18 July 2011

1QFY12 Results Update | Sector: Automobiles

Bajaj Auto

BSE SENSEX

S&P CNX

18,507

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel.Perf.(%)

M.Cap. (INR b)

M.Cap. (USD b)

5,567

BJAUT IN

289.4

1,665/1,190

2/15/15

409.9

9.2

CMP: INR1,417

TP: INR1,761

Buy

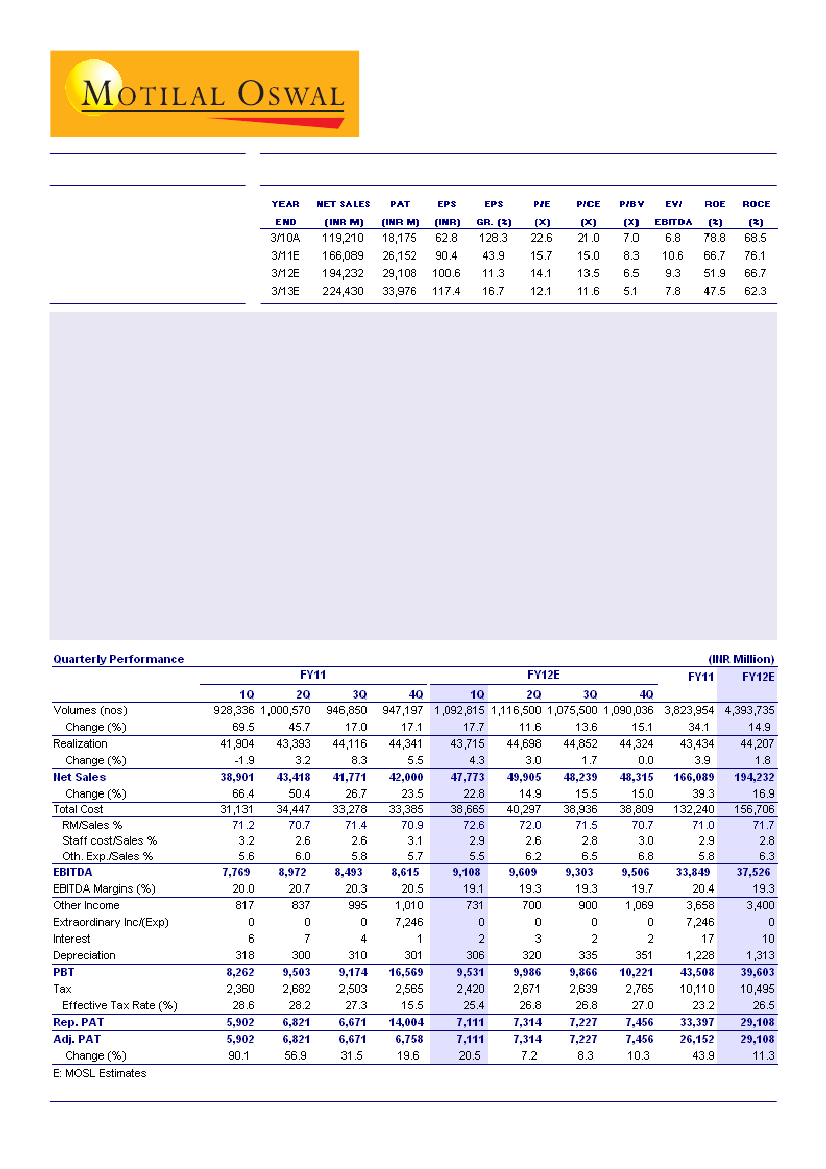

Bajaj Auto's results were below our expectations. EBITDA margin was 19.1%, lower than our estimate of 19.6%. Lower

than expected realizations (inferior market and product mix) and higher raw material cost impacted margins. Recurring

PAT was INR7.1b v/s our estimate of INR7.5b.

Volumes grew 17.7% YoY (15.4% QoQ); realizations declined 1.4% QoQ (grew ~4.3% YoY) due to inferior product

mix (higher share of <125cc segment) and higher exports (39% of volumes v/s 29% in 4QFY11).

EBITDA margin declined 140bp QoQ (90bp YoY) to 19.1% (v/s our estimate of 19.6%), hit by lower realizations and

higher RM cost. Despite increase in cash balance to INR47.3b (INR42.4b as at March 2011), other income was

INR731m, restricting PAT at INR7.1b.

While the DEPB scheme has been extended till September 2011, the management has indicated that it would be

gradually passing-on any loss due to withdrawal of DEPB. Our estimates factor in status quo in DEPB benefit. Its

withdrawal could impact our FY12/FY13 EPS by ~10%.

Valuation and view:

We are cutting our EPS estimate for FY12 by 3.8% to INR100.6, as we model in lower other

income and lower tax. However, we maintain our EPS estimate of INR117.3 for FY13. The stock is attractively valued at

14.1x FY12E EPS of INR100.6 and 12.1x FY13E EPS of INR117.4. Maintain

Buy,

with a target price of INR1,761 (~15x

FY13E EPS).

Jinesh Gandhi

(Jinesh@MotilalOswal.com) + 91 22 3982 5416

Mansi Varma

(Mansi.Varma@MotilalOswal.com) + 91 22 3982 5418