2 November 2017

Market snapshot

Equities - India

Close

Chg .%

Sensex

33,600

1.2

Nifty-50

10,441

1.0

Nifty-M 100

19,687

0.6

Equities-Global

Close

Chg .%

S&P 500

2,579

0.2

Nasdaq

6,717

-0.2

FTSE 100

7,488

-0.1

DAX

13,466

1.8

Hang Seng

11,636

1.1

Nikkei 225

22,420

1.9

Commodities

Close

Chg .%

Brent (US$/Bbl)

60

-0.8

Gold ($/OZ)

1,279

0.5

Cu (US$/MT)

6,899

1.2

Almn (US$/MT)

2,168

1.2

Currency

Close

Chg .%

USD/INR

64.6

-0.3

USD/EUR

1.2

0.1

USD/JPY

114.0

0.7

YIELD (%)

Close

1MChg

10 Yrs G-Sec

6.9

0.0

10 Yrs AAA Corp

7.7

0.0

Flows (USD b)

1-Nov

MTD

FIIs

0.2

0.5

DIIs

-0.1

1.4

Volumes (INRb)

1-Nov

MTD*

Cash

432

347

F&O

6,940

6,560

Note: YTD is calendar year, *Avg

YTD.%

26.2

27.5

37.2

YTD.%

15.2

24.8

4.8

17.3

23.9

17.3

YTD.%

9.1

10.3

24.9

27.2

YTD.%

-4.8

10.4

-2.6

YTDchg

0.4

0.1

YTD

5.7

11.2

YTD*

299

5,539

Today’s top research idea

Rain Industries (Initiating Coverage): Enduring tailwinds

Re-rated, yet attractive

RAIN is globally the second largest producer of calcine pet coke (CPC) and coal tar

pitch (CTP), which are used in aluminum smelting.

v

The dual benefit of demand growth and supply shock is driving CPC prices and

margins.

v

Capacity cuts in RAIN’s key markets have turned the margin outlook favorably for

CTP.

v

Global leadership, product innovation, and long-standing relationships with

leading customers and raw material suppliers are the key barriers to entry.

v

RAIN is investing in high-IRR projects to capitalize on the exponential rise in CPC

demand in India and in debottlenecking coal tar distillation in Europe.

Although the stock has got re-rated, valuations still appear attractive. We value the

stock at INR362 based on 6.5x EV/EBITDA of CY19E, and initiate coverage with a Buy

rating.

Research covered

Cos/Sector

Rain Industries (IC)

Auto

Bharti Airtel

GAIL (India)

Hero MotoCorp

Godrej Consumer

Tech Mahindra

TVS Motor

Concor

Shriram Trans.

Divi’s Lab.

Other Results

Results Expectation

Key Highlights

Enduring tailwinds; Re-rated, yet attractive

November 2017 Volumes numbers

Cost-structuring measures show results

Making room for higher crude oil price

In-line results

Soaps drives India biz growth

Profitability resurrection on track

In-line results; decadal-high EBITDA margins

Cost efficiencies to drive up margins

Strong quarter; expect buoyancy going forward

Regulatory issues impact revenues

CIFC | JSW | HEXW | BLSTR | DBCL | JKBK | ENIL | KPIT | RADIOCIT

GETD | GNP | PWGR | SCUF | TRCL | VEDL

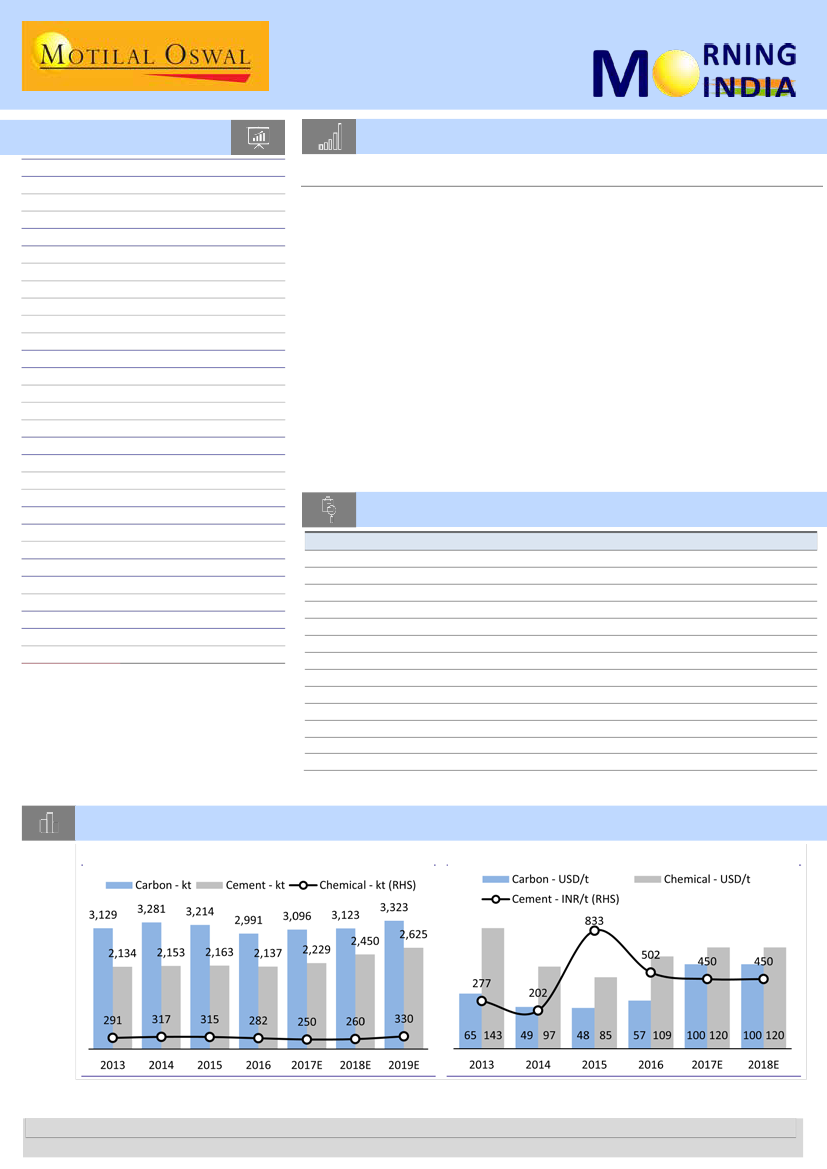

Chart of the Day: Rain Industries (Initiating Coverage) – Enduring tailwinds

Volumes driven by demand and capex

Margins (EBITDA/t) improving on tailwinds

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.