16 October 2017

2QFY18 Results Update | Sector: Financials

Bajaj Finance

Buy

BSE SENSEX

32,634

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, (INR m)

Free float (%)

S&P CNX

10,231

BAF IN

Strong growth continues; RoE of 20%+ despite large capital raise

546.9

Bajaj Finance’s (BAF) 2QFY18 PAT increased 37% YoY to INR5.57b (2%

843.8/13.1

miss). Performance across parameters was largely in line with the trend.

1578 / 762

AUM continued its robust growth trajectory (+38% YoY, +5% QoQ) to

7/50/63

reach INR721b, led by impressive growth in consumer finance (+42% YoY)

1518

and commercial business (+57% YoY).

42.1

CMP: INR1,889

TP: INR2,300(+22%)

Financials & Valuations (INR b)

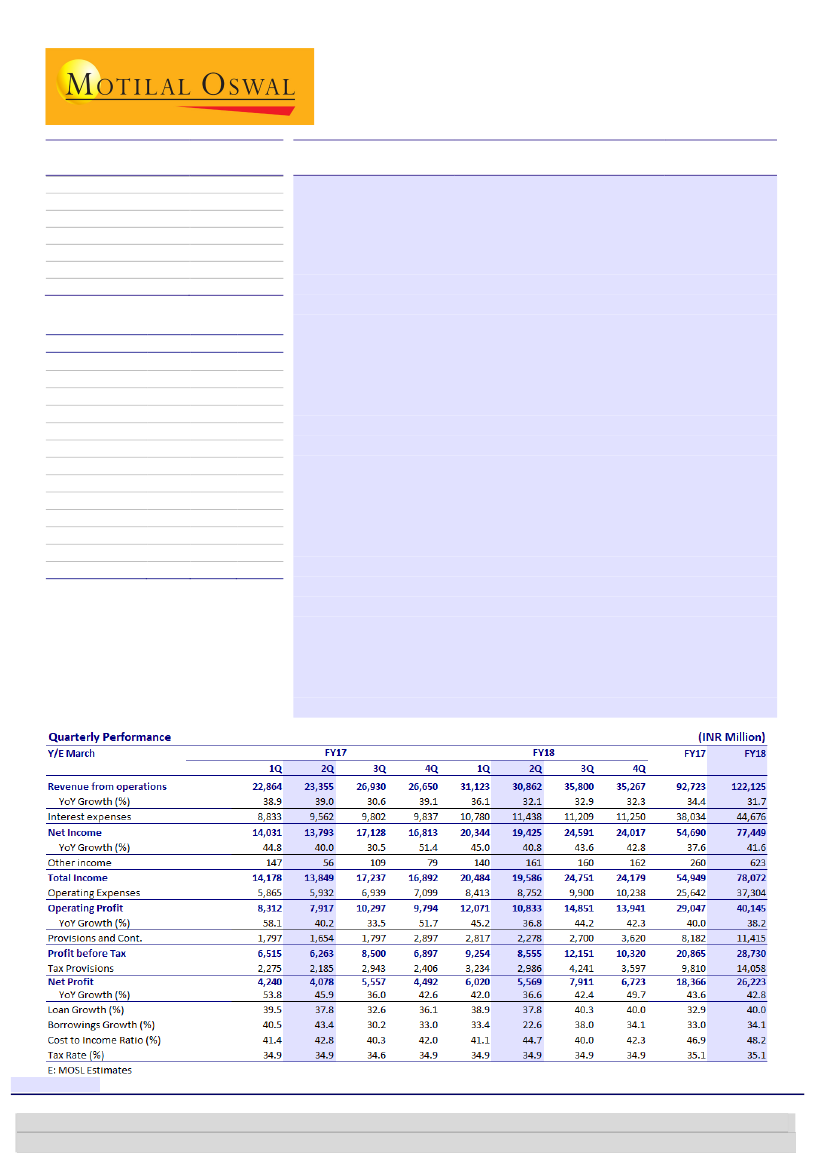

Y/E March

2017 2018E

NII

54.7

77.4

PPP

36.4

51.7

PAT

18.4

26.2

EPS (INR)

32.0

45.7

EPS Gr. (%)

43.6

42.8

BV/Sh. (INR)

167

285

RoA on AUM (%)

3.3

3.5

RoE (%)

21.6

20.2

Payout (%)

14.0

12.5

Valuations

P/E (x)

59.0

41.3

P/BV (x)

11.3

6.6

Div. Yield (%)

0.2

0.3

2019E

104.8

73.1

36.5

63.7

39.3

339

3.6

20.4

12.5

29.7

5.6

0.4

Cross-sell personal loans grew 54% YoY to INR76b (11

th

consecutive

quarter of 50%+ AUM growth).

The size of this book is now within

sniffing distance of the CD financing book (INR80b).

This validates the

cross-sell expertise of BAF’s business model – on-board the customer

through CD loans, and then cross-sell personal and other loans.

Our

estimate is that BAF has tapped just ~15% of its CD financing customer

base for personal loans, implying huge opportunity ahead.

Asset quality and margins were stable QoQ. Management remains

cautious on LAP and SME growth ahead, due to hyper competition and

the lagged impact of demon and GST.

Valuation and view:

BAF, a dominant player in the consumer durables

financing segment, continues to reap the benefits of healthy consumer

demand, increasing its market share in consumer and also other

businesses. Within the consumer financing business, it has demonstrated

its ability to cross-sell, as evident from strong growth in the personal

loans portfolio over the past three years. Its focus on the SME and

commercial lending segments may depress margins and RoE, but will

keep growth strong. At the same time, it is proactive in detecting early

warning signals with regard to asset quality. We maintain our estimates

for FY18/20 and reiterate

Buy

with a target price of INR2,300 (30x

September 2019 EPS, implied 6x PBV).

Research Analyst: Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415

| Piran Engineer

(Piran.Engineer@MotilalOswal.com); +91 22 3980 4393

Nitin Aggarwal

(Nitin.Aggarwal@MotilalOswal.com); +91 22 3982 5540

| Anirvan Sarkar

(Anirvan.Sarkar@MotilalOswal.com); +91 22 3982 5505

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.