run rate

Jio will at least incur

INR325b of expenses

once it stops

capitalizing expenses

Increase in non-trade

payables of INR309b

support FCF

IND-AS transition lead to INR98b decline in

networth

Auditor’s name

Chaturvedi & Shah

Deloitte Haskins & Sells LLP

Rajendra & Co.

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INR m

Free float (%)

Subsidiaries drag overall performance:

GRMs were at an 8-

year high of USD11/bbl (Singapore complex: USD5.8/bbl),

resulting in an increase in standalone PAT to INR314b (FY16:

INR274b). However, subsidiaries dragged performance, with an

aggregate loss of INR86b. Reliance Holding USA reported a loss

of INR61b, while Jio generated a loss of INR0.3b.

~INR325b to be expenses once jio stops capitalizing expenses:

RIL’s

telecom venture, Jio commenced commercial operations

from Sept 5, 2016. It currently capitalizes project development

costs (FY17: INR217b). The capitalized costs and depreciation

of assets used for Jio will be expensed when the management

believes the assets are available for use in the manner

intended by it. When this happens, we believe Jio will incur

annual expenses of at least INR325b. Of these, INR110b will be

depreciation, and the balance will be recurring expenses

(which may increase depending on the level of operation and

the period for which it is considered as operational).

FCF remains negative, supported by non-trade payables:

FCF

post interest (adj.) declined to negative INR396b on higher

cash capex at INR766b (FY16: INR466b). We note that FCF in

FY17 was significantly supported by increase in trade and other

payables of INR309b (FY16: INR80b). Of this increase, INR171b

pertains to other payables, which include security deposits,

creditors for capex and financial liability for fair value.

Ind-AS transition leads to INR98b decline in net worth:

This is

primarily on account of decline in value of assets recognized

for (a) change in accounting for oil and gas activity: INR376b,

(b) CWIP and ITUD of Jio: INR120b, and (c) FV of proved

developed reserves of shale gas: INR58b. However, this was

partially offset by upward revaluation of land by INR511b.

Stock Info

RIL IN

3,251.0

5,157/77.3

1665/992

2/34/41

11929

55.0

Mar-17

45.0

11.6

24.8

18.6

Jun-16

45.1

13.0

22.7

19.3

Shareholding pattern (%)

As on

Promoter

DII

FII

Others

Jun-17

45.0

11.1

25.6

18.3

Note: FII Includes depository receipts

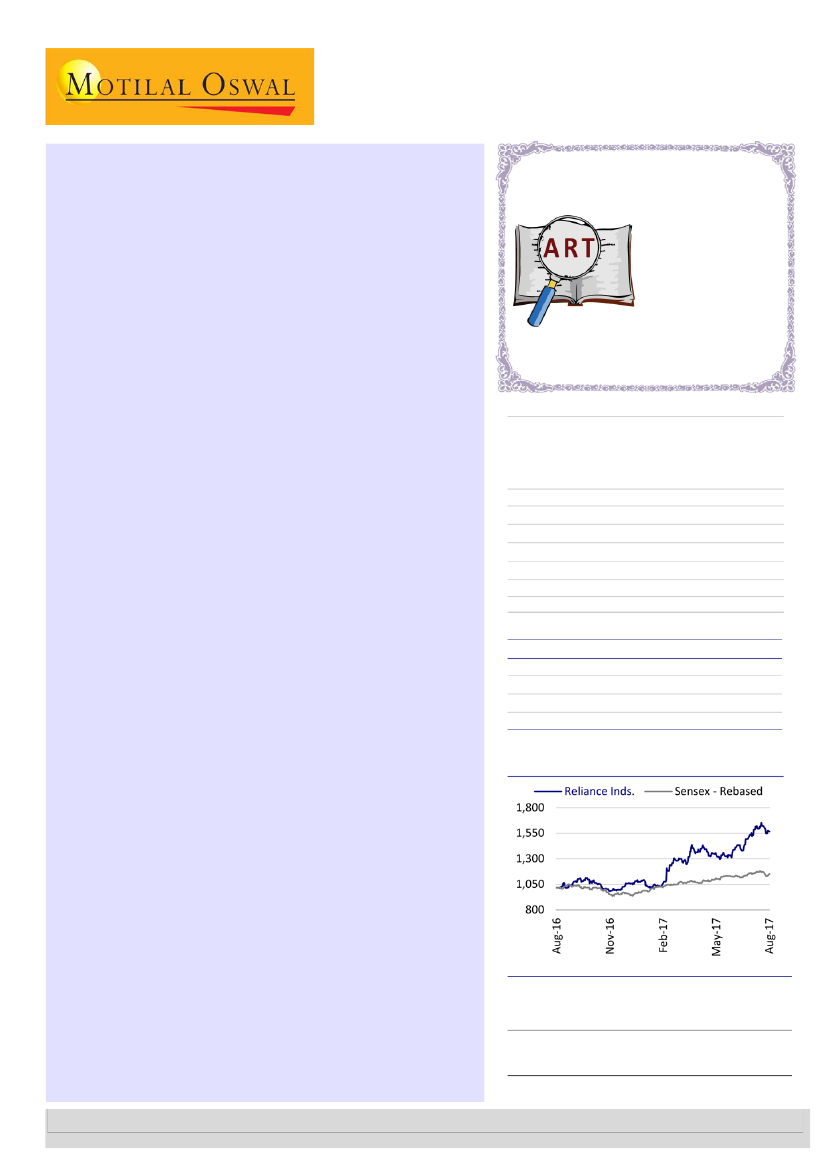

Stock Performance (1-year)

Sandeep Ashok Gupta – Research analyst

(S.Gupta@MotilalOswal.com); +91 22 39825544

Somil Shah – Research analyst

(Somil.Shah@MotilalOswal.com); +91 22 3312 4975

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.