PNB Housing Finance

BSE SENSEX

33,043

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

10,295

PNBHF IN

166

231 / 3.6

1715/789

-14/-7/-

690

61.1

25 Oct 2017

2QFY18 Results Update | Sector: Financials

CMP: INR1394

TP: INR1750 (+25%)

Buy

Growth story continues

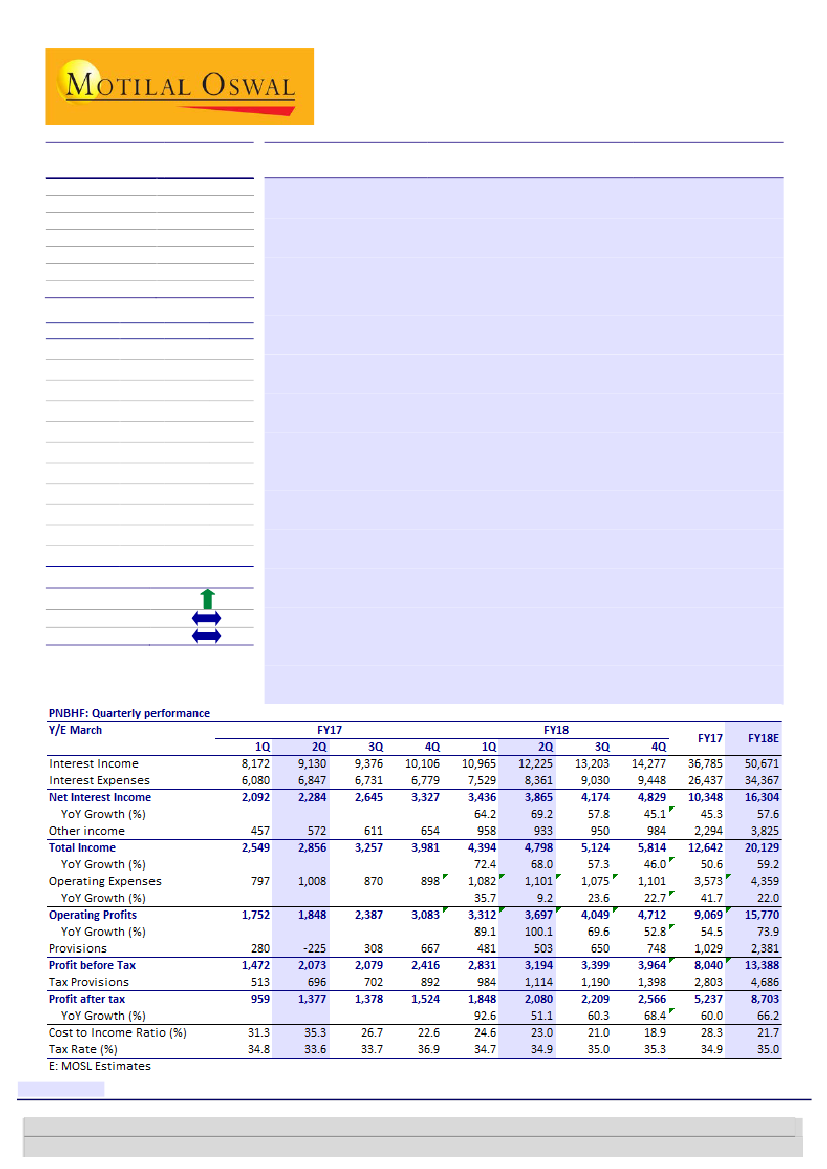

PNB Housing Finance’s (PNBHF) 2QFY18 PAT grew robustly by 51% YoY to

INR2.08b, led by its strong AUM growth, YoY improvement in margins and

lower C/I ratio (albeit off a high base).

Disbursements grew 45% YoY to INR74b. While this is certainly a very strong

performance, it was a tad lower than disbursements in 1QFY18, suggesting

some impact of RERA, and possibly GST.

Generally, the second quarter is

seasonally strong in terms of disbursements for an HFC.

AUM growth of 47% YoY was in line with estimates. The mix has remained

largely stable on both QoQ and YoY basis.

C/I ratio (calculated) declined over 1,200bp YoY and 160bp QoQ to 23%. The

sequential improvement is commendable, in our view.

One of the key factors

driving this is improving employee productivity.

As per company disclosures,

both disbursements/employee and loans outstanding/employee have

increased at ~20% CAGR over the past two years (note that this number does

not account for off-roll sales staff). We believe continued operating leverage is

key to RoA/RoE improvement, and thus, for valuations to sustain.

Valuation view:

PNBHF continues to deliver strong growth in its loan book.

Increasing geographical spread and new branch openings (110 branches in

FY20E v/s 66 in FY17) are expected to result in the loan book growing to ~INR1t

by FY20 (37% CAGR). With the pace of investments slowing down, coupled with

operating leverage benefits kicking in, the expense ratio is set to decline

meaningfully. Credit costs, however, are expected to inch up marginally on

account of portfolio seasoning. All these factors put together are expected to

drive 41% PAT CAGR over FY17-20E, with RoE inching toward high-teens over

the medium term. We upgrade our FY18-20 EPS estimates by 2-9%.

Buy

with a

target price of INR1,750 (3.8x Sep 2019E BVPS, 22x Sep 2019E EPS).

Financials & Valuations (INR b)

Y/E March

2018E 2019E 2020E

NII

15.7

21.0

27.9

PPP

PAT

EPS (INR)

BV/Sh. (INR)

RoAA (%)

RoE (%)

Payout (%)

P/E (x)

P/BV (x)

Div. Yield (%)

15.8

8.7

52.5

371.1

1.7

15.0

20.9

26.5

3.8

0.7

21.0

11.0

66.5

423.7

1.5

16.7

20.9

21.0

3.3

0.9

28.1

14.7

88.8

494.0

1.5

19.4

20.9

15.7

2.8

1.1

Estimate change

TP change

Rating change

Research Analyst: Piran Engineer

(Piran.Engineer@MotilalOswal.com); +91 22 3980 4393 |

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415

Nitin Aggarwal

(Nitin.Aggarwal@MotilalOswal.com); +91 22 3982 5540

| Anirvan Sarkar

(Anirvan.Sarkar@MotilalOswal.com); +91 22 3982 5505

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.