Manpasand Beverages

BSE SENSEX

35,965

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

11,028

MANB IN

114.4

43.8 / 0.7

Vadodara capacity expansion to aid growth; Varanasi and Sri City’s

512 / 310

expansion pushed ahead

-19/-16/-10

85.0

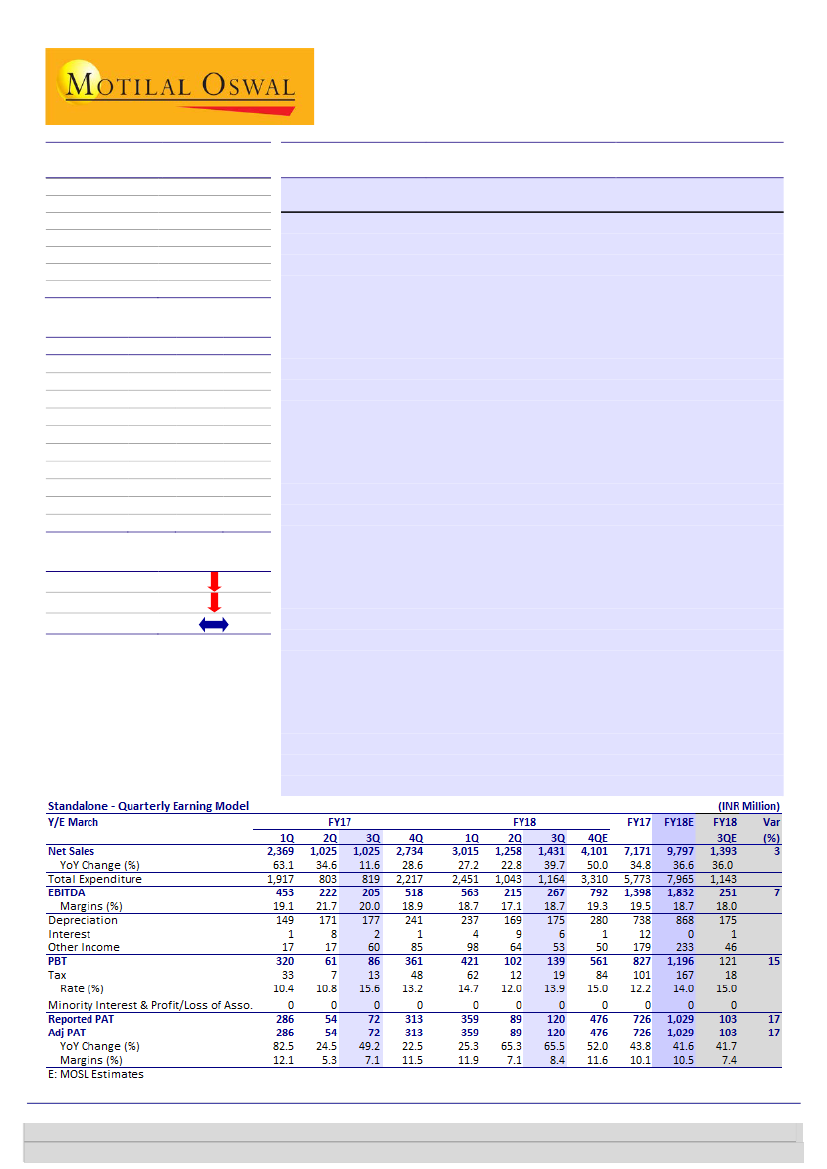

Revenue in-line; EBITDA and PAT beat estimates:

MANB’s 3QFY18 revenue

increased 39.7% YoY on a like-to-like basis (after netting off excise of

55.9

31 January 2018

3QFY18 Results Update | Sector: Consumer

CMP: INR381

TP: INR467(+22%)

Buy

Distribution network expansion on track

Financials & Valuations (INR b)

2018E 2019E

Y/E Mar

Net Sales

9.8

14.4

EBITDA

1.8

2.8

PAT

1.0

1.5

EPS (INR)

9.0

13.2

Gr. (%)

41.6

47.2

BV/Sh (INR)

107.6

117.6

RoE (%)

7.4

11.8

RoCE (%)

8.6

13.6

P/E (x)

42.4

28.8

P/BV (x)

3.5

3.2

2020E

18.8

3.7

2.1

17.9

35.6

131.1

14.4

16.7

21.2

2.9

Estimate change

TP change

Rating change

INR37m from revenue of 3QFY17) to INR1,431m (est. of INR1,393m). EBITDA

margin shrunk 130bp YoY to 18.7% (est. of 18%) in 3QFY18, led by an

increase in raw materials cost (+250bp to 60.8% of net sales). However,

other expense and employee cost declined 60bp and 40bp YoY to 16.3% and

4.3%, respectively. EBITDA grew 30% YoY to INR267m (est. of INR251m) in

3QFY18. Accordingly, adj. PAT grew 65.5% YoY from INR72m to INR120m

(est. of INR103m).

Ramping up distribution through Parle network:

MANB had initiated

product supply through Parle’s distribution network in West Bengal in

2QFY18 (revenue contribution ~5% in 3QFY18). The company has thus far

profiled 150 distributors for 30,000 outlets and expects to reach a target of

1,000 distributors by 4QFY18. The distribution is expected to ramp up in line

with capacity expansion planned by the company, with the next geographies

to target being UP, Maharashtra and Gujarat.

Trial run at Vadodara commences; Varanasi to follow suit:

MANB has

commenced the trial run of recently completed expansion of Vadodara

facility, the benefit of which will be fully reflected in 4QFY18 and 1QFY19.

Expansion of Varanasi facility, however, is delayed by 1-2 months, and is

now expected to commence by April 2018.

Valuation view:

We cut our earnings estimate by ~11% for both FY19 and

FY20 on account of delay of 1-2 months in commissioning of Varanasi and Sri

City facilities, as well as the expected commissioning of the plant in north-

east (Orissa) being pushed to FY20. We value the stock at 26x FY20E EPS,

with a target price of INR467 (22% upside) and maintain our

Buy

rating.

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Niket Shah – Research Analyst

(Niket.Shah@MotilalOswal.com); +91 22 6129 1535

Aksh Vashishth – Research Analyst

(Aksh.Vashishth@motilaloswal.com); +91 22 6129 1553