27 November 2017

Metals Weekly

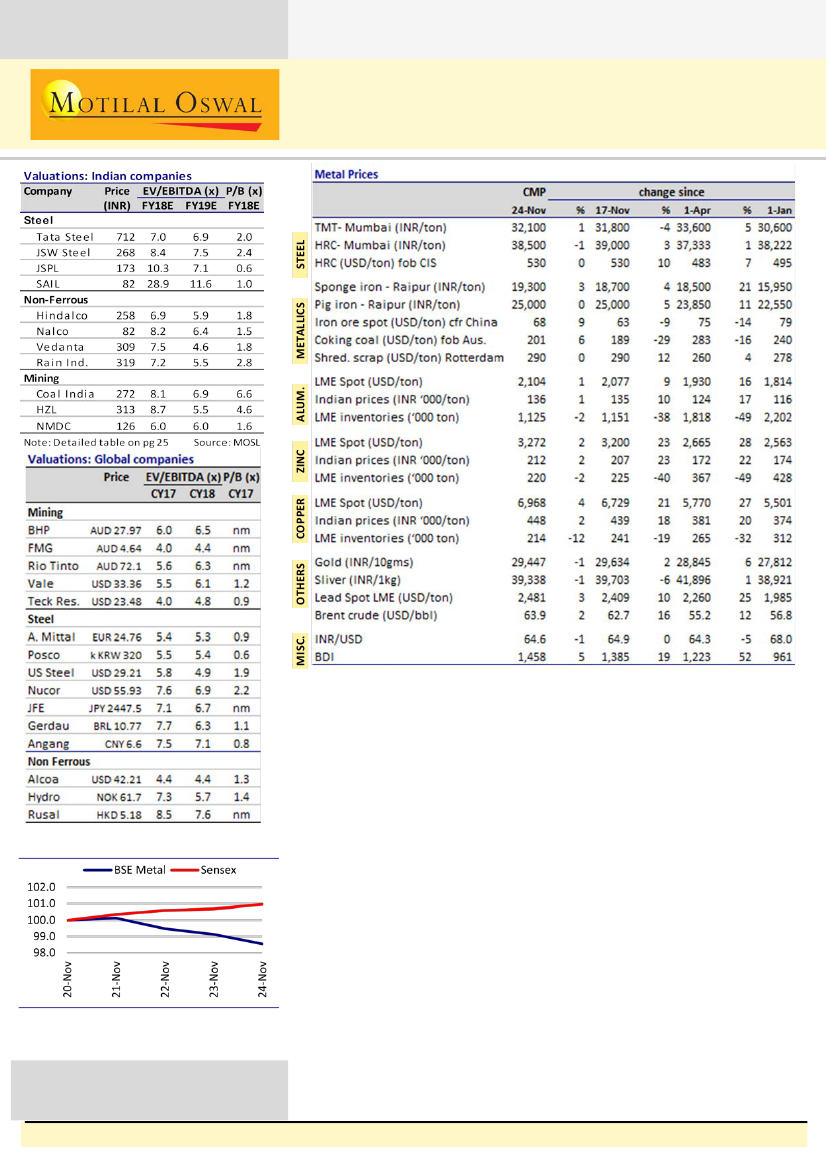

BSE Metals Index v/s Sensex

Source: Bloomberg

Note: Indexed to 100 on 20 Nov 2017

Stock performance table on pg 26

Indian steel:

Long product (TMT Mumbai) prices were up ~1% WoW.

Sponge iron prices were up ~3% WoW, while domestic scrap prices were

marginally higher. Pellet prices were marginally higher. Domestic iron ore

prices were unchanged. Domestic HRC prices were down ~1% WoW, but

import price offers were unchanged.

Raw materials:

Iron ore prices (China cfr) were up ~8% WoW. Thermal

coal prices were marginally lower. Coking coal prices were up ~6% WoW

on reports of supply disruption in Australia. China’s pellet import prices

were marginally lower.

Europe:

HRC prices were unchanged. Product spreads were lower. CIS HRC

export prices were unchanged. Rotterdam scrap prices were also

unchanged.

China:

Local HRC prices were marginally lower, but rebar prices were

higher. Export HRC and rebar prices were up ~1% WoW.

Base metals:

Aluminum (cash LME) was up ~1% WoW, while alumina was

marginally lower. Copper (cash LME) was up ~4% WoW. Zinc and lead

were up ~2% and 3%, respectively. Brent crude was up 2% WoW.

Iron ore and coking coal prices increase ~8% WoW

Investors are advised to refer through

important disclosures made at the last

page of the Research Report

.

Sanjay Jain

(SanjayJain@MotilalOswal.com); +91 22 3982 5412 /

Dhruv Muchhal

(Dhruv.Muchhal@MotilalOswal.com)