28 February 2018

Market snapshot

Equities - India

Close

Chg .%

Sensex

34,346

-0.3

Nifty-50

10,554

-0.3

Nifty-M 100

19,682

-0.9

Equities-Global

Close

Chg .%

S&P 500

2,744

-1.3

Nasdaq

7,330

-1.2

FTSE 100

7,282

-0.1

DAX

12,491

-0.3

Hang Seng

12,647

-1.5

Nikkei 225

22,390

1.1

Commodities

Close

Chg .%

Brent (US$/Bbl)

66

-1.4

Gold ($/OZ)

1,318

-1.1

Cu (US$/MT)

6,986

-1.3

Almn (US$/MT)

2,172

0.3

Currency

Close

Chg .%

USD/INR

64.9

0.1

USD/EUR

1.2

-0.7

USD/JPY

107.3

0.4

YIELD (%)

Close

1MChg

10 Yrs G-Sec

7.7

-0.02

10 Yrs AAA Corp

8.2

-0.02

Flows (USD b)

27-Feb

MTD

FIIs

-0.1

-1.7

DIIs

0.2

2.7

Volumes (INRb)

27-Feb

MTD*

Cash

314

379

F&O

5,555

8,471

Note: YTD is calendar year, *Avg

YTD.%

0.9

0.2

-6.9

YTD.%

2.6

6.2

-5.3

-3.3

8.0

-1.6

YTD.%

-0.7

1.2

-3.1

-3.7

YTD.%

1.6

1.9

-4.8

YTDchg

0.3

0.3

YTD

0.5

2.6

YTD*

405

7,814

Today’s top research idea

UPL (Initiating Coverage): Reaping growth

Generic pesticides, backward integration to drive profitability

A multitude of products going off-patent would unleash a generics opportunity

of ~USD3b over CY17-20. With strong R&D and integrated manufacturing

facilities, UPL is in a sweet spot to grab the impending opportunity in the

generics market.

The company is also set to benefit from the increasing phenomenon of pest

resistance across crops with its broad array of products, which enables it to

launch new combinations to tackle resistance.

Pest resistance to major agrochemical ‘glyphosate’ (market size of ~USD5b)

could provide UPL with its next key growth driver – its variant, ‘gluphosinate’.

We expect UPL to clock ~12% revenue CAGR and ~14% PAT CAGR over FY18-20

and value the company at 17x FY20E EPS of INR55.6, arriving at a TP of INR945.

Initiate coverage with Buy.

Research covered

Cos/Sector

Key Highlights

UPL (Initiating Coverage) Reaping growth

Auto Sales Estimate

Overloading ban to continue driving CV wholesales

Piping hot news

Nirav Modi's Firestar Diamond files for bankruptcy as PNB fraud hits $2 b

The international jewelry business that's part of the empire controlled by Nirav

Modi, a billionaire accused of masterminding India’s biggest bank fraud, has

filed for bankruptcy in the US just as the Indian lender at the heart …

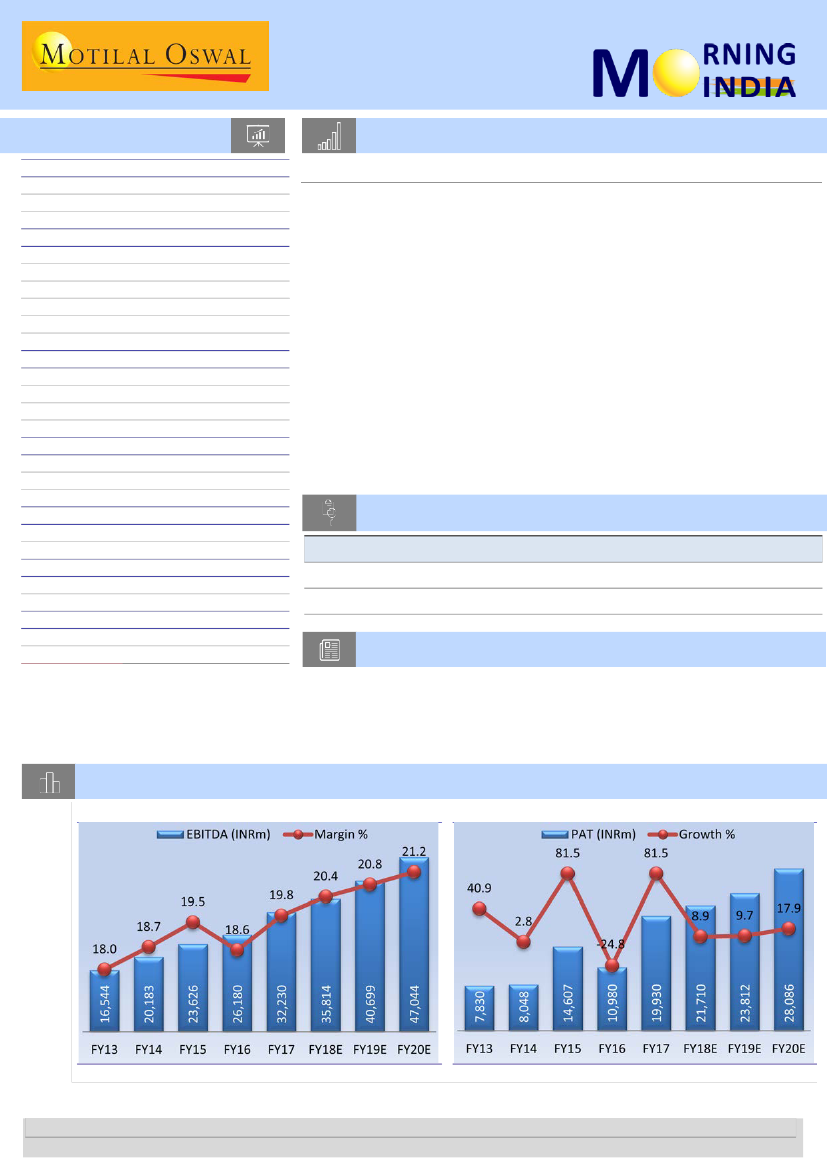

Chart of the Day: UPL (Initiating Coverage): Reaping growth

EBITDA margin to expand 80bp over FY18-20

PAT to post CAGR of ~14% over FY18-20

Source: Company, MOSL

Source: Company, MOSL

Research Team (Gautam.Duggad@MotilalOswal.com)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.